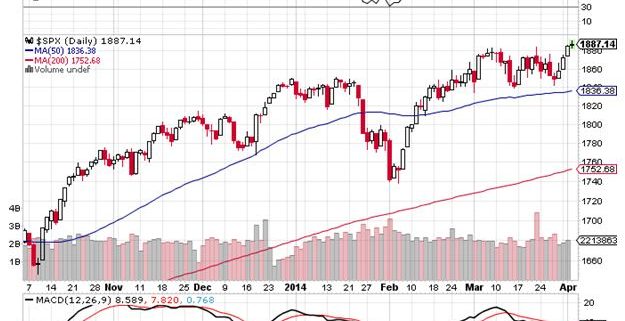

Mad Day Trader Jim Parker is expecting the second quarter of 2014 to be an uneventful, low volume, range trading affair. There is insufficient momentum in the major indexes to substantially break out of the ranges established in Q1.

He does see a modest upward bias to the market. But it is going to have to fight for every point. Sector leadership will change daily, with a brutal rotation. The market is still paying the price of having pulled forward too much performance into 2013.

Jim is a 40-year veteran of the financial markets and has long made a living as an independent trader in the pits at the Chicago Mercantile Exchange. He has worked his way up from a junior floor runner to advisor to some of the world?s largest hedge funds. We are lucky to have him on our team and gain access to his experience, knowledge, and expertise.

Jim uses a dozen proprietary short-term technical and momentum indicators to generate buy and sell signals. Below are his specific views for the new quarter according to each asset class with specific pivot points.

Stocks ? It will be a ?RISK ON? quarter for equities, but not by much. Stocks are still digesting the meteoric gains of 2013. A solid close in the S&P 500 (SPX) over 1,895 will take us right to 1,950. A failure brings us back to 1,800 quickly. Far more important is the NASDAQ, which has been the lead index for some time now. A convincing break of 3,700 will take us to the old high at 4,800. Old, big tech (XLK) will provide the leadership.

Bonds ? Are not going anywhere and Jim is a better seller of rallies. The 30-year futures contract is providing the guidance here, and it has been acting particularly poorly. The flattening of the yield curve has been one of the most dramatic in recent memory. If the (TLT) breaks the 50-day moving average at $107, the next stop will be $105. Demolish that, and we plunge to $101, which equates to a 3.05% yield on the ten year Treasury bond.

Foreign Currencies - The big focus of the currency markets now is to be long the British pound (FXB) and short the Japanese yen (FXY). It would be best to buy the cross, but the individual legs should work as well, as I have done in my The Mad Hedge Fund Trader?s model trading portfolio with a short yen position. The Australian dollar (FXA) decisively broke $91.50 to the upside and is now targeting $93. You should buy any pullbacks to $91.50, as long as central bank governor George Stevens keeps his mouth shut. The Euro (FXE) will be a safer sell after this week?s ECB meeting in order to avoid an ambush from president Mario Draghi.

Precious Metals - Gold (GLD) looks terrible and should be avoided at all costs. Gold bugs would be better off finding a long dark cave and hiding. We are dead in the middle of a six-month range and are likely to test the bottom at $1,200 next. Only a major rally would negate this view. As for silver (SLV), it is dead in the water, so don?t bother.

Energy - Oil (USO) looks sickly as well, now that the boost we got from the Crimean crisis is fading. The $92-$107 range continues. Get a good break of $98.50 and it will target $92. Jim is a better seller of Texas tea than a buyer. Jim also wants to sell the next decent rally in natural gas (UNG) going into the summer, looking for surging fracking supplies to swamp the market by then.

Ags - Soybeans (SOYB) are definitely the crop of the year, and the ETF could easily tack on another 10% from here. Corn (CORN) got a boost from yesterday?s bullish USDA report and could follow through. Only wheat (WEAT) is looking poorly from a technical perspective, and lacks the global fundamentals to help it.

Volatility - Buy the dips and sell the rips. The current $13 low is attractive, and Jim expects it to trade as high $22 sometime in Q2 if we break resistance at $15.50. A long VIX position also makes a nice hedge for your other ?RISK ON? positions as well.

If you are not already getting Jim?s dynamite Mad Day Trader service, please get yourself the unfair advantage you deserve. Just email Nancy in customer support at support@madhedgefundtrader.com and ask how to upgrade your existing Global Trading Dispatch service for an additional $1,000 a year.