Tick Talk

While waiting two hours to vote at the Incline Village Library this weekend, I counted the number of smartwatches in the line.

Seemed like everyone was checking their heart rates in the cold. One woman's Apple Watch even suggested she sit down after standing too long in the 40-degree weather.

That got me thinking about the billions flowing into medical wearables - and where that money should really be going instead.

Let's start with some sobering numbers about atrial fibrillation (AFib), the crown jewel of smartwatch detection capabilities.

Yes, Apple's (AAPL) 2020 study showed their watches can detect 84% of AFib cases during monitoring sessions. Sounds impressive, until you dig deeper.

Of the 50 million Americans wearing smartwatches, these devices identify only about 5,000 new AFib cases annually - a mere 0.083% of the 6 million Americans affected by the condition.

Plus, the real money tells a different story. The U.S. performs 250,000 ablation procedures yearly, creating a $3.2 billion market growing at 10% annually.

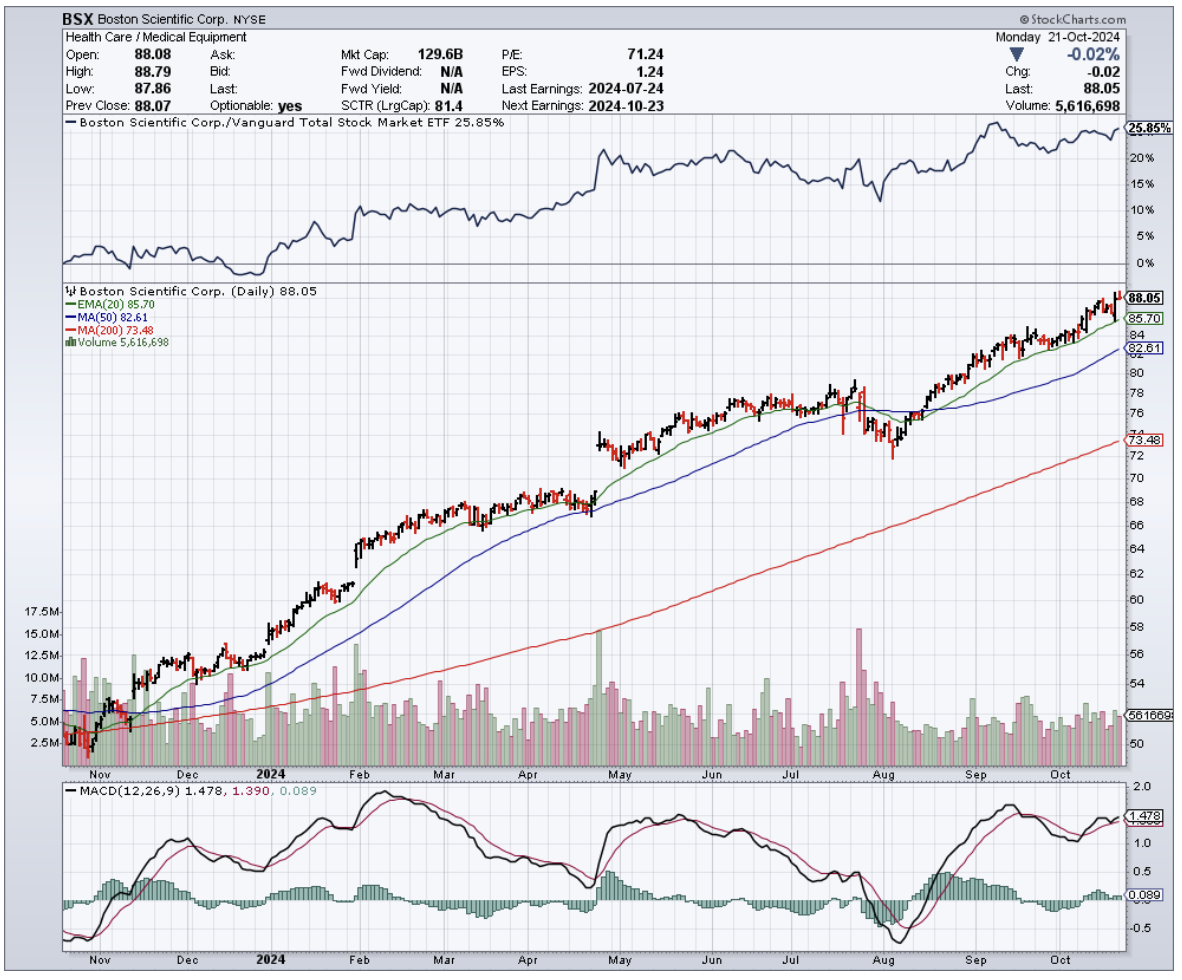

Abbott Laboratories (ABT), Boston Scientific (BSX), and Medtronic (MDT) dominate this space, with combined annual revenues of $12.4 billion from their cardiac rhythm management divisions alone.

Those 5,000 smartwatch-detected cases? They represent just 2% of annual ablation procedures. Not exactly the revolution we've been promised.

The story doesn't improve when we look at sleep apnea detection.

While Apple and Samsung tout their sleep-monitoring capabilities, their watches identify only about 60,000 of the 2 million new sleep apnea cases diagnosed yearly - that's 3% of new diagnoses.

Meanwhile, ResMed (RMD) and Inspire Medical Systems (INSP) generated combined revenues of $4.8 billion last year from sleep apnea treatments.

The smartwatch contribution to their patient pipeline is barely a rounding error.

Still, it’s not like this sector is a complete waste. The global smartwatch market stands at $58 billion and is projected to reach $98 billion by 2027, growing at 10.5% annually. Impressive, until you compare it to the traditional medical device market: $495 billion, reaching $718 billion by 2029.

The cardiac monitoring device segment alone represents $24.5 billion, expanding at 6.9% annually.

More importantly, traditional medical device companies are growing their revenues faster than smartwatch detection is adding to their patient base.

But, like I said, don't write off the sector entirely. The next generation of smartwatches promises some intriguing possibilities.

Continuous blood pressure monitoring could tap into a $23 billion market.

Non-invasive glucose tracking might crack the $28 billion diabetes monitoring space by 2027.

Enhanced sleep diagnostics could open up another $12.8 billion in opportunities.

So what's the smart play here?

Near term, keep your focus on established leaders like Abbott and Medtronic. Their upcoming Q4 earnings reports will tell us more about traditional patient acquisition trends than any smartwatch sales figures.

Watch for FDA clearances too - Abbott's new cardiac mapping system, expected in Q1 2025, could be a game-changer.

Looking out 12-24 months, keep your eye on companies like Dexcom (DXCM) and Insulet (PODD) as glucose monitoring moves mainstream.

ResMed's new sleep diagnostic platforms, launching mid-2025, could redefine how we think about sleep medicine.

Meanwhile, Boston Scientific's push into AI-enhanced cardiac monitoring might just bridge the gap between consumer tech and serious medical devices.

For long-term thinkers, watch for companies developing hybrid solutions that combine traditional devices with consumer tech.

The real breakthrough will come when medical device makers start acquiring wearable technology companies. That's when you'll know the revolution is real.

Remember, following the patient flow matters more than following the hype flow. Just like timing your visit to avoid a two-hour voting line, timing in the market is everything.

And right now, the time is right for medical device stocks, not their flashier smartwatch cousins.