Torpedo Fired On Tech Market

Torpedoes have been fired on the tech market, so what should you do?

We have suffered some damage, and in the short-term, don’t bet the ranch on a rapid reversal.

Tech’s bellwether stock, Nvidia (NVDA), has cratered from $150 per share and is now closing down at $100 per share.

The selloff is real and unrelenting.

Treasury yields slid on bets that an economic slowdown would force the Federal Reserve to slash interest rates. Bitcoin slipped below $80,000.

The administration said the US economy faces “a period of transition,” deflecting concerns about the risks of a cool down as his early focus on tariffs and federal job cuts causes market turmoil.

President Trump doubled down on the current policy path and acknowledged the chance of “disruption,” all adding up to a letdown in sentiment.

If you thought Monday would give us a small reprieve, think again.

We were hit with another tsunami of selling.

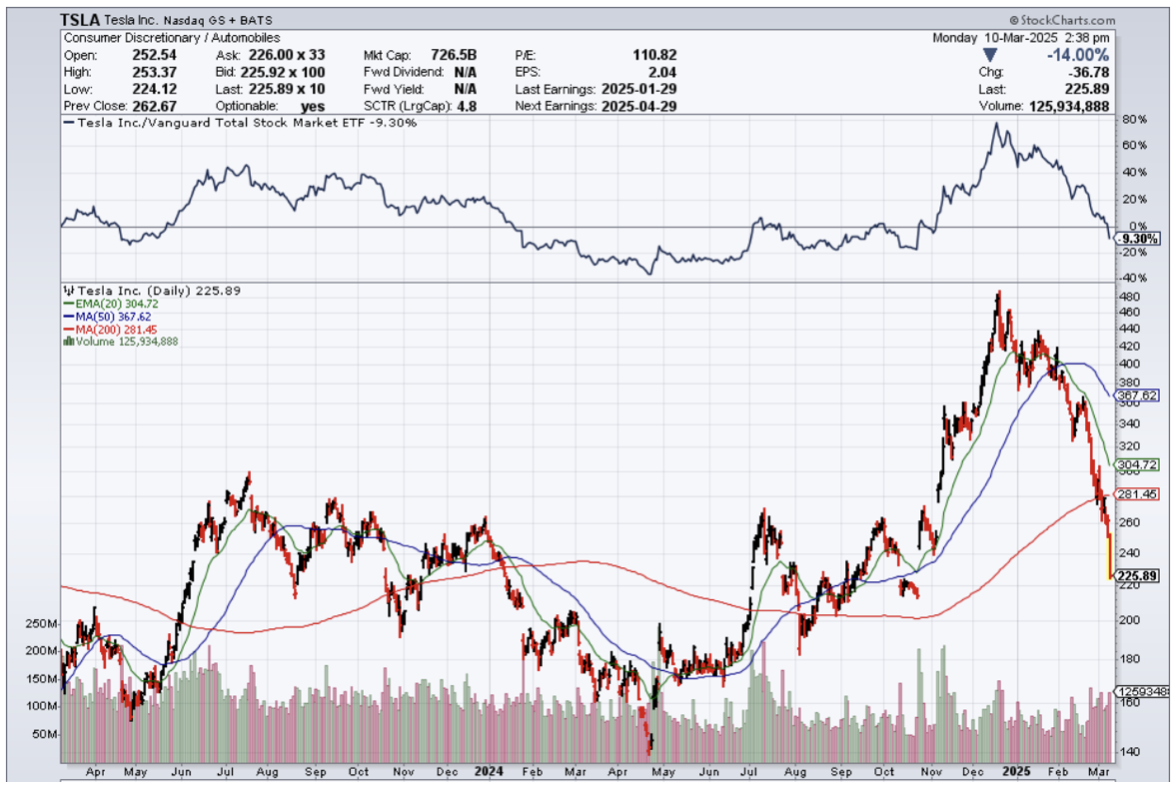

Tesla is down 14% while I speak, and Musk’s political involvement has made this stock untouchable. Apple is down 5%, and Palantir is down over 10%.

In the short-term, it seems as if the administration will speak out every chance they get to push along the tariff policies, and they don’t care about the stock market.

That has to worry investors, and I would advise the street to the sidelines so this can work itself through.

At the end of the day, it is a real worry where that extra incremental dollar will come to help the bottom line of tech companies.

Consumers are getting scared away, and entire countries are on alert for the quickly changing policies.

This type of backdrop is not conducive to an appreciating tech market.

Markets continue to prove sensitive to trade policy, as considerable uncertainty remains over the size and scope of tariffs to be implemented.

The stock selloff in tech has been so pronounced that I think we are through a good chunk of it.

We could rattle around a little and trudge sideways with dips on bad employment and bad consumer numbers.

Americans from all walks of life are cutting back.

A startling statistic shows that over 50% of the spending is done by only the top 1% of Americans, meaning a bigger load is carried by the few.

Indeed, many at the bottom of the economic pyramid have not seen an upturn in fortunes after going through 2001, 2008, 2020, and then the inflation that occurred after that.

It all stinks of a saturated tech market where even institutions are dumping stocks to lock in profits.

The administration appears to have bait and switched us to condition us to rate the yield of interest rates as the ultimate barometer of economic health.

Remember, we have been stuck in this high rates and high price environment in almost every asset class for quite a while.

It appears as if Trump is trying to break this up so that there is more price discovery and a healthier functioning market.

In the short term, watch out below because the prior admin has been blamed for the current selloff, and Trump wants to flush out the system before “saving” it before mid-term elections.

In the short-term, scale back tech positions is the responsible strategy because it is very obvious that the economy is about to weaken, and tech management will need to signal to investors of rapidly shrinking revenue targets.