The Bombshells Headed Our Way

This certainly promises to be an interesting week for the markets. On Thursday, we get the Department of Labor?s weekly jobless claims at 8:30 AM EST. If we clock a fourth consecutive week over 380,000, or go even higher, then an exact repeat for last year?s summer slowdown will be in play. So will the 25% drop in equity markets that followed.

This will be confirmed by an April nonfarm payroll of less than 100,000, the result of hiring being pulled forward into January and February by the warm winter, and then puffed up by the seasonal adjustment process.

This will bolster the relentless torrent of negative economic data that has been rapidly deteriorating for the last two months, which no one seems to be noticing but me. Here is the latest batch:

April 30 - Chicago Purchasing Managers Index down from 62.2 in March to 56.2 in April

April 30 - Personal Spending fell from 0.9% in February to 0.3% in March

April 27 - The real shocker was that Q1, 2012 GDP fell out of the bottom at 2.2%, compared to an earlier prediction of 2.5%, and a 3.0% rate before that. The current quarter is now expected to fall to the 1% handle.

April 26 - Weekly jobless claims stayed at a high 388,000.

April 25? - March durable goods fell -4.2%, in part due to a decline in domestic aircraft orders.

The corporate Q1 earnings reports are winding down, and look like they will come in bang on my 5% prediction. This is down substantially from last year?s 15% rate. When these reports finish, where is the next upside surprise coming from? In almost every case, each announcement generated a lot of selling on the news.

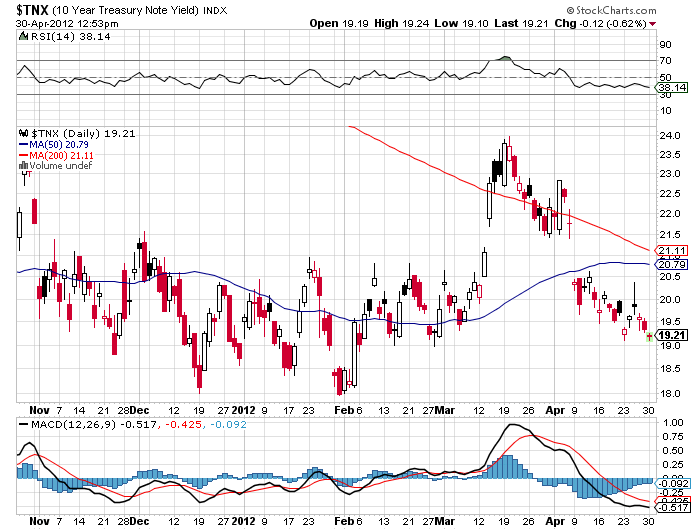

Permabulls beware: Rising multiples against falling earnings growth doesn?t go on for very long. Please note also that Treasury bond yields have given up all their gains this year and are poised to break to the low end of their one year range. This usually heralds a major ?RISK OFF? move bad for asset prices everywhere.

In case you didn?t have enough to worry about, on Sunday we get the French presidential election, where Socialist Fran?ois Hollande is leading conservative Nicolas Sarkozy by an impressive eight points. A much bigger borrowing and spending government in France could trigger the next wave of the European sovereign debt crisis, and lots of those riots that stock traders despise. Better take your significant other out to a French restaurant on Saturday night because it may not be there on Sunday.

It is possible that the data suddenly turn on a dime and return to an improving trend. But it is also possible that pigs fly. As for me, I?ve already got my weekend reservations at San Francisco?s Gary Danko?s. Frogs, hang on to your legs!