The Insurance Company Always Rings Twice

Got an interesting call yesterday from an old college buddy - let's call him Bob. We go way back to our UCLA days, before I headed to Tokyo and he went into tech.

He was fuming because UnitedHealth (UNH) just denied his family's third claim this year, something about an "experimental treatment" for his daughter's rare condition.

Coming from a guy who just cashed out of his third startup, hearing him rant about insurance bureaucracy was pretty rich.

Still, his situation got me thinking. After hanging up, I dug into what's really happening with insurance stocks, and the picture isn't pretty.

UnitedHealth Group, our nation's biggest health insurer, just had its worst week in years - dropping 9.5% after one of their executives was tragically murdered, which sparked an unexpected spotlight on their claims practices.

Cigna (CI) and CVS Health (CVS) caught the same downdraft, falling 4.5% and 5% respectively.

But here's what really caught my attention: UnitedHealthcare's denial rate for Medicare Advantage claims has more than doubled since 2020, hitting 22.7% last year.

Interestingly, this spike happened right as they rolled out new automation processes. Funny how that works, isn't it?

Experian Health's latest report shows this isn't isolated - 73% of healthcare providers are reporting more denials than ever, with processing times stretching longer and longer.

The cost of this trend? The Council for Affordable Quality Healthcare estimates $31 billion annually in administrative expenses alone.

Meanwhile, biotech companies find themselves in an awkward position. They're developing treatments that cost more than a house in the Hamptons and then need these very same insurers to make them accessible.

Amgen's (AMGN) been crushing it with their human therapeutics portfolio, pulling in $28.2 billion in revenue last year.

Biogen's (BIIB) making serious moves in neurological treatments, though their path has been rockier - just ask anyone who followed the Aduhelm saga.

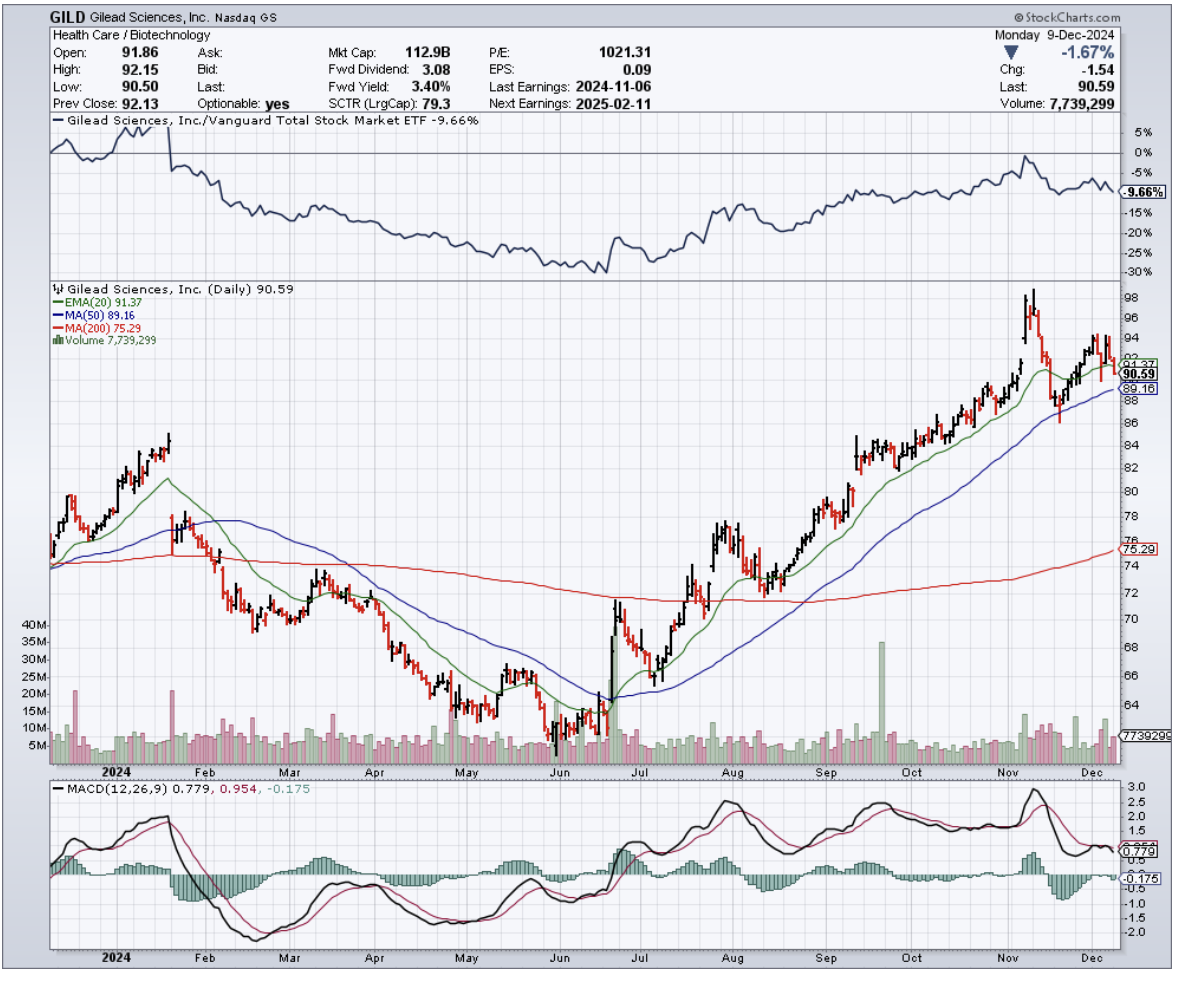

Gilead Sciences (GILD), our antiviral champions, have managed to stay above the fray, partly because their HIV and hepatitis treatments have become standard of care.

But even these giants must wonder:: as insurers tighten their prior authorization screws, what happens to patient access?

These biotechs spend billions developing breakthrough treatments - Amgen alone dropped $4.4 billion on R&D last year - only to face the insurance industry's equivalent of "computer says no."

The irony isn't lost on anyone: insurers need innovative treatments to justify their premiums, while biotech needs insurance coverage to justify their R&D spending.

It's a delicate dance that's worked reasonably well so far, but these rising denial rates have everyone on edge. Just last quarter, we saw several biotech earnings calls dominated by questions about insurance coverage rather than clinical trials.

So what should we do? Well, I say UnitedHealth and Cigna are "holds" right now - the current turbulence needs time to settle.

CVS Health is showing broader operational challenges that suggest it might be wise to consider selling. But Humana (HUM), with their strong Medicare Advantage presence, looks promising.

On the biotech side, Gilead looks like an excellent stock to buy on the dip. Its leadership in antivirals and solid pipeline make it compelling.

Amgen and Biogen? Keep them on your watch list while they try to find their footing in this situation.

Bob texted me again this morning - turns out he's filing an appeal with help from one of Silicon Valley's top healthcare attorneys. Typical Bob, bringing a cannon to a knife fight.

But maybe that's exactly what this sector needs right now - some heavy artillery to shake up the status quo.

For those willing to dodge the crossfire, there might just be some spoils of war worth picking up. After all, fortune favors the bold—and sometimes, the heavily armed.