Trade Alert - (C) September 15, 2020 - BUY

When John identifies a strategic exit point, he will send you an alert with specific trade information as to what security to sell, when to sell it, and at what price. Most often, it will be to TAKE PROFITS, but, on rare occasions, it will be to exercise a STOP LOSS at a predetermined price to adhere to strict risk management discipline.

Trade Alert - (C) –BUY

BUY the Citigroup (C) October 2020 $37.50-$40 in-the-money vertical Bull Call spread at $2.25 or best

Opening Trade

9-15-2020

expiration date: October 16, 2020

Portfolio weighting: 10%

Number of Contracts = 44 contracts

By now, we know that Citigroup was just hit with a surprise $900 loss through an operational error, probably a Russian hack. Adding insult to injury, the government has said it will impose sanctions against (C) for lax defenses.

As a result, the stock dove 12% in two days, moving completely out of synch with the rest of the banking sector.

I am therefore buying the Citigroup (C) October 2020 $37.50-$40 in-the-money vertical Bull Call spread at $2.25 or best.

Don’t pay more than $2.35 or you’ll be chasing.

This is a very low risk, deep in-the-money position. (C) would have to drop below the May closing low for us to lose money.

If you don’t play options, buy the stock for a long term investment.

Banks are the quality play in the market right now as they have the lowest price earnings multiple at 6X and the best growth outlook in any economic recovery.

Banks now account for 15.5% of (SPY) earnings but are only 10% of stock market capitalization. Big tech gives us 13% of earnings but are a hefty 20% of market capitalization. Because of this, there is about to be a big rotation out of tech and into banks.

This cycle of COVID-19 infections is imminently going to peak out and start declining, at least for the short term.

As a result, I believe the core long FANG trade is long overdue for a break. Instead, I think we are about to witness a major rotation into domestic economic “recovery” stocks. Stocks will keep going up, but the leadership will change. Bonds and gold are also due for profit-taking.

There is no better domestic recovery play than the big banks. During a recovery, they will benefit from steeply rising interest rates, fewer defaults, yet continued government subsidies.

DO NOT USE MARKET ORDERS UNDER ANY CIRCUMSTANCES.

Simply enter your limit order, wait five minutes, and if you don’t get done, cancel your order and increase your bid by 5 cents with a second order.

This is a bet that Citigroup (C) would not trade below $40 by the October 16 option expiration day in 22 trading days.

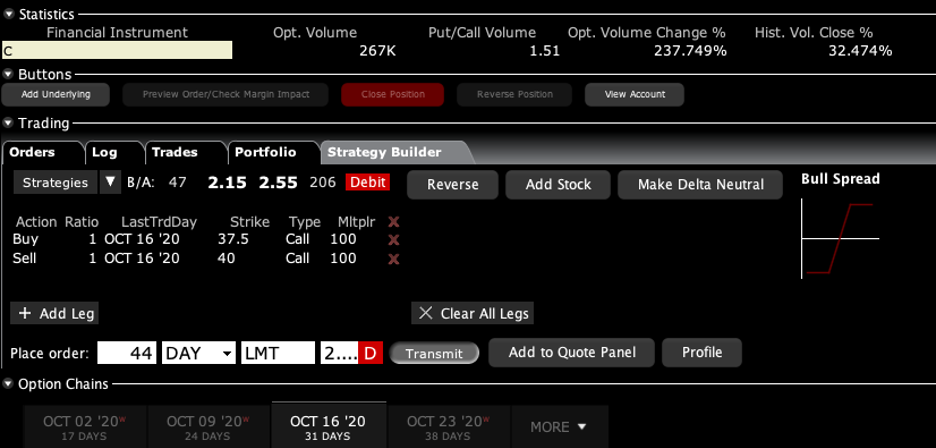

Here are the specific trades you need to enter this position:

Buy 44 October 2020 (C) $37.50 calls at………….………$9.25

Sell short 44 October 2020 (C) $40 calls at……..….…..$7.00

Net Cost:……………………..…….………..………….......….....$2.25

Potential Profit: $2.50 - $2.25 = $0.25

(44 X 100 X $0.25) = $1,100, or 11.11% in 22 trading days.

To see how to enter this trade in your online platform, please look at the order ticket above, which I pulled off of Interactive Brokers.

If you are uncertain on how to execute an options spread, please watch my training video by clicking here.

The best execution can be had by placing your bid for the entire spread in the middle market and waiting for the market to come to you. The difference between the bid and the offer on these deep in-the-money spread trades can be enormous.

Don’t execute the legs individually or you will end up losing much of your profit. Spread pricing can be very volatile on expiration months farther out.

Keep in mind that these are ballpark prices at best. After the alerts go out, prices can be all over the map.