Trade Alert - (DE) July 12, 2024 - BUY

When John identifies a strategic exit point, he will send you an alert with specific trade information on what security to sell, when to sell it, and at what price. Most often, it will be to TAKE PROFITS, but, on rare occasions, it will be to exercise a STOP LOSS at a predetermined price to adhere to strict risk management discipline.

Trade Alert - (DE) – BUY

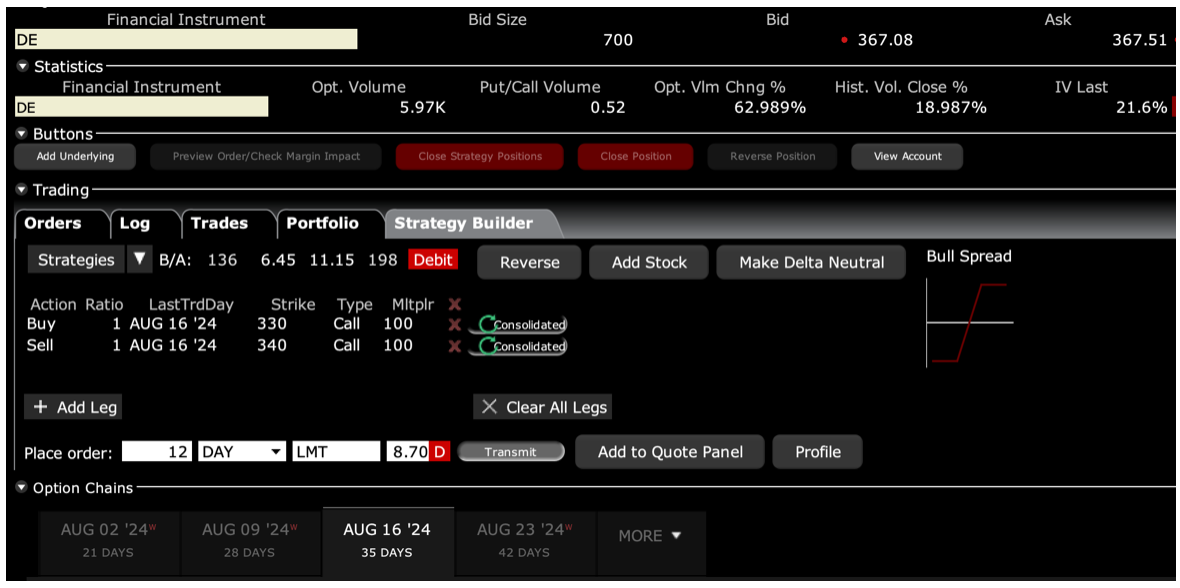

BUY the Deere & Co. (DE) August 2024 $330-$340 vertical BULL CALL debit spread at $8.70 or best

Opening Trade

7-12-2024

expiration date: August 16, 2024

Portfolio weighting: 10%

Number of Contracts = 12 contracts

The writing is not only on the wall right now, it’s blasting us with great neon lights. That was the message this morning from the Consumer Price Index, which this morning delivered a gob-smacking 0.1% DECLINE in June.

As a result, a Fed interest rate cut of 25 basis points is now a certainty and all falling interest rate plays in the stock market are in play. Rising rate plays and flat technology could be the trade for the rest of 2024.

It is all very positive for capital-intensive industries like Deere & Co (DE).

This is all on top of a major rotation in the market underway, out of technology stocks that have been leading all year into interest rate-sensitive stocks. We have already seen major upside breakouts in gold and silver and old-line industrials are jumping on the bandwagon.

If you can’t do options, buy the stock. My long-term target for (DE) is $450, up nearly 50% from today’s $307.

Therefore, I am buying the John Deere (DE) August $330-$340 vertical BULL CALL debit spread at $8.70 or best.

Don’t pay more than $9.20 or you will be chasing.

The bull case for Deere & Co. is simple. Falling interest rates will bring huge cost reductions for heavy borrowers like (DE). The company provides tractors and other heavy equipment used for agriculture, mining, and construction, all of which will see imminent turnarounds thanks to lower interest rates.

Deere $ Co shares are trading at a positively subterranean price-earnings multiple of 11X, compared to 21X doe the S&P 500 and 40X for (NVDA). It also pays a modest 1.63% dividend yield.

For details about Deere & Co (DE), please click here for their website.

This is a bet that the (DE) will not fall below $340 by the August 16 option expiration in 25 trading days.

Here are the specific trades you need to execute this position:

Buy 12 August 2024 (DE) $330 calls at………….………$42.00

Sell short 12 August 2024 (DE) $340 calls at…….……$33.30

Net Cost:………………………….………..…………........….....$8.70

Potential Profit: $10.00 - $8.70 = $1.30

(12 X 100 X $1.30) = $1,560 or 14.94% in 25 trading days.

If you are uncertain about how to execute a bear put options spread, please watch my training video by clicking here.

The best execution can be had by placing your bid for the entire spread in the middle market and waiting for the market to come to you. The difference between the bid and the offer on these deep-in-the-money spread trades can be enormous.

Don’t execute the legs individually or you will end up losing much of your profit. Spread pricing can be very volatile on expiration months farther out.

Keep in mind that these are ballpark prices at best. After the alerts go out, prices can be all over the map.