The Yen Carry Trade Blow Up

When I staggered downstairs at 11:00 PM to check the close for the Tokyo stock market, my eyes just about popped out of my head. Yikes! Down 6.3%! The yen was up another 2% to ?94 against the US dollar as well!! It looked like the world was in for another round of ?RISK OFF? with a turbocharger. Fasten your seatbelts, and pack an extra pair of shorts.

So I called an old friend in Japan who always seems to know what is going on whenever the wheels fall off there. Ed Merner is the CEO of the Atlantis Japan Growth Fund (LSE-AJG), who has long been rated the number one stock picker in the Land of the Rising Sun. Ed?s fund, which trades on the London Stock Exchange, was, at one point, up a gob smacking 53% this year without a stitch of leverage.

When the ink was barely dry on the US Japan peace treaty in 1950, Ed?s father uprooted his family from the rural High Sierra hamlet of Truckee, California, and moved them to Tokyo. That gave him a front row seat to the economic miracle that followed in the fifties and sixties.

Ed started managing money just a few years before me, in 1970. He toiled away as a portfolio manager at Schroeder?s & Co. in Tokyo for 25 years and then launched his own firm in 1995. Ed, who is a fascinating individual and a genuine nice guy, is the man I always turn to for my long-term view on Japan. Suffice it to say, Ed knows which end of a piece of sushi to hold upward, and is said to be able to snatch a fly midair with a pair of chopsticks. His Japanese is flawless, and he is now regarded as a local celebrity.

Ed says that the ?Rebirth of Japan? story is anything but over, and in fact, is just getting started. He thinks that the Nikkei index could soar from the current ?12,445 to above the 1989 all time high of ?39,000 in years to come. What we are seeing now is a long overdue rest for the world?s best performing major stock market. Bank of Japan mouthing?s of empty platitudes, rather than concrete action is what triggered the current rout.

Much of the money that went into Japan this year was of the hot, algorithm driven variety. You saw this in the dominance of the index names in trading, like Sony (SNE), Toyota (TM), and Honda Motors (HMC). Individual stock picking almost ceased to exist as an investment strategy. When the same hedge funds all tried to unwind their Japanese stock longs and yen shorts at the same time, you got the predictable flash fire in the movie theater. Margin calls became the order of the day.

As the index money leaves in this correction, it will be replaced by more traditional mutual fund and individual investors, who have a more stable orientation. Stock selection will become more fundamentally driven. That?s when Japan transitions from the flavor of the day to a serious core investment.

Now is about the time you should expect that to happen. Japan?s upper House of Councilors election will take place on July 21, and Prime Minister Abe?s ruling Liberal Democratic Party will win by a landslide. After that, you can expand Abe?s plans for an overdue major restructuring of the economy to mature from idle speculation to specific proposals. That is what the market wants to hear. Until then, he is loath to ruffle political feathers. He is going to have to break a lot of eggs to make this omelet.

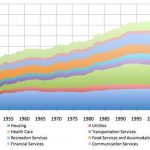

On the table in his ?Third Arrow? plan are deregulation of virtually all financial markets, modernization of the health care system, immigration reform to open the way for more foreign workers, and rationalization of a bloated government bureaucracy. International trade will get streamlined and capital investment incentivized. More infrastructure spending will be aimed at maintenance and repair, so there will be no more ?bridges to nowhere.?

Oh, and he wants to enable the national pension fund system to step up its purchases of Japanese stocks. Abe wants to compress all of the deregulation that the US has enacted in the past 30 years into the next three.

The truly encouraging thing here is that Abe?s early actions are already bearing fruit. ?Arrows? 1 and 2 put the country on track to double its money supply in two years and paved the way for a staggering $150 billion in new public works spending. The crash in the yen this prompted is causing corporate earnings to go through the roof. Those results will be reported in the fall.

Then, the best company performance in two decades and a national reorganization plan on the scale of Roosevelt?s New Deal will be the impetus for the next leg up in the Great Japanese Bull Market of the 2010?s. That is why I banged out Trade Alerts on Wednesday to buy Japanese stocks through the Wisdom Tree Japan Hedge Equity ETF (DXJ) and sell short the yen through the Currency Shares Japan Yen Trust ETF (FXY) and the Proshares Ultra Short Yen ETF (YCS).