The Truth About Cryptocurrencies as an Asset Class

It's my responsibility to new readers of the Mad Hedge Bitcoin Letter to offer an imminent snapshot of where we are in the crypto universe at this point in time.

It would be negligent if I didn't.

To say that Bitcoin is the only investment in the crypto sphere is also not true. Bitcoin is the biggest and most trusted crypto network, and many have become grotesquely wealthy because of it. Yet there are other altcoins out there.

Knowing what to digest and what to avoid like the plague is where I come in.

Don't get me wrong. I'm still highly bullish on Bitcoin as an asset, but we don't operate in a vacuum.

Many altcoins have been performing alongside Bitcoin in recent months. Bitcoin is up approximately 5% year to date, although it's recently fallen through the $90,000 to $100,000 range.

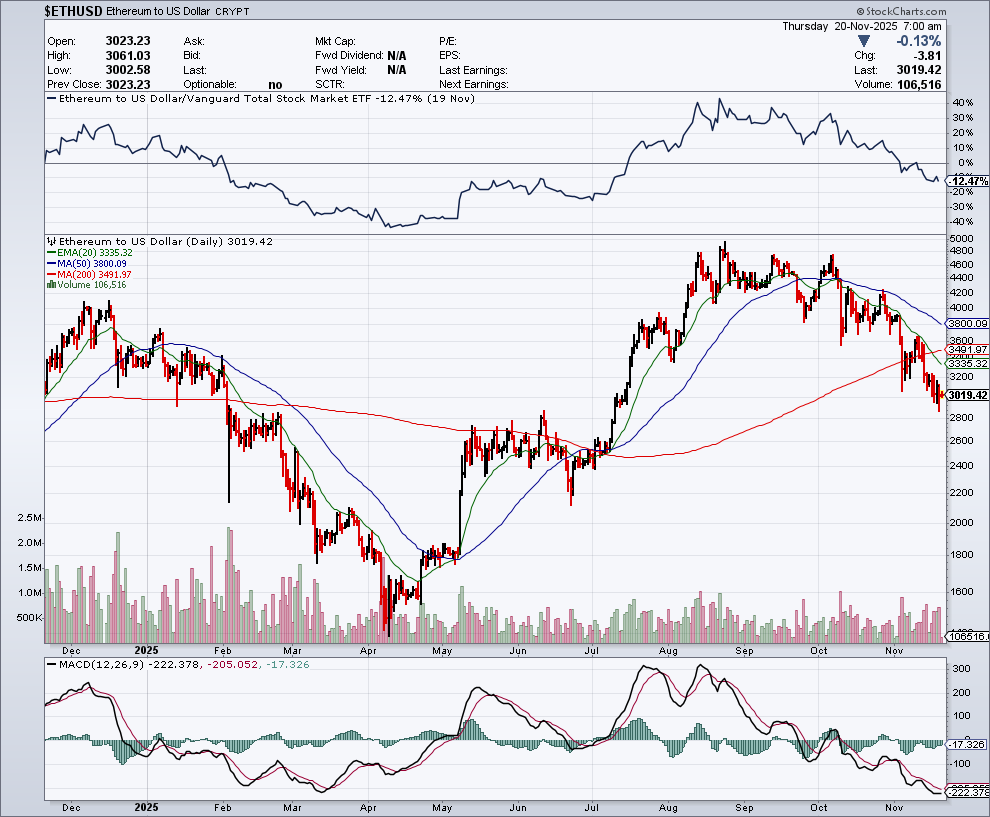

Ethereum, for instance, is trading around $3,000 to $3,400 in November 2025. This reflects a pullback from earlier highs this year.

The earlier expectation that Ethereum would push past its former May high of approximately $4,200 hasn't materialized as of late 2025. This prediction is now flagged for review.

As one might have assumed, lesser coins with cheaper pricing benefit or suffer from the law of small numbers, with wider gaps in percentage change on up and down days.

It's simply the nature of the beast.

Overall, the second largest cryptocurrency by valuation performing well is a highly bullish signal for Bitcoin itself. It also signals increasing adoption, which is positive for the security and regulation of the broader asset class.

I subscribe to the rising tide lifts all boats theory in cryptocurrencies, because it does more to legitimize the top asset than pull capital away from it.

The most poignant takeaway is that readers can't overlook other cryptocurrencies simply because Bitcoin is the apex warrior.

Returning to the foundations, cryptocurrencies have a reputation for being difficult to understand. Don't be embarrassed if you're befuddled. I felt the same way the first day I tried to understand this material.

A poll earlier this year found that a large share of people who'd heard of cryptocurrencies still had little or no understanding of how they work.

How Do I Buy Bitcoin?

Conventional wisdom has it that the most likely route is a Bitcoin online exchange.

Create an account, then enter a payment method.

Reputable exchanges will require information such as bank account details or a debit or credit card. Proof of identity is required, such as a driver's license, ID, or passport.

After verification, you can purchase Bitcoin by transferring it to a personal hot wallet. Then you can buy and sell the asset.

Remember that these accounts coming directly from Bitcoin brokers aren't insured and aren't secure.

Therefore, a better way to mitigate risk is by going through a Bitcoin ETF on the United States public markets with an official broker registered with the Securities and Exchange Commission, SEC.

Not only do public stocks provide additional security as a Bitcoin trading vehicle, but ETFs aggregate crypto asset tracking data points, which reduces volatility even further.

Unregulated crypto exchanges come with a higher level of operational and systemic risk. Not everyone wants to venture into the arid Wild West without a horse or water.

