The Top Dog In Animal Healthcare

You've likely witnessed a scene like this: You're at the park, and you see a young couple playing fetch with their golden retriever.

The dog is absolutely loving life, jumping and bounding after the ball, tail wagging furiously. It's a heartwarming scene, and it's one that's becoming more and more common these days.

In fact, just the other day, over coffee, a veterinarian buddy of mine spilled the beans.

"You wouldn't believe how people are pampering their pets these days," she said, shaking her head in amusement. "It's no longer just about the basics—food and health. Nope, we're talking top-tier, VIP treatment. They're ready to drop serious cash to ensure their furry friends are living their best lives."

It's a whole new world for pets, and their owners are leading the charge, wallets wide open.

And that is where Zoetis (ZTS) comes in. This company is the top dog (pun intended) in the animal healthcare space, and it's been making some serious waves in the market lately.

Now, I know what you're thinking - "What about those big-shot human healthcare stocks like Amgen (AMGN), Johnson & Johnson (JNJ), and Pfizer (PFE)?"

Well, let me tell you, Zoetis has been giving them a run for their money since spinning off from Pfizer back in 2013. This company has been posting positive annual EPS growth every single year, with an average annual EPS growth rate of a whopping 15.9%.

But that's not all — Zoetis has also been dishing out some seriously impressive dividend growth, with a CAGR of nearly 25% since it was spun off. That's right, this stock is checking all the boxes for dividend growth investors.

And if you think this is just an income play, think again.

Zoetis has been absolutely crushing the S&P 500, posting price returns of 492% compared to the market's measly 176% gains over the last decade.

So, what's the secret behind Zoetis' success?

Well, it all comes down to our furry (and sometimes scaly) friends. You see, people are lonelier than ever these days, and they're turning to pets for that much-needed companionship.

The US Surgeon General even called loneliness an epidemic, sounding the alarm on its dire impacts on health, likening its risks to smoking up to 15 cigarettes a day.

From the gripping claws of loneliness among young adults to the isolation felt by mothers with young children, the pandemic has only deepened this crisis, affecting a staggering 36% of Americans.

More than that, this loneliness trend isn't just about having a buddy to binge-watch Netflix (NFLX) with. It's actually impacting our species' survival. Studies show that sexual activity is on the decline, and technology is distorting the way we interact with each other.

It's a bit of a downer, I know, but here's where Zoetis shines through. As people turn to pets for love and affection, they're also shelling out some serious cash to keep their furry friends healthy and happy.

The American Pet Products Association says that nearly 87 million U.S. households own pets (roughly 66%), and it's not just the younger generations who are getting in on the action. Baby Boomers and Gen Xers are also big-time pet owners.

What does all this pet love mean for the industry? Well, the pet industry is expected to be a $150 billion behemoth in 2024.

Now, what really sets Zoetis apart from the pack? It all comes down to pricing power and growth potential.

In the animal health market, drug prices aren't determined by pesky regulations, government buyers, or PBMs. That means Zoetis can charge premium prices for their trusted, name-brand drugs without having to jump through hoops.

Plus, with less competition in the animal health space, Zoetis' products have longer growth runways and aren't constantly battling generic copycats.

For context, Elanco (ELAN), Zoetis' pure-play competitor, only managed to bring in $4.4 billion in sales.

So, what's the bottom line here?

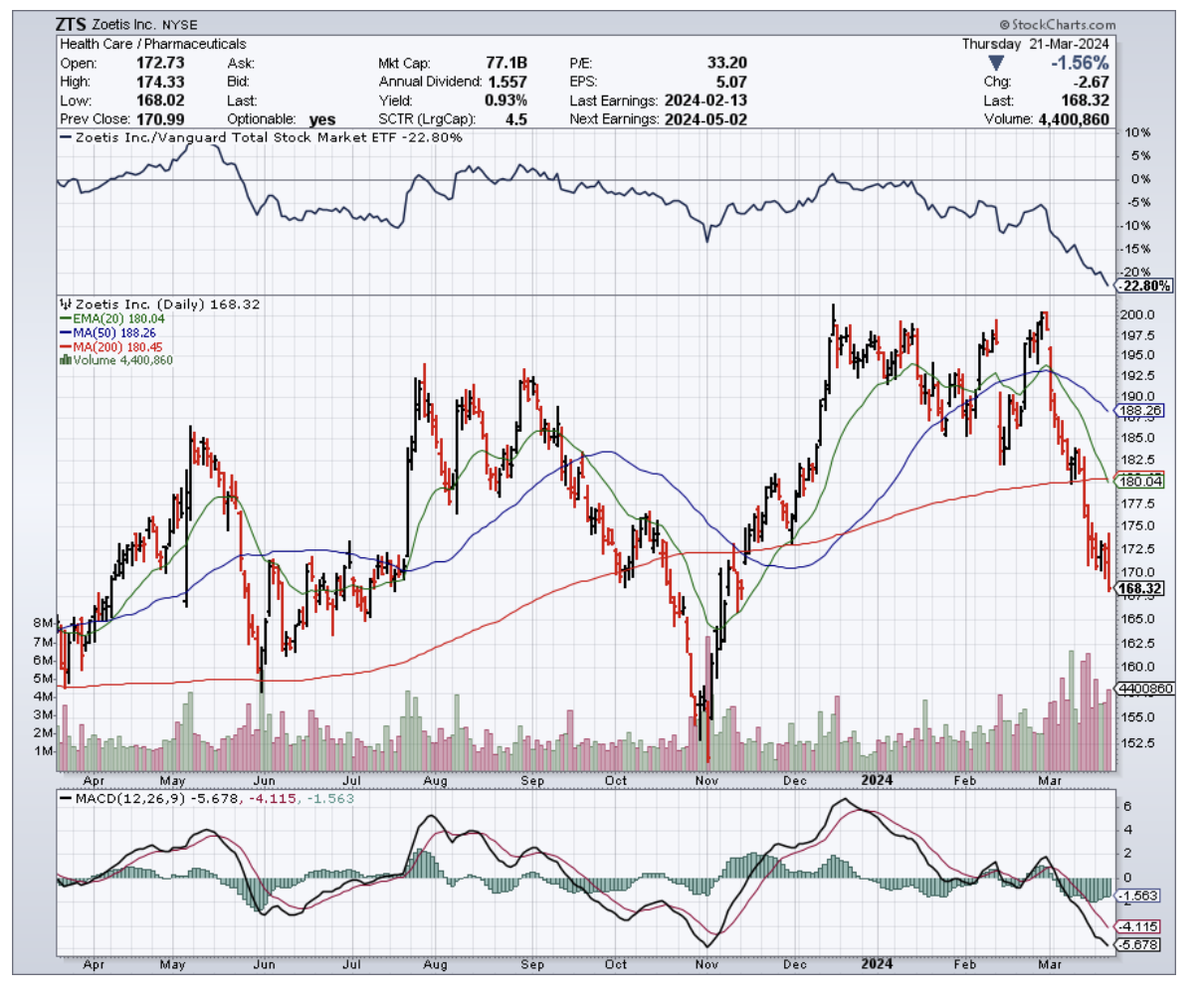

Zoetis is a best-in-breed play on the booming animal healthcare market, with a safe and growing dividend to boot. As this sell-off continues, Zoetis keeps climbing higher on my personal watch list. I'm ready to back up the truck and load up on shares come April when I put my March dividends to work.

If you're looking for a unique way to play the healthcare space with a company that's got plenty of bark and bite, Zoetis might just be the stock for you.