Trade Alert - (CCJ) October 3, 2024 - TAKE PROFITS - SELL

When John identifies a strategic exit point, he will send you an alert with specific trade information as to what security to sell, when to sell it, and at what price. Most often, it will be to TAKE PROFITS, but on rare occasions, it will be to exercise a STOP LOSS at a predetermined price to adhere to strict risk management discipline.

Trade Alert - (CCJ) – TAKE PROFITS

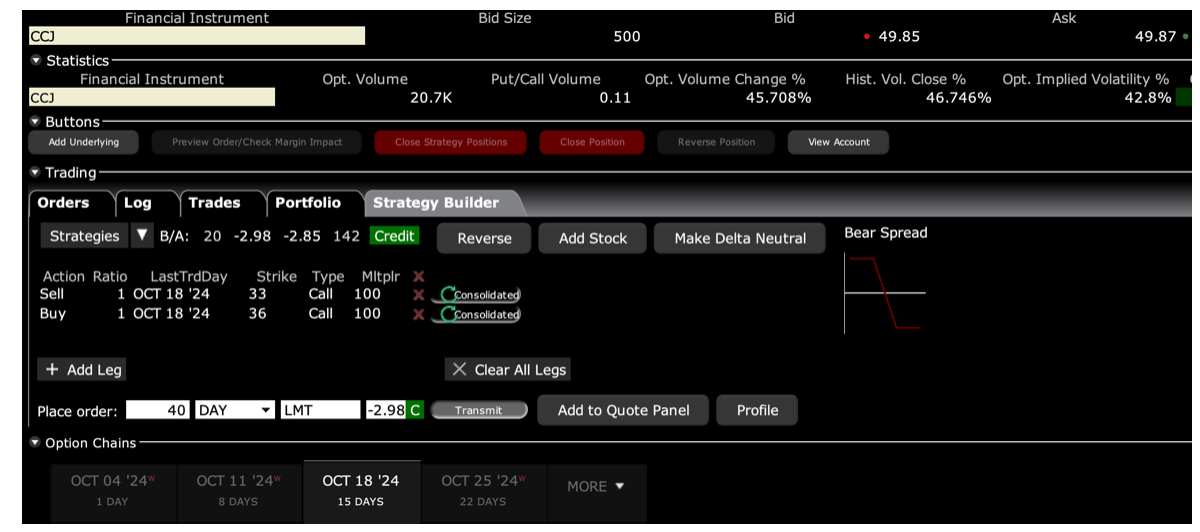

SELL the Cameco (CCJ) October 2024 $33-$36 in-the-money vertical Bull Call spread at $2.98 or best

Closing Trade

10-3-2024

expiration date: October 18, 2024

Number of Contracts = 40 contracts

My time at the Atomic Energy Commission in the 1970s finally paid off.

In a mere 15 days, (CCJ) has exploded 38%. Everything went right with this trade. With 96% of the maximum potential profit in hand, the risk-reward of continuing is no longer favorable.

This is a classic example where the equity owners made a lot more money, some 38% than call spread owners at 19.2%.

If you don’t do options, buy the stock. My target for (CCJ) in 2026 is $80, up 120%.

I am therefore selling the Cameco (CCJ) October 2024 $33-$36 in-the-money vertical Bull Call spread at $2.98 or best.

As a result, you get to take home $1,920 or 19.2% in 15 days. Well done, and on to the next trade.

DO NOT USE MARKET ORDERS UNDER ANY CIRCUMSTANCES.

Simply enter your limit order, wait five minutes, and if you don’t get done, cancel your order and lower your offer by 2 cents with a second order.

How would you like to buy a stock that is a call option on:

* A recovery of the US economy

*A recovery of the Chinese economy

*The expansion of the electrical grid

*The conversion to clean energy

*The next generation of new energy technology

Then that would be Cameco.

