If you've been watching Merck (MRK) lately, you might think the pharmaceutical giant has caught a nasty case of the market flu. After years of being the biotech golden child, Merck's stock has been sliding down the charts faster than a greased pig at a county fair.

But before you start writing eulogies for this pharma powerhouse, let's dig into the nitty-gritty and see if there's still some fight left in this old dog.

First, let's talk about Keytruda. This cancer-fighting wonder drug is Merck's bread and butter, bringing in a whopping $7.3 billion in Q2 2024 alone. That's a 16% year-over-year jump, beating expectations by $100 million.

But here's the rub: Keytruda now accounts for nearly half of Merck's total revenue. It's like having a star quarterback who scores all your touchdowns - great until he sprains an ankle.

And boy, has Keytruda stubbed its toe lately. The FDA's advisory committee gave a thumbs down to expanding its use in certain stomach cancer patients.

Then there's the Phase 3 trial flop in colorectal cancer and two other discontinued trials. It's enough to make even the most bullish investor reach for the Tums.

With Keytruda showing signs of vulnerability, Merck's bigwigs have clearly decided it's time to spread their bets. They're not about to let their golden goose turn into a sitting duck. So, they’ve gone on a buying spree.

EyeBio, Elanco's Aqua business, Harpoon Therapeutics, CN201 - the list goes on. On paper, it looks smart. Diversify the portfolio, reduce the Keytruda dependency.

But Wall Street's not impressed, especially after Merck slashed its 2024 profit outlook by $1.05 per share to pay for this shopping spree.

Now, you might be wondering if Merck's lost its marbles with all this spending. Is Merck just throwing money around like a drunken sailor, or is this the kind of long-term thinking that separates the biotech wheat from the chaff? Only time will tell, but I've got a hunch these moves might pay off down the road.

Speaking of long-term thinking, Merck's not just acquiring companies left and right. They're also working on extending Keytruda's reign with a subcutaneous version that could push its patent protection into the late 2030s.

But they know better than to put all their eggs in one basket, even if it's a golden one.

That's where Merck's latest blockbuster deal comes in. They've just inked a $1.9 billion agreement with Mestag Therapeutics, a bold move into the world of inflammatory diseases. It's like Merck's discovered a new chess piece on the biotech board, and they're betting it could be a game-changer.

I know Mestag isn't exactly a household name, but these Cambridge, England-based whiz kids are doing some fascinating work with fibroblasts.

For those of you who forgot their biology lessons, fibroblasts are connective tissue cells that play a bigger role in inflammation and tumors than we once thought.

So why is Merck so excited about these little cellular workhorses?

Well, Merck's betting big that Mestag's Reversing Activated Fibroblast Technology (RAFT) platform could be the next big thing in inflammatory disease treatment. The deal gives Merck the option to license therapies against a "prespecified number of potential targets."

Mestag's got three preclinical programs in the pipeline. The frontrunner is MST-0300, a FAP-LTBR agonist designed to "supercharge" antitumor immunity.

Following close behind is M402, a stromal checkpoint agonist antibody aimed at dampening myeloid-driven biology in inflammatory disease.

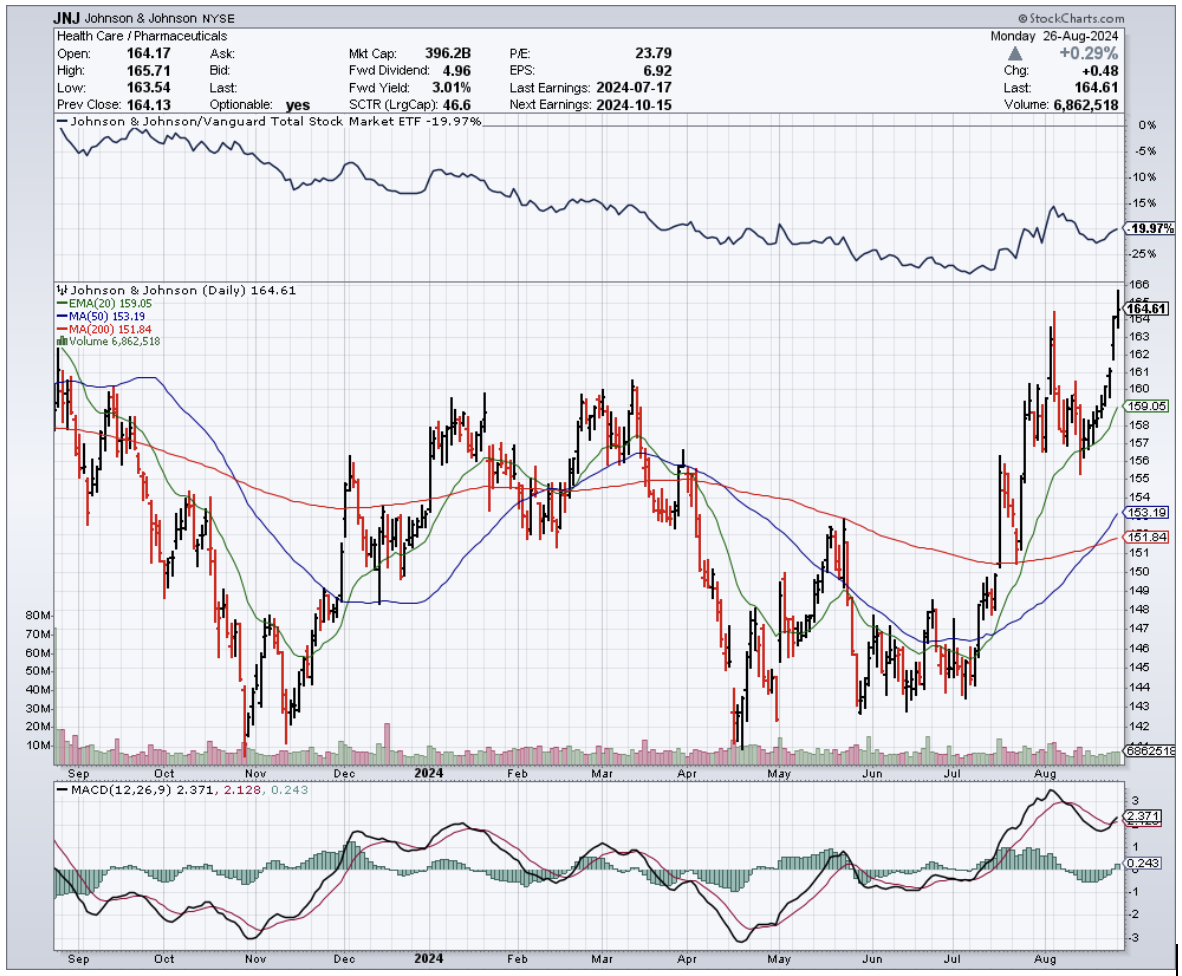

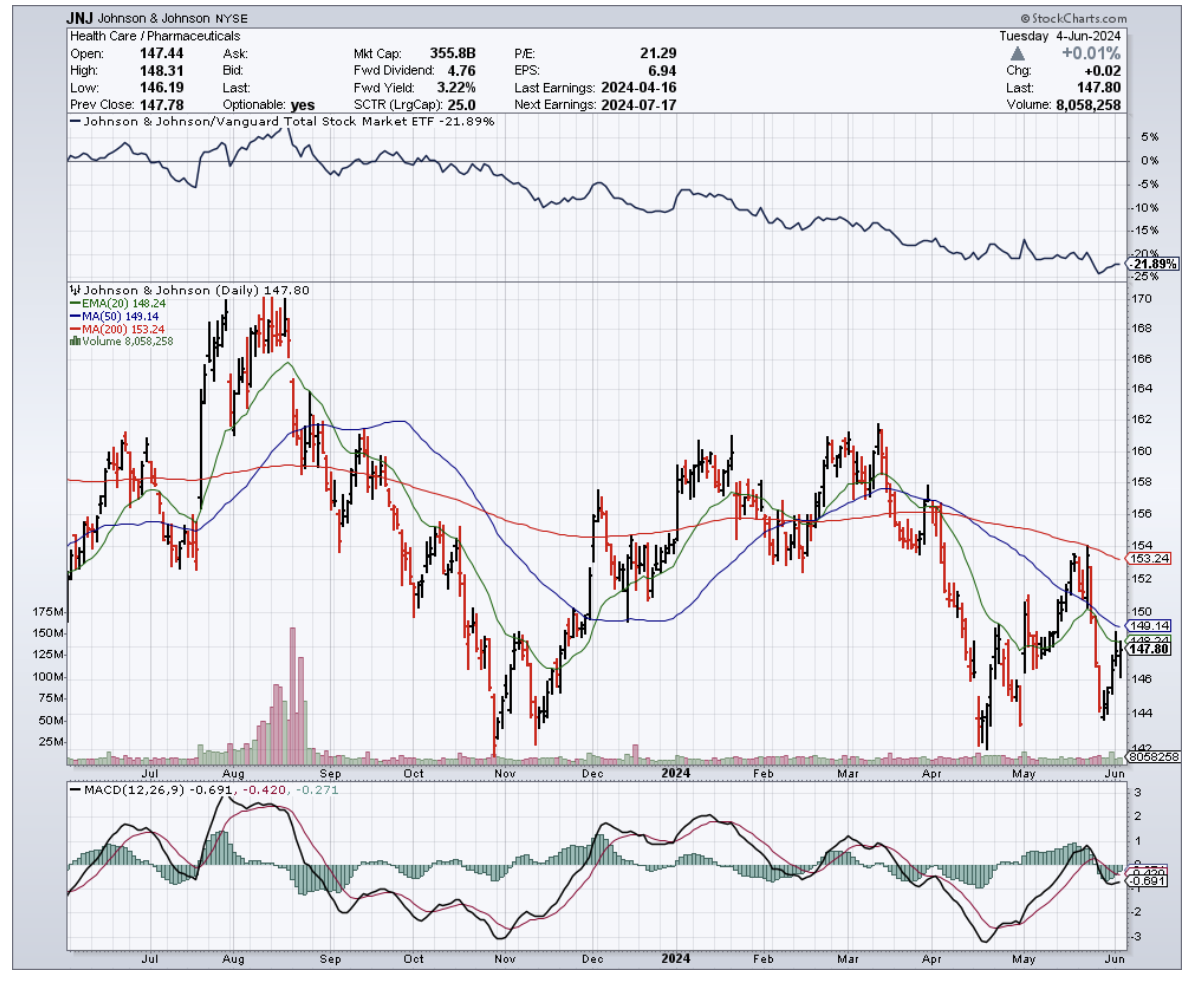

Notably, Merck isn't the only big fish swimming in Mestag's pond. Johnson & Johnson's (JNJ) Janssen unit also signed its own two-target collaboration back in 2021.

With all these moves, you might be wondering if Merck's still a safe bet or if it's gone off the deep end.

Look, Merck's got more challenges than a one-armed juggler at the moment. But here's the thing: its current stock price is sitting at a level that's bounced back before.

With a solid 2.8% dividend yield that's been growing for 13 straight years, Merck might just be the kind of steady Eddie that value investors dream about.

Sure, there are risks. Keytruda's dominance is both a blessing and a curse. Also, those pricey acquisitions need to pay off. And who knows what Medicare will do next on drug pricing.

But if you've got the stomach for some short-term turbulence, Merck could be poised for a comeback. It's got a strong foundation, a pipeline full of potential, and enough cash to weather the storm. I suggest you buy the dip.