Trade Alert - (CCI) July 18, 2024 - BUY LEAPS

When John identifies a strategic exit point, he will send you an alert with specific trade information as to what security to sell, when to sell it, and at what price. Most often, it will be to TAKE PROFITS, but, on rare occasions, it will be to exercise a STOP LOSS at a predetermined price to adhere to strict risk management discipline.

Trade Alert - (CCI) – BUY

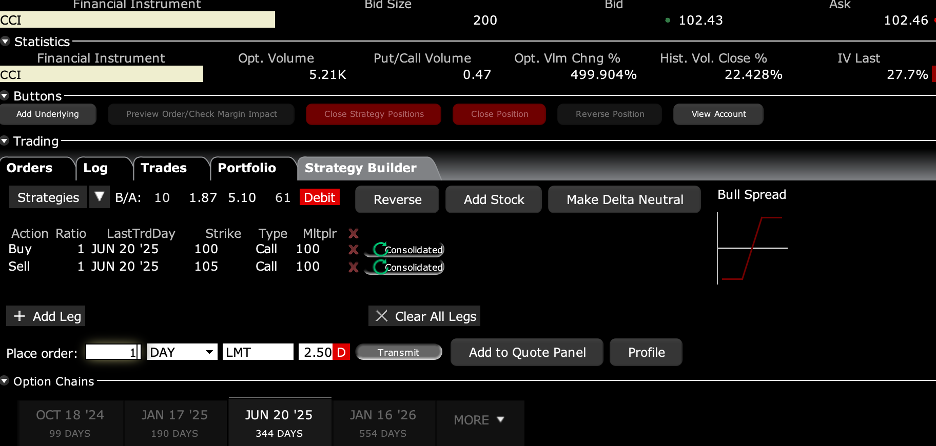

BUY the Crown Castle International (CCI) June 2025 $100-$105 at-the-money vertical Bull Call debit spread LEAPS at $2.50 or best

Opening Trade

7-12-2024

expiration date: June 20, 2025

Number of Contracts = 1 contract

The writing is not only on the wall right now, it is blasting us with great neon lights. That was the message from the Consumer Price Index, which delivered a gob-smacking 0.1% DECLINE in June.

As a result, a Fed interest rate cut of 25 basis points is now a certainty and all falling interest rate plays in the stock market are in play. Rising rate plays and flat technology could be the trade for the rest of 2024.

It is all very positive for capital-intensive stocks.

Houston-based Crown Castle International is a real estate investment trust (REIT) and provider of shared 5G cell phone towers in the United States. Its network includes over 40,000 cell towers approximately 85,000 route miles of fiber supporting small cells and fiber solutions.

The company offers shareholders a very attractive triple play.