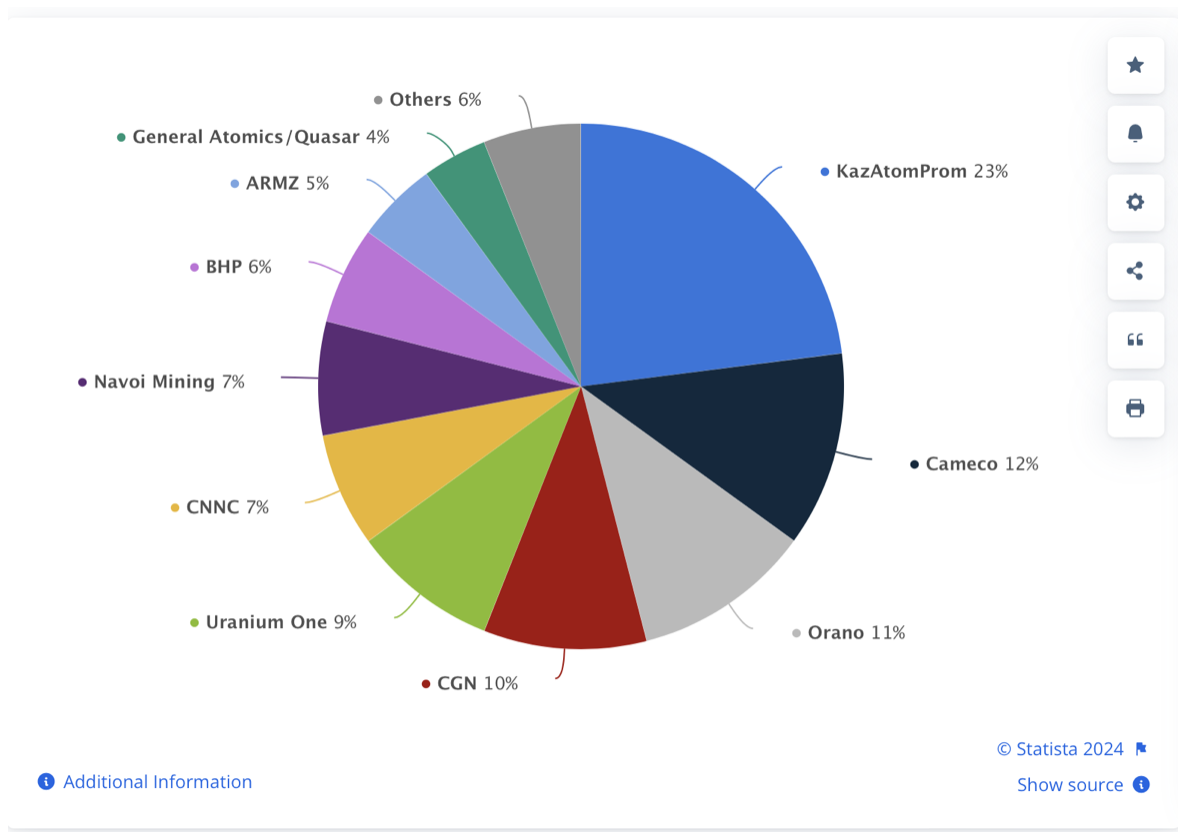

Cameco Corporation (formerly Canadian Mining and Energy Corporation) is the world's largest publicly traded uranium company, based in Saskatoon, Saskatchewan, Canada. It is the world's second-largest uranium producer, accounting for 11.61% of world production.

