Trade Alert - (EBAY) September 25, 2019 - BUY

When John identifies a strategic exit point, he will send you an alert with specific trade information as to what security to sell, when to sell it, and at what price. Most often, it will be to TAKE PROFITS, but, on rare occasions, it will be to exercise a STOP LOSS at a predetermined price to adhere to strict risk management discipline.

Tech Alert - eBay Inc. (EBAY) – BUY

BUY eBay Inc. (EBAY) October 2019 $30-$35 in-the-money vertical BULL CALL spread at $4.03 up to $4.08

Opening Trade

9-25-2019

expiration date: October 18, 2019

Portfolio weighting: 10%

Number of Contracts = 24 contracts

EBay Inc on Wednesday replaced Chief Executive Officer Devin Wenig with finance head Scott Schenkel on an interim basis and said it continued to explore options for its businesses, sending its shares down nearly 3% which is why option prices are whipsawing around.

The pricing is extremely volatile as I witnessed the call spread drop from $4.25 to $4.10 then to $4.03 in a matter of minutes as implied volatility exploded.

It is prudent to use limit orders and if you cannot get this done then try it again the next day as it is impossible to call the bottom in trading.

I’ll use this short term dip to strap on a trade. Ebay looks like a good long term bet for buy and hold investors.

EBay had come under pressure from hedge funds Elliott Management Corp and Starboard Value to restructure and sell some of its businesses.

In response, eBay in March announced a review of its ticketing unit, StubHub, and eBay Classifieds businesses. It had also agreed to appoint two new directors to its board as part of an agreement with activist investors to avert a proxy contest.

The review is fluid and it expects to provide an update shortly.

Wenig, 52, is stepping down from the CEO role after more than four years at the helm.

A dispute over the sale of Classifieds business led to Wenig's departure.

Ebay’s board will undertake a search for the next CEO.

In general, investors following the eBay (EBAY) saga should be cheering from the sidelines as the master plan from Elliot Management and Starboard are pressuring eBay’s management into the radical changes the investors initially called out for.

Rewarding the vulture funds with two board seats along with spearheading a comprehensive review of the business model appears more probable than not.

The forced changes have imminent repercussions to the stock price as the breaking up of the company into individual pieces is seen as coaxing out more embedded value while separating out the main e-commerce platform for a long-awaited fix.

These are two highly bullish signals.