The Skinny On Economic Growth

What might just give economies a bigger jolt than the frenzy of the Super Bowl or a jampacked Taylor Swift world tour? If you guessed the recent buzz around weight-loss drugs, take a bow. You see, it's not just about slimming waistlines anymore – these breakthrough medications could be a game-changer for the whole economy.

But first, a sobering reality check: health issues have been nibbling away at the U.S. labor force like a sneaky termite over the last 30 years, shaving off two to three percentage points.

Then there's the matter of early departures from this mortal coil, chipping away another 0.2 percentage points from annual labor growth.

Not to mention the legion of unsung heroes caring for the ailing, effectively benched from the workforce, leading to a 3% labor force deficit.

Among all the health issues affecting the labor force, obesity has been identified as a sneaky little gremlin, dragging down productivity and participation in the workforce.

With obesity affecting 40% of the U.S. population, we're talking about a hefty 1% slash in total output.

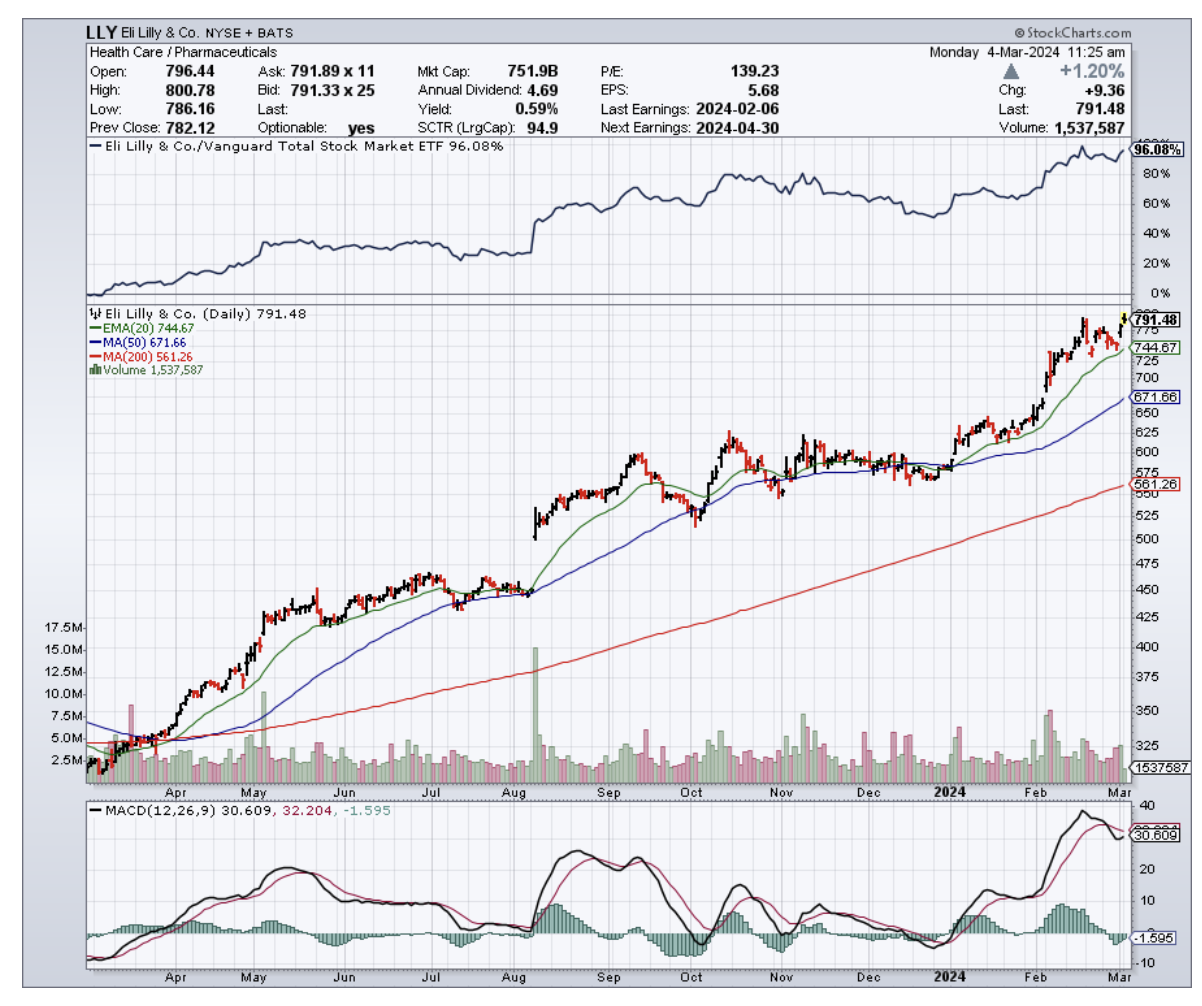

But what if there was a way to combat this? Enter stage left: Eli Lilly (LLY). Sure, you might know them as a big-league player in the pharma world, but did you know they're the brains behind blockbuster medications like Trulicity, Mounjaro, and cancer-battling Verzenio?

And the story gets even more exciting – it's not just their existing all-star lineup that's sent their stock soaring 180% since 2021. Their latest weight-loss marvel, Zepbound, got the FDA's green light last November. Think of it as Mounjaro's twin, sporting the same molecule but with a different name to keep things clear for their existing diabetes patients.

This breakthrough signals a massive shift in the obesity treatment landscape. The global anti-obesity market is projected to explode to a staggering $100 billion annually by 2030 – a dramatic leap from last year's $6 billion. To put that in perspective, global spending on cancer treatments is estimated at $220 billion this year.

Naturally, Lilly is poised to grab a big slice of that pie. Analysts are predicting a healthy 21.4% revenue boost this year, and nearly 24% by 2025. Talk about a growth spurt.

As for earnings? They're looking at nearly tripling in that timeframe. The future's so bright, Lilly might need shades.

But here's the catch: Lilly's stellar rise has its stock priced at a premium, and then some. We're talking 60 times this year's expected earnings. And while the company's profit train is set to chug along, not every stock can keep up those lofty valuations in the long haul.

