Trade Alert - (AMZN) August 5, 2024 - STOP LOSS - SELL

When John identifies a strategic exit point, he will send you an alert with specific trade information as to what security to sell, when to sell it, and at what price. Most often, it will be to TAKE PROFITS, but, on rare occasions, it will be to exercise a STOP LOSS at a predetermined price to adhere to strict risk management discipline.

Trade Alert - (AMZN) – STOP LOSS

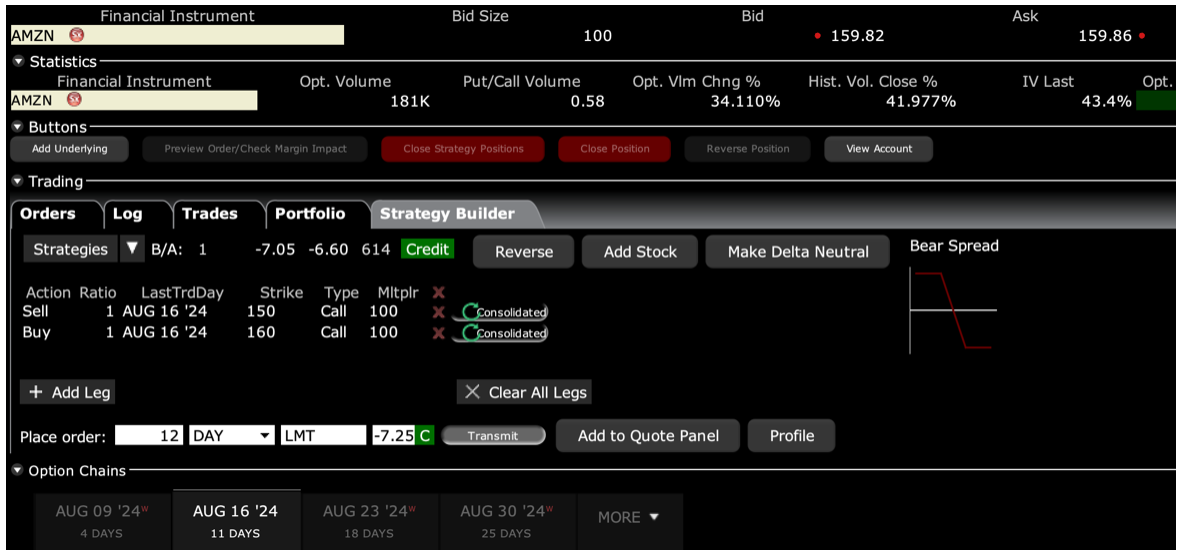

SELL the Amazon (AMZN) August 2024 $150-$160 in-the-money vertical Bull Call spread at $7.25 or best

Closing Trade

8-5-2024

expiration date: August 16, 2024

Portfolio weighting: 10%

Number of Contracts = 12 contracts

It's tough to beat a global stock market panic.

Markets worldwide are in freefall as “de-grossing” breaks out with a vengeance. When all the hedge funds in the world want to go into cash at once, you don’t want to stand in the way. Don’t bother attempting any logic here about valuations. Out is out.

The stock market is now discounting a recession that isn’t going to happen. A reaction like this is what you would expect with a Nonfarm Payroll job LOSS of 500,000, which we actually got during the pandemic, not a GAIN of 114,000. But markets always overreact, as they are now run by similar algorithms and 25-year-olds who’ve never seen this before.

In one month, the price-earnings multiple for (NVDA) has gone from 40x to 28X. It’s now a classic “falling knife” situation. The best thing to do here is to de-risk, keep your hedges and shorts, and wait for the dust to settle.

What is the worst-case scenario? We are already down 10% from the top, so take it to 15%-20%. After that, we will have fabulously low prices from which to launch the post-presidential election rally.

How will we recognize the bottom?

1) Watch the bond market like a hawk, which has seen one of the most explosive rallies of all time, taking ten-year US Treasury yields from 4.50% down to 3.65% in a mere month. When it tops, stocks will rally.

2) A single positive data point could turn this market. The next one of any substance is the Consumer Price Index out August 14 in seven trading days.

3) An inter-meeting interest rate cut by the Federal Reserve. While rare, these can happen during economic emergencies. Is a stock market crash an “economic emergency”? Only if it spreads to the broader economy. Only Jay Powell knows for sure. One thing is certain. The pace and extent of interest rate cuts has vastly accelerated, greatly boosting the economy. Eventually, markets will figure this out.

While I didn’t handle this meltdown perfectly, I did pretty well. I went into it with four technology short positions in (NVDA) and (TESLA) and only one long in (AMZN) added days ago. All of my positions expire in nine trading days, thus greatly limiting the damage with very short expirations.

The important thing here is to live to fight another day.

I am therefore selling the Amazon (AMZN) August 2024 $150-$160 in-the-money vertical Bull Call spread at $7.25 or best.

DO NOT USE MARKET ORDERS UNDER ANY CIRCUMSTANCES.

Simply enter your limit order, wait five minutes, and if you don’t get done, cancel your order and lower your offer by 10 cents with a second order.

This was a bet that Amazon would not fall below $160 by the August 16 option expiration in 12 trading days.

Here are the specific trades you need to exit this position:

Sell 12 August 2024 (AMZN) $150 calls at………….…............;……$13.00

Buy to cover short 12 August 2024 (AMZN) $160 calls at……..……$5.75

Net Proceeds:….……………….………..………….................…..............$7.25

Loss: $9.00 - $7.25 = -$1.75

(12 X 100 X -$1.75) = -$2,100

If you are uncertain about how to execute an options spread, please watch my training video by clicking here.

The best execution can be had by placing your bid for the entire spread in the middle market and waiting for the market to come to you. The difference between the bid and the offer on these deep-in-the-money spread trades can be enormous.

Don’t execute the legs individually or you will end up losing much of your profit. Spread pricing can be very volatile on expiration months farther out.

Keep in mind that these are ballpark prices at best. After the alerts go out, prices can be all over the map.