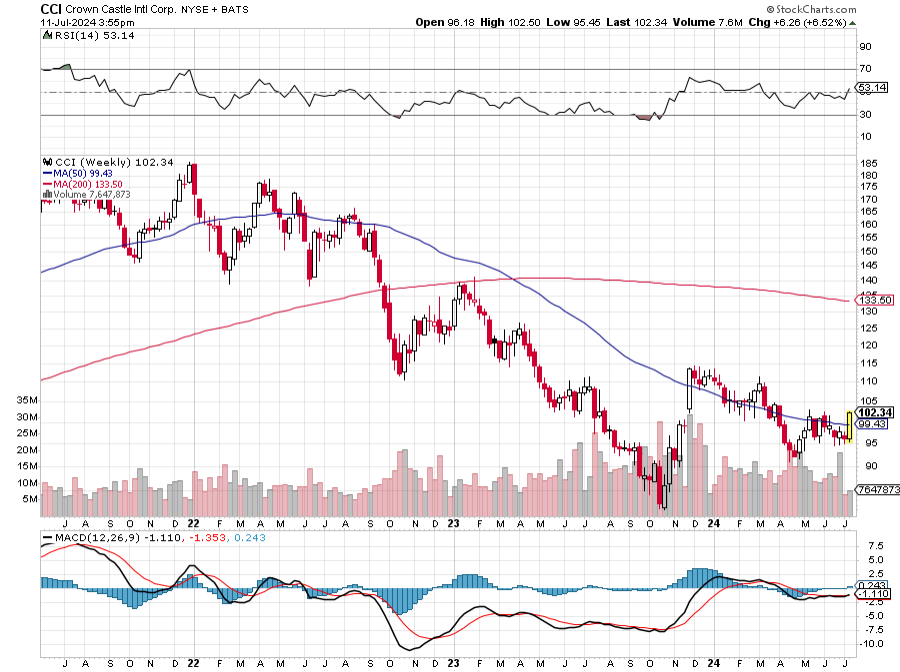

(CCI) has been tarred by the REIT brush, which has been suffering mightily from high interest rates. It also has been dragged down by the poor performance of commercial real estate REITS. As a result, (CCI) shares have cratered 54% and are an extreme bargain here. A 6.62% dividend yield is certain to suck in a lot of yield-chasing buyers, handily beating 90-day T-bills at 5.18%.

What happens next? Interest rates fall, causing REITS to rocket.

One thing is certain. Demand for 5G cell phone towers will continue to grow exponentially as the technology continues its global rollout.

So (CCI) is an interest rate play, a technology play, and a dividend play, all of which will do well from here. There aren’t very many technology stocks still crawling off the bottom.

I am therefore buying the Crown Castle International (CCI) June 2025 $100-$105 at-the-money vertical Bull Call debit spread LEAPS at $2.50 or best.

Don’t pay more than $3.00 or you’ll be chasing on a risk/reward basis.

If you are looking for a cheap lottery ticket, then here is a lottery ticket.

While the chance of winning a real lottery is something like a million to one, this one is more like 10:1 in your favor. And the payoff is double in a year. That is the probability that Crown Castle International (CCI) shares will rise over the next 11 months.

If you want to get more aggressive with more leverage, use a pair of strike prices higher up. This will give you a larger number of contracts at a lower price.

Please note that these options are illiquid and may take some work to get in or out. Start at my price and work your way up until you get done. Executing these trades is more an art than a science.

Let’s say the Crown Castle International (CCI) June 2025 $100-$105 at-the-money vertical Bull Call debit spread LEAPS at $2.50 are showing a bid/offer spread of $2.00-$3.00, which is normal. Enter an order for one contract at $2.30, another for $2.40, another for $2.50, and so on. Eventually, you will enter a price that gets filled immediately. That is the real price. Then enter an order for your full position at that real price.

Notice that the day-to-day volatility of LEAPS prices is miniscule since the time value is so great. This means that the day-to-day moves in your P&L will be small. It also means you can buy your position over the course of a month just entering new orders every day. I know this can be tedious, but getting screwed by overpaying for a position is even more tedious.

Look at the math below and you will see that if (CCI) shares are slightly higher than unchanged in 11 months it will generate a 100% profit with this position, such is the wonder of LEAPS.

Only use a limit order. DO NOT USE MARKET ORDERS UNDER ANY CIRCUMSTANCES. Just enter a limit order and work it until you find the real price.

This is a bet that Crown Castle International will close above $105 by the June 20, 2025 option expiration in 11 months.

Here are the specific trades you need to execute this position:

Buy 1 June 2025 (CCI) $100 call at…………..…$11.00

Sell short 1 June 2025 (CCI) $105 call at………$8.50

Net Cost:………………………….………..……..….....$2.50

Potential Profit: $5.00 - $2.50 = $2.50

(1 X 100 X $2.50) = $250 or 100% in 11 months.

If you are uncertain about how to execute a bear put options spread, please watch my training video by clicking here.

The best execution can be had by placing your bid for the entire spread in the middle market and waiting for the market to come to you. The difference between the bid and the offer on these deep-in-the-money spread trades can be enormous.

Don’t execute the legs individually or you will end up losing much of your profit. Spread pricing can be very volatile on expiration months farther out.

Keep in mind that these are ballpark prices at best. After the alerts go out, prices can be all over the map.