And let's not forget about the competition. Novo Nordisk (NVO), with its own contenders Ozempic and Wegovy, is nipping at Lilly's heels, even as Amgen (AMGN) and others are hot on the trail with promising candidates of their own.

Yet, Lilly's not sweating it. With Zepbound (aka Mounjaro for the weight-conscious) already making waves as a go-to for obesity treatment, they're sitting pretty. It's like they've already won half the battle, with doctors and patients already in the know about this not-so-secret weapon.

Still, as tempting as it might be to hop on the Lilly bandwagon after seeing those numbers, we need to do a quick reality check before investing. It's important to remember that every stock has its ups and downs.

For starters, Lilly's stellar rise means their stock is trading at a premium – a hefty 60 times this year's expected earnings. And while the company's profit train is definitely chugging along, that kind of lofty valuation might be a bit too spicy for some investors' taste, especially in the long run.

So, what's the takeaway for those who want in on the action? Lilly's current price tag might give you pause, especially if you're looking for a bargain.

It's been a wild ride for this stock, and sometimes the best moves involve waiting for the market to catch its breath.

However, their dominant position in a rapidly expanding market definitely makes them a player worth watching closely. I suggest to buy on the dip.

Switching gears for a second, let’s take a look at the big picture. It turns out that widespread use of GLP-1 medications like Lilly's could deliver way more than just individual weight loss. We're talking about a potential shot in the arm for the entire U.S. economy.

Think about it: if 30 million Americans hop on the GLP-1 train with drugs like Mounjaro and Zepbound, and a conservative 70% of them see benefits, we could see a 0.4% boost in the U.S. GDP. And that's just the starting line.

In a best-case scenario, where 60 million Americans embrace these treatments and a whopping 90% benefit, the GDP could potentially surge by a full 1%. Even with more modest projections, with 15 million users and a 50% success rate, the economic impact would still be noteworthy.

This isn't just pocket change – it's serious economic muscle. With the right push, these weight-loss drugs could be the breakthrough prescription our economy needs, adding some serious pep to our growth alongside countless individual health transformations. Now, isn't that a story worth following?