If you trade with an official brokerage registered with the SEC, your bank deposits are covered by Federal Deposit Insurance Corporation, FDIC, insurance up to $250,000 per account holder. Brokerage crypto assets themselves aren't FDIC insured.

There's also another layer of protection. You're covered by the Securities Investor Protection Corporation, SIPC.

SIPC protects brokerage accounts up to $500,000, including a $250,000 limit for cash intended for securities transactions.

Cash held solely to earn interest isn't protected. SIPC was established by Congress but is funded by its member broker dealers.

In many cases, SIPC protects against unauthorized trading or theft in the account.

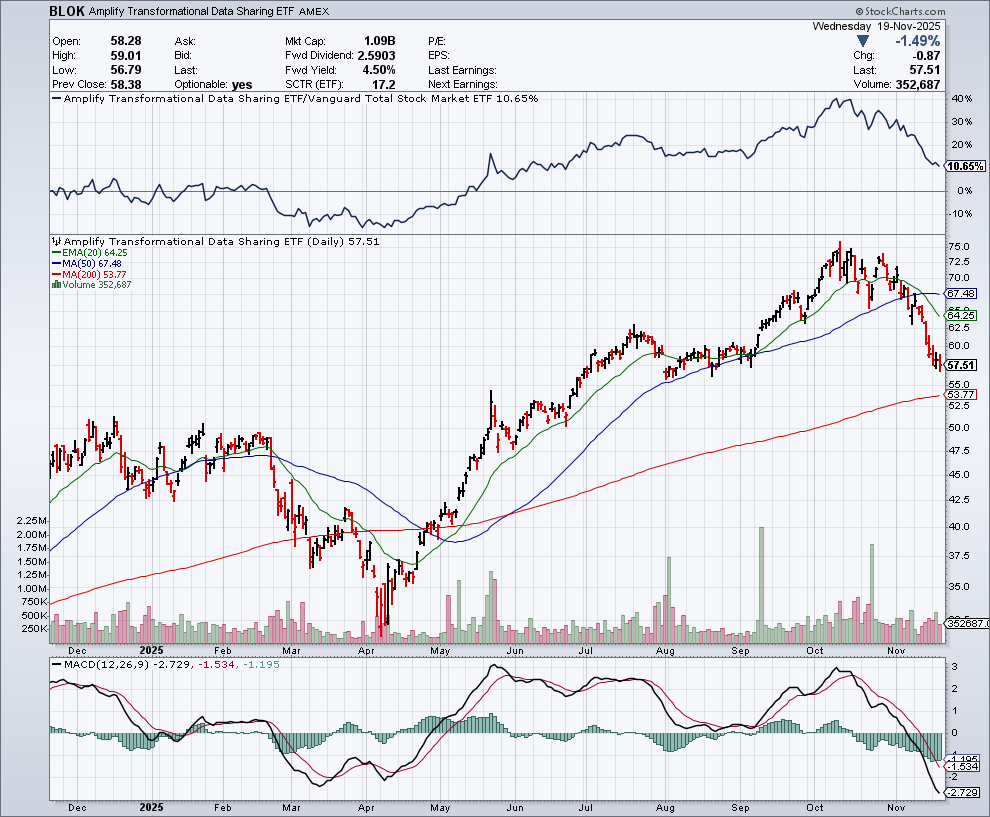

My favorite crypto ETF in the earlier years of this publication was the Amplify Transformational Data Sharing ETF (BLOK). It's grown into one of the strongest blockchain related ETFs on the market since its inception.

BLOK is an actively managed ETF that seeks to provide total return by investing at least 80% of its net assets in equity securities of companies actively involved in the development and utilization of blockchain technologies.

BLOK's largest holdings included MicroStrategy Incorporated, now rebranded as Strategy Inc., and the Canadian crypto mining company Hut 8 Mining Corp. I've already circulated a trade alert on Strategy Inc. to new readers and remain highly bullish on the company.

However, this ETF encompasses more than Strategy Inc. It offers broader exposure to firms related to Bitcoin, crypto miners, and software companies heavily involved in crypto.

Hut 8 engages in industrial scale Bitcoin mining operations. It owns and operates dozens of BlockBoxes in Drumheller, Alberta, and Medicine Hat, Alberta.

BlockBoxes are among the most powerful and cost effective Bitcoin mining units available on the market.

BLOK doesn't track Bitcoin one to one, but it mimics Bitcoin's price action relatively closely, with less extreme swings.

Controlling excess volatility is something you should be happy about. BLOK also has an expense ratio of 0.71%, which is reasonable for those who want to buy and hold the ETF rather than actively trade the derivative.

Buying BLOK is still a reliable way to ensure safer trading under the SEC framework, although some investors prefer a higher risk profile and may seek more direct exposure.

The crypto revolution is now well beyond its infancy, but the possibilities remain vast because adoption is still expanding.

However, we can't assume Bitcoin will always lead the charge. Paying attention to developments throughout the industry provides deeper insight into how the bellwether, Bitcoin, is performing and reacting to future challenges as the top asset.

The truth is that several winners will benefit from higher crypto prices, not just Bitcoin. Blockchain technology will also be a major winner from higher crypto prices.

Even if one doesn't want to profit from crypto, this will remain one of the intellectual challenges of a lifetime.

Lastly, I'd like to note the price call made in 2021 that projected Bitcoin at $66,000 by the end of that year. That prediction was surpassed long ago. Bitcoin eventually reached a peak of approximately $126,000 in October 2025.