The Technical/Fundamental Tug of War: Who Will Win?

For the last few weeks, I have had two groups of analysts screaming in my ears.

Fundamental researchers are asserting that at $105 per share in earnings, generating a price earnings multiple of 15, stocks are at the historic middle of a 10-22 range. Q2 earnings are over, and modestly outperformed on the upside, although not with the magnitude seen in recent quarters. Plus, the taper is on the table, and the Federal Reserve may deliver a surprise at its upcoming September meeting.

Furthermore, risk assets are about to enter a period of seasonal strength. If you ?sell in May and go away?, you should then ?return in September and buy, fill your boots.?

No, no, cry the technicians. Although the small caps (IWM) have been going gangbusters, the large cam Dow and S&P 500 indexes have failed to put in new highs, raising the risk of a failed double top.

What is a befuddled individual investor to make of all this? My belief is that fundamentals always win out over the long term, and that technical cues are at best, a lagging indicator. I use charts for guidelines on where to place orders on a short term basis. The longer you stretch out your time frame, the less relevant they become.

At best, technicals are right 50% of the time, right in the same league as a coin toss, and most of the brokers and investment advisors out there. How many technical analysis hedge funds are out there? None. They are all fundamentally driven. The same technicians making the incredibly bearish prognostications today were making equally convincing bearish arguments last November.

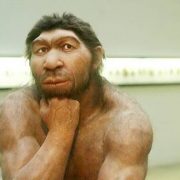

However, since we are descended from prehistoric hunter-gatherers, we are all visually oriented. We respond to stimuli we can see much more rapidly than those we can conceive. A picture truly is worth 1,000 words, and probably a lot more. That?s why so many brokerage firms use them to sell research. I employ charts to back up my fundamental arguments because they are so easy to understand, definitely not the other way around.

So I think the fundamentals will eventually win out, and that we will get the autumn rally that I have been predicting. In fact, we may be only four years into a seven year bull market that is in the process of boosting price earnings multiples from 10 to 18 or 19. The mountain of cash sitting on the sidelines, and the failure of the major indexes to pull back more than 7.5% this year are telling you as much.

Exactly when will the big move up happen? Don?t ask me. Go ask a technician.