The Biotech's Orbituary Was Premature

Last Tuesday, while stuck in airport security behind a family debating whether insulin syringes count as "liquids," I had an epiphany about Wall Street's chronic inability to see past quarterly earnings reports.

Here was life-saving biotechnology reduced to a TSA checkbox, while across the terminal, CNBC was breathlessly explaining why Amgen's (AMGN) "patent cliff" makes it uninvestable. Sometimes the best opportunities hide in plain sight, disguised as disasters.

That absurd little scene reminded me of another moment burned into my biotech brain: Tokyo, 1970s, a smoky coffee shop. I once watched a businessman inject insulin with the calm precision of someone adjusting their tie.

It wasn’t dramatic. It was routine. And that’s what made it profound.

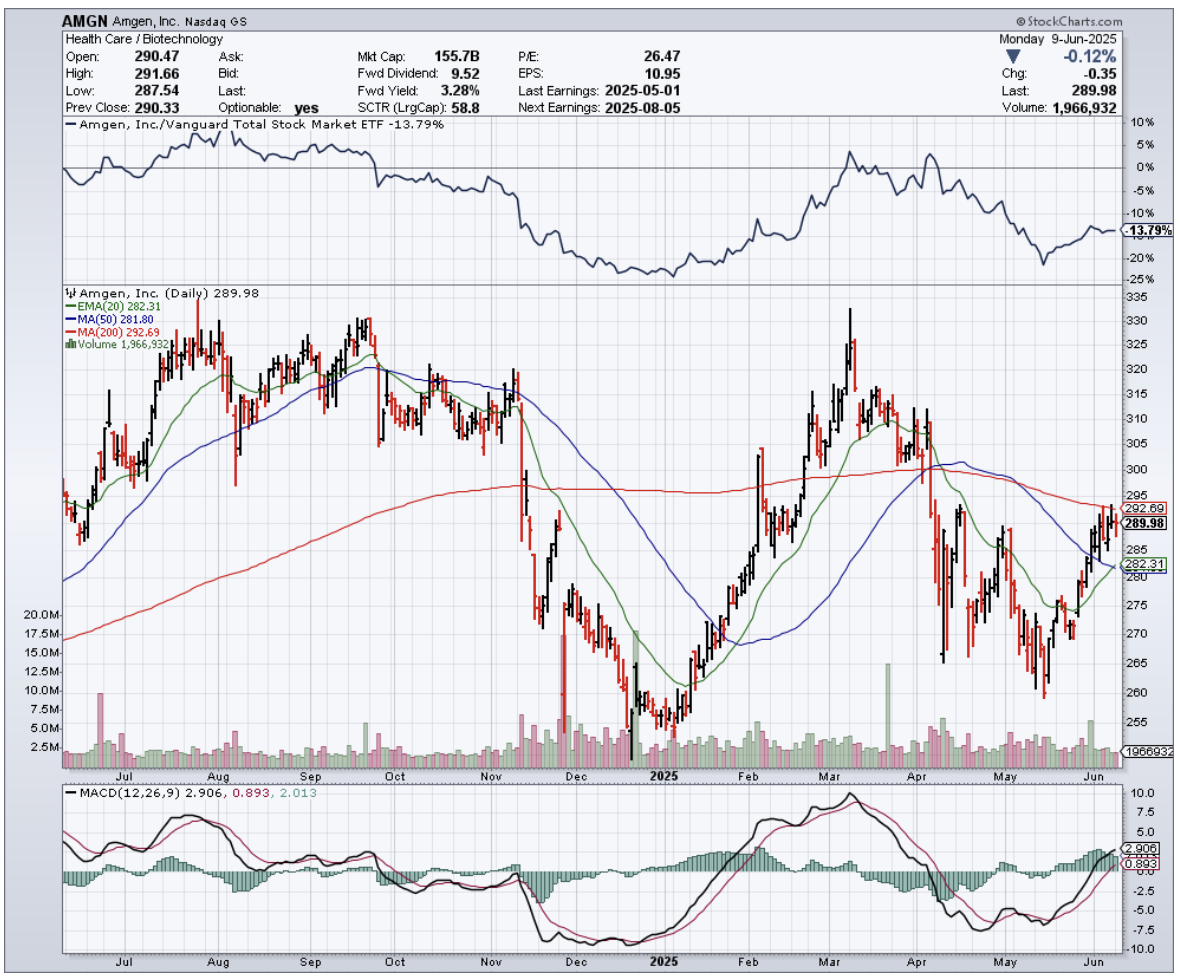

That image — cutting-edge science seamlessly woven into daily life — stayed with me. It’s also why Amgen, trading around $289, has me as intrigued today as I was back when calculators were a luxury.

Fast-forward to now: Wall Street is acting like Amgen is headed for biotech hospice care. Nearly 30% of its revenue base is tiptoeing toward patent expirations.

Prolia and Xgeva lost exclusivity in February, and biosimilar vultures are already circling. Enbrel, once a $3.3 billion cash cow, just took a 47% haircut on net pricing, dragging sales down 10% year-over-year.

The numbers look brutal…on paper. But investing based on spreadsheets alone is like judging a Michelin meal by the grocery receipt.

Here’s what the Street is missing: Amgen isn’t waiting for a mercy kill. It’s executing what might be biotech’s most impressive strategic pivot since Genentech discovered you could print money with recombinant DNA.

This is where MariTide comes in. Amgen’s obesity moonshot has been generating buzz since its trials started, and it’s starting to prove that it isn’t just another GLP-1 bandwagon play.

MariTide combines GLP-1 agonism with GIP antagonism into a once-monthly shot. This is a dramatic upgrade from Novo Nordisk’s (NVO) blockbuster, Ozempic, which requires weekly injections.

Think of it as rent once a year instead of weekly: same effect, way less hassle. Analysts are quietly penciling in $5 billion in peak sales.

Then there's olpasiran, which is a small interfering RNA therapy targeting lipoprotein(a) — a heart disease culprit with no current treatments. One in five people carry this risk, and olpasiran showed significant efficacy in the New England Journal of Medicine. This could be a multibillion-dollar market, rivaling the $9.3 billion PCSK9 inhibitor space.

And the delicious irony? Amgen’s discounted cash flow suggests the market expects the company to shrink. Negative 0.4% growth is priced in. But even 2.5% annual growth could yield a 27% upside.

Now, its first quarter results tell a different story. Revenue surged 9% to $8.1 billion. Operating margins improved despite brutal pricing pressure. Management projects 2025 revenue of up to $35.7 billion.

That doesn’t sound like a company preparing for its own funeral.

Smart money agrees. Amgen’s $27.8 billion Horizon acquisition brought Tepezza, a $1.9 billion play for Thyroid Eye Disease, into the fold.

Meanwhile, biosimilar Wezlana, aka the first Stelara lookalike with FDA approval, generated $150 million in its first quarter. These aren’t Hail Marys. They’re calculated, long-term bets.

What makes Amgen irresistible is the combo platter: steady cash flow (a healthy 33.3% free cash margin), ongoing shareholder returns, and moonshot optionality in MariTide and olpasiran.

It's the kind of setup that rewards patience, especially when the market is too distracted to notice the obvious.

It brings to mind something my old biochemistry professors used to say: the most elegant solutions often masquerade as problems until their brilliance clicks into place.

Amgen’s strategy, replacing aging blockbusters with next-gen therapies addressing massive unmet needs, is exactly that kind of misjudged genius. I suggest you buy the dip.