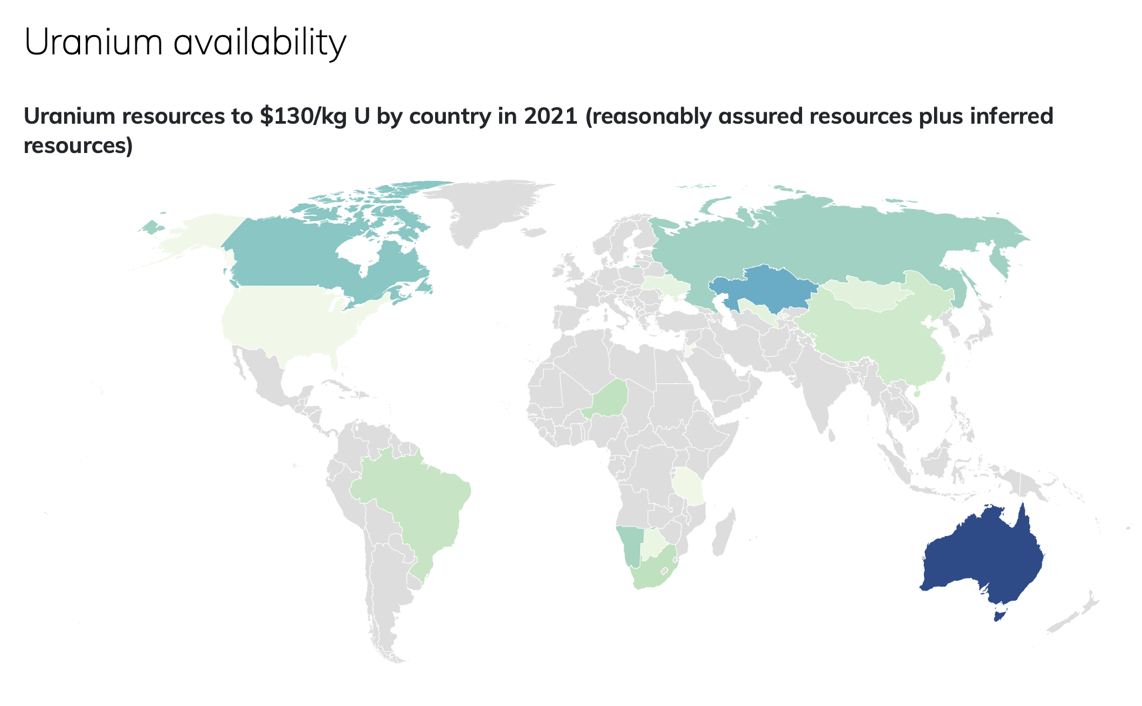

My hedge fund buddies are piling into this stock because the nuclear renaissance is just getting started. The electrification of our energy sources is creating immense demand for new electric power sources. China alone plans to build 115 new nuclear power plants, putting new upward pressure on fuel supplies. Also, the world’s largest producer, KazAtomProm in Kazakhstan, just announced an 11% cutback in production because of processing shortages (click here).

Nuclear power is also viewed as a backup for new alternative sources for the days when the sun doesn’t shine and the wind doesn’t blow. Western countries also need to replace Russian supplies of uranium in compliance with sanctions. Even California has moved to extend the life of its sole remaining nuclear power plant at Diablo Canyon by five years (San Onofre and Rio Seco were closed years ago).

Cameco is one of the largest global providers of uranium fuel. Utilities around the world rely on its products to generate safe, reliable, emissions-free nuclear power. The company is meeting the ever-increasing demand for clean, baseload electricity while delivering energy solutions to support the world's net-zero goals. It doesn’t need wind nor the sun to generate nuclear power.

DO NOT USE MARKET ORDERS UNDER ANY CIRCUMSTANCES.

This was a bet that Cameco (CCJ) would not fall below $36 by the October 18 option expiration in 26 days.

Keep in mind that Cameco is one of the most volatile stocks in the market with an implied volatility in the options of 44%. That means that after a big drop, you should see a bigger rise. You don’t have to buy it today. A greater selloff would be ideal. But it should be at the core of any long-term LEAPS portfolio, and it is selling at bargain prices.

To learn more about the company, please visit their website at https://www.cameco.com/about

Here are the specific trades you need to exit this position:

Sell 40 October 2024 (CCJ) $33 calls at………….…….......…$17.00

Buy to cover short 40 October 2024 (CCJ) $36 calls at..…$14.02

Net Proceeds:….……………….………..………….…....................$2.98

Profit: $2.98 - $2.50 = $0.48

(40 X 100 X $0.48) = $1,920 or 19.2% in 15 days.

If you are uncertain on how to execute an options spread, please watch my training video by clicking here.

The best execution can be had by placing your bid for the entire spread in the middle market and waiting for the market to come to you. The difference between the bid and the offer on these deep-in-the-money spread trades can be enormous.

Don’t execute the legs individually or you will end up losing much of your profit. Spread pricing can be very volatile on expiration months farther out.

Keep in mind that these are ballpark prices at best. After the alerts go out, prices can be all over the map.