Trade Alert - (C) September 21, 2020 - SELL-STOP LOSS

When John identifies a strategic exit point, he will send you an alert with specific trade information as to what security to sell, when to sell it, and at what price. Most often, it will be to TAKE PROFITS, but, on rare occasions, it will be to exercise a STOP LOSS at a predetermined price to adhere to strict risk management discipline.

Trade Alert - (C) –SELL-STOP LOSS

SELL the Citigroup (C) October 2020 $37.50-$40 in-the-money vertical Bull Call spread at $2.05 or best

Closing Trade

9-21-2020

expiration date: October 16, 2020

Portfolio weighting: 10%

Number of Contracts = 44 contracts

I ran a 200-man trading division at Morgan Stanley for years and was constantly in hiring mode. Very occasionally, I would hire someone who was great at interviews but were the worst nightmare the day they sat at their desk on the trading floor. They spent all day on personal calls, brought in no business, and invited constant inquiries from the SEC.

Once in a while, I run into trades like those bad hires.

Two weeks ago, I added a call spread on Citigroup (C). The next day, it was hit with a surprise $900 loss through an operational error, probably a Russian hack.

Adding insult to injury, the government has said it will impose sanctions against (C) for lax defenses. As a result, the stock dove 12% in two days, moving completely out of synch with the rest of the banking sector. I stopped out of the position before I even heard the details of the disaster.

I call this getting snake bit, taking on a trade which gets hit with an unforeseen disaster the day it clears.

I went back into (C) with strikes $8, or 16.7% lower, assuming that the bad news was in the price. However, when bank stocks rallied last week (C) was dead as a doorknob, while my other bank long in JP Morgan Chase (JPM) brought in a nice profit. There was clearly another shoe to fall on (C).

So, on Friday, I decided to dump (C) at the Monday morning opening. A few hours later Supreme Court Justice Ruth Bader Ginsberg died triggering a monstrous rise in volatility. (C) will almost certainly take another dive.

I got snake bit by the same stock twice in two weeks.

I am therefore with great disgust selling the Citigroup (C) October 2020 $37.50-$40 in-the-money vertical Bull Call spread at $2.05 or best.

The first loss you take is always the best one. The key to making money in 2020 is to stop out of losers as fast as you can.

DO NOT USE MARKET ORDERS UNDER ANY CIRCUMSTANCES.

Simply enter your limit order, wait five minutes, and if you don’t get done, cancel your order and lower your offer by 5 cents with a second order.

This was a bet that Citigroup (C) would not trade below $40 by the October 16 option expiration day in 22 trading days.

Here are the specific trades you need to exit this position:

Sell 44 October 2020 (C) $37.50 calls at………............….………$6.70

Buy to cover short 44 October 2020 (C) $40 calls at……….…..$4.65

Net Proceeds:.…….................………..…….………..………….….....$2.05

Loss: $2.25 - $2.05 = $0.20

(44 X 100 X $0.20) = $880, or 4.60%.

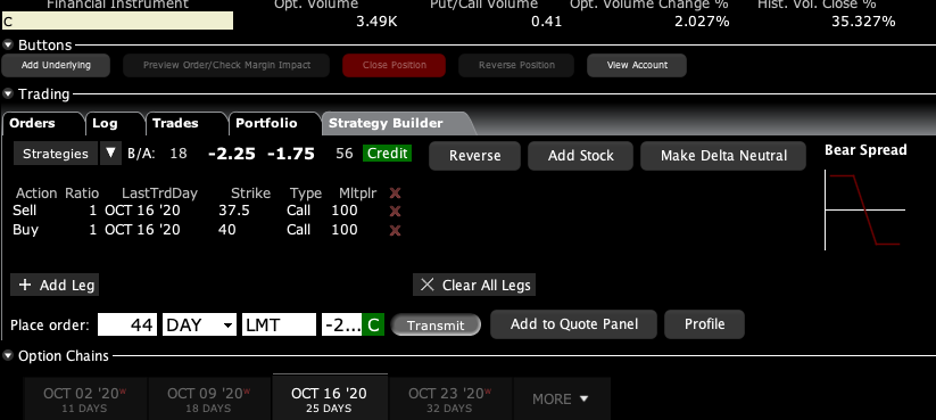

To see how to enter this trade in your online platform, please look at the order ticket above, which I pulled off of Interactive Brokers.

If you are uncertain on how to execute an options spread, please watch my training video by clicking here.

The best execution can be had by placing your bid for the entire spread in the middle market and waiting for the market to come to you. The difference between the bid and the offer on these deep in-the-money spread trades can be enormous.

Don’t execute the legs individually or you will end up losing much of your profit. Spread pricing can be very volatile on expiration months farther out.

Keep in mind that these are ballpark prices at best. After the alerts go out, prices can be all over the map.