THE NEW ‘49ERS

(NVDA), (AMD), (INTC), (QCOM), (GOOGL), (MSFT), (AMAZN)

You know, I was just thinking about how history has a funny way of repeating itself.

Take Samuel Brannan, for example. This guy had some serious guts and vision. He made an absolute killing during the California Gold Rush back in the 1800s, but not by getting his hands dirty in the goldfields. Oh no, he was way too smart for that.

Instead, he invested in the tools that the miners needed to pan for gold. And you don’t need me to tell you that Brannan’s idea paid off big time. At the time, he was raking in the equivalent of $43 million a year in today's money. Overnight, he became the richest man in California.

Now, you might be thinking, "That's great, but what does this have to do with me?"

Well, we are in the middle of a new kind of gold rush — the AI gold rush. Analysts say this could create a mind-boggling $1.5 trillion in market value by 2030 — that's trillion with a "T.”

As expected, you've got giants such as Microsoft (MSFT) and Google (GOOGL) scrambling to integrate AI into their search engines. Understandably, investors are just itching to get a piece of the action.

But just like in Brannan's day, a real opportunity also lies in those providing the tools that make AI possible. So far, one name stands out above the rest: Nvidia (NVDA). Basically, what this company does is cranking out the chips that power AI technology.

And since big companies and startups need hundreds or even thousands of these chips to create their chatbots and image generators, Nvidia has become much like how John D. Rockefeller's Standard Oil dominated the oil refining game, or how Netflix revolutionized the streaming world. It's that big.

In fact, it already has a whopping 95% of the market for graphics processors used in machine learning, which is a big part of AI That's right, 95%!

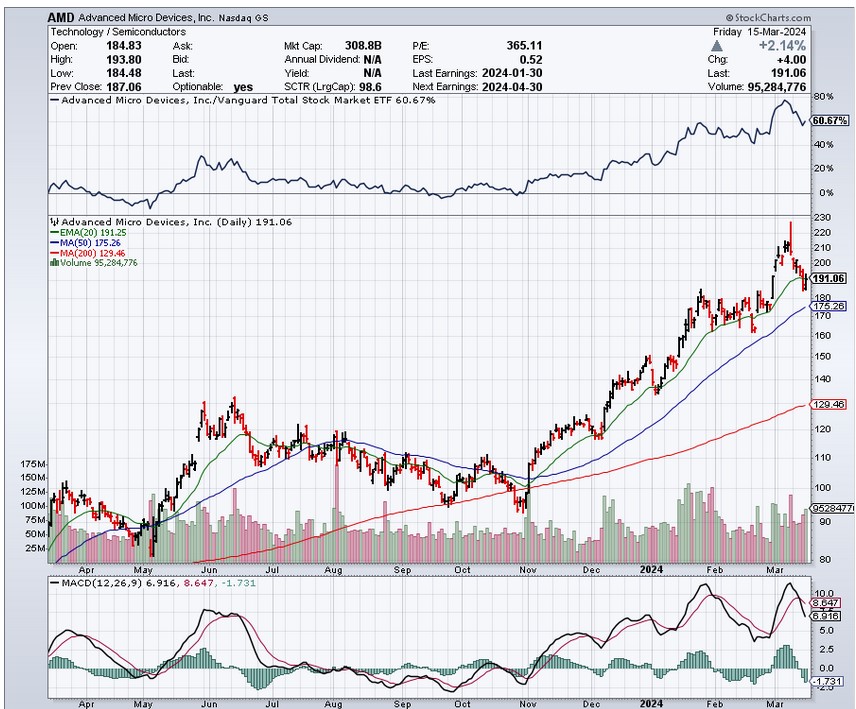

But Nvidia isn't the only one in this arena. Advanced Micro Devices (AMD), Intel (INTC), Qualcomm (QCOM), Google, and Amazon (AMZN) all want a piece of the AI pie.

AMD has been nipping at Nvidia's heels with its fancy CDNA accelerators and Instinct GPUs. Meanwhile, Intel's going all-in with its Habana Gaudi chips. Even Qualcomm, the mobile chip giant, is getting in on the action with its Cloud AI 100 accelerators.

And don't even get me started on Google and Amazon.

Google has been developing its very own Tensor Processing Units that it could start selling, and Amazon Web Services is probably cooking up some custom AI chips as we speak.

The point is, the AI revolution is just getting started. Sure. Nvidia might be leading the pack now, but this race is definitely far from over.

As AI becomes more and more a part of our lives, we're going to see new startups and innovators coming out of the woodwork with mind-blowing hardware and software.

So, what should you do? Spread your bets, my friends. Get some skin in the game with pure-play AI companies like Nvidia, but don't put all your eggs in one basket. Diversify with some of these other potential winners.

So aside from panning for gold, it’s also strategic to find those "pick and shovel" companies that are making all these advancements possible.

Think of Nvidia and its competitors as your discoveries as the modern-day Samuel Brannans, with these companies providing the essential tools for this 21st-century gold rush. And just like in 1849, the smart money can also be found on the toolmakers, not the miners.

After all, while history doesn't repeat itself, it often rhymes.