Biogen (BIIB) is taking another crack at Alzheimer’s. This is a crucial moment for the biotech following its move to abandon its plans to market Aduhelm, another Alzheimer’s treatment after healthcare insurers refused to pay for it despite gaining FDA approval.

The moment of truth will come this fall when Biogen and Eisai (ESALY) are anticipated to share the results of their massive trial created to determine whether lecanemab, their latest candidate for Alzheimer’s, can deliver its promise to decelerate the progression of the neurodegenerative condition in early-stage patients.

Needless to say, an effective Alzheimer’s drug would not only bring incredible development and hope for patients and their loved ones but also offer a much-needed reprieve for Biogen.

Success would push the biotech to pursue a quick turnabout, with Biogen and Eisai already planning to request an accelerated approval. If the Phase 3 data turns out promising, then the next move would be to clear the way to get Medicare coverage, ensuring that the Aduhelm debacle won’t happen again.

In terms of market opportunity, treatments like lecanemab can rake in over $20 billion in sales in the United States alone.

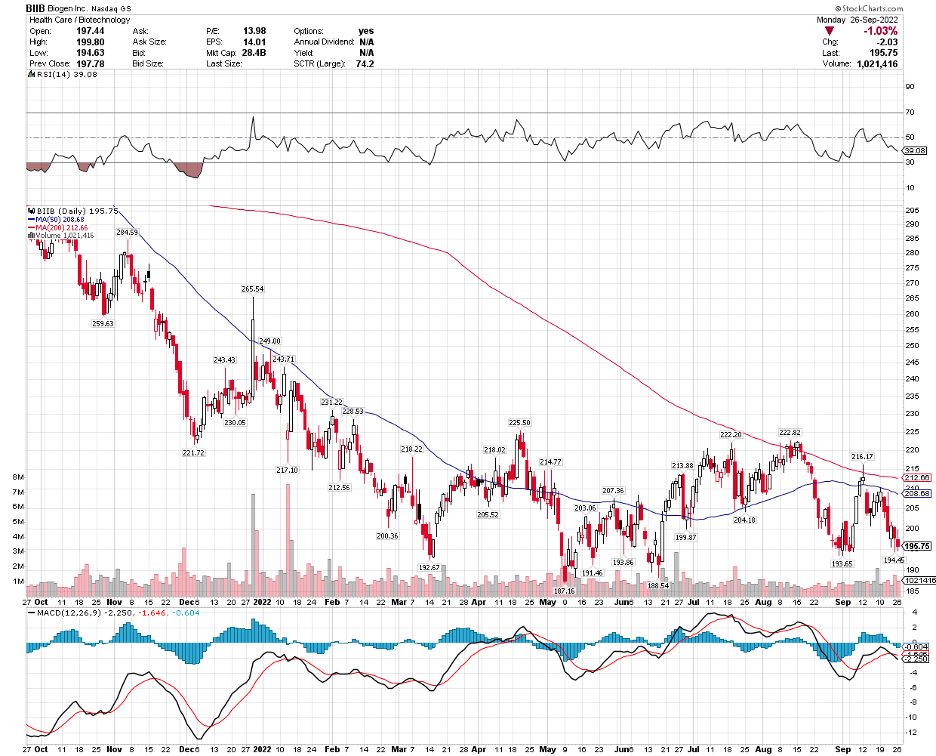

Still, investors remain cautious. After all, betting on a positive result of an Alzheimer’s trial has proven to be a wrong move in the past—a sentiment that’s apparent in Biogen’s beaten-down price these days.

When Aduhelm gained approval in June 2021, Biogen’s shares climbed almost 40%. Unfortunately, the price steadily fell as the biotech encountered roadblock after roadblock since the drug’s approval and commercialization.

Last year, Biogen shares rose from $270 to hit $400 following Aduhelm’s approval. These days, the biotech has been trading at roughly $205. That’s about 40% below its price in 2018.

By April 2022, Biogen threw in the towel when Medicare flat-out rejected any request to pay for Aduhelm.

More than that, though, Biogen’s results for its lecanemab trial could spell the difference for other Alzheimer’s drugs in late-stage development, including the candidates from Roche (RHHBY) and Eli Lilly (LLY).

What would happen if Biogen fails again?

A failure would make the beginning of a new period for the biotech. Looking at Biogen’s pipeline and portfolio, it’s clear that the next move would either be to sell off pieces of the company or become more aggressive in pursuing mergers.

With the primary business unable to deliver, the expectations shift to the pipeline to pick up some slack. Unfortunately, Biogen’s lineup looks underwhelming. Its disastrous Aduhelm project caused too much damage to the biotech’s finances, restricting its clinical trials.

While Biogen remains the biggest pure neurology biotech thus far, this position is under attack, and its pipeline seems too slow to react in the wake of back-to-back failures.

Reviewing Biogen’s pipeline in Phase 3 trials does not show any candidates that stand out as groundbreaking or transformative. None has the capacity to anchor the company anytime soon.

Apart from that, Biogen is facing fierce competition in its other treatments, including its MS portfolio from the likes of Novartis (NVS), Amgen (AMGN), and Regeneron (REGN).

Meanwhile, more and more pharma names are challenging its neurology drugs like Bristol Myers Squibb (BMY), AbbVie (ABBV), and Merck (MRK). Even Pfizer (PFE) is making a play in this sector with its plan to acquire neurology biotech pure-play Biohaven.

Given Biogen’s track record, the best thing to do right now is to sit and wait until the data are out. If the data turns out positive, then the opportunity would be massive enough for investors to buy in later.

Besides, Eli Lilly and Roche will also release their results in the following months. Those will offer a clearer path and better flesh out the picture of the future of this segment. Most importantly, these will provide investors with safer options to make their bets.