The Bitcoin Bull Story is In-Tact

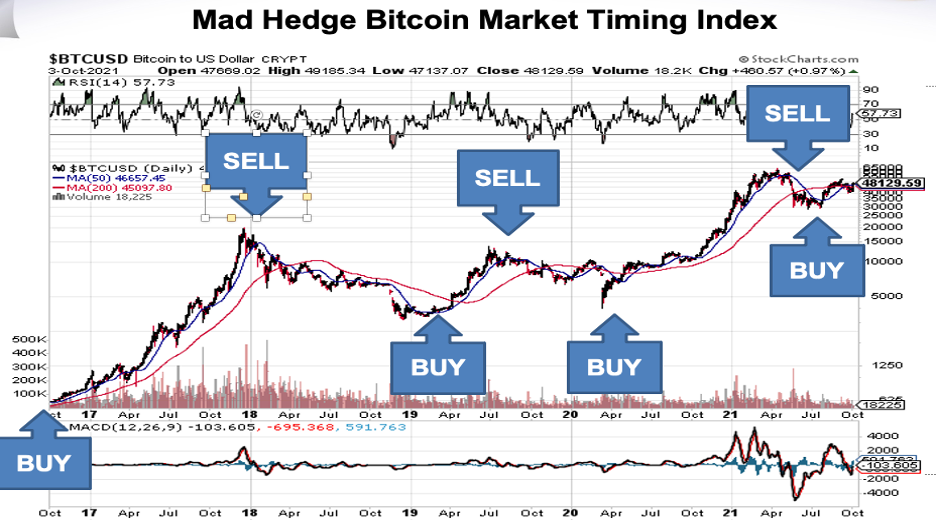

No, the Bitcoin bull market is not over, but we won’t get our Santa Claus rally this year.

The short-term reversal in prices has been encouraging, but I do expect further bouts of volatility to occur most likely in early January.

We received some great signaling that capital isn’t bolting out the back of the stable with Bitcoin returning to over $50,000 overnight inspired by one of the largest wallets to buy the equivalent of $137 million more Bitcoin.

This Bitcoin whale is loading up again here, even though so many people and fake bitcoin keyboard warriors are saying that we are now in a bear market.

I don't see any confirmation of the bear market yet as no key support has been lost.

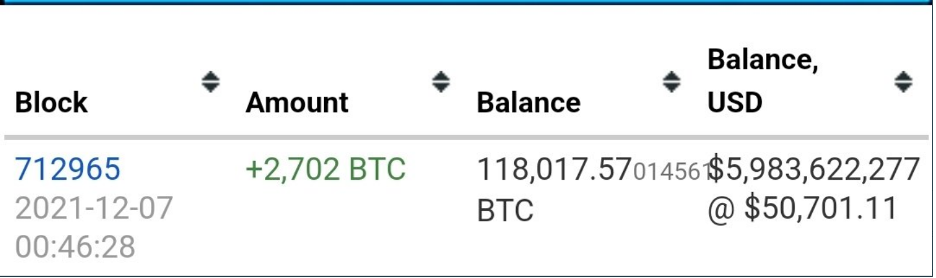

This wallet holder upped the ante overnight with a single purchase of 2,700 BTC — taking their total to 118,017 BTC.

The buy crushes previous recent transactions and increases the holder’s balance to breathtaking record levels.

This is officially the highest number of BTC ever held in this wallet: 118,017 BTC, in total this big spender has poured $2.5B USD to buy BTC with an average cost basis of $21,160 per BTC.

Interest and demand in Bitcoin rose a lot in 2021 despite the volatility. More than half of current investors got in over the last 12 months, adding another positive data point to the Bitcoin narrative.

In a survey of 1,000 people, about a quarter said they already owned Bitcoin and of that 55% said they started investing this year.

The results highlight the explosive growth cryptocurrencies have seen this year as investors plowed money toward the volatile asset class amid growing mainstream adoption.

It is becoming increasingly difficult for investors to ignore Bitcoin as its price continues to rise.

Major altcoins have also reversed course with this relief rally.

Ether (ETH) rallied 11.4% Tuesday, outpacing BTC in a pattern mimicked by several other large-cap tokens.

Other altcoins like Cardano (ADA) and Litecoin are up over 9% validating my thesis of altcoins outgaining Bitcoin for the catch-up trade.

I don’t believe that this weekend's crash can partially be blamed on the US congress' upcoming questioning of top crypto executives. Nobody knows yet how badly this investigation will impact the market, but I wouldn’t say anything meaningful will happen.

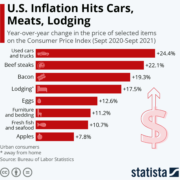

In fact, much of the volatility has been caused by poor communication from the US Central Bank that peaked with US Fed Chair Jerome Powell signaling the Fed will move faster than expected to tame inflation.

The algorithms had a field day dumping positions in volume.

Consensus had it that interest rate expectations would largely be left alone this December, but the Fed signaling that they plan to move earlier to break off the inflation genie caused all risk assets into a short-term tailspin.

That being said, I don’t believe the Fed will do more damage the rest of this month, and we should experience a relief rally into the yearend.

I would double down and say the Fed could have waited until January, because everyone understands how bad inflation is running its course, and it was largely baked into the market.

To get ahead of the next CPI inflation number is definitely a knee-jerk reaction and if the Fed has more of these fast pivots in 2022, we will experience a 10-15% correction in Bitcoin each time.

Long term, the US financial system will not be able to stave off highly inflationary policies, it’s like a drug addiction that can’t be shaken off.

Triggering inflationary-backed economic growth is the only way to make a dent in the federal debt hole, it just means that home price and wages will be a lot higher in nominal terms every year.

I merely see this short-term swoon as one step backward before we push forward again with the wild inflation.

People in the know have acknowledged that many corporations are building up reserves for 30% increases for 2022 salary and that is not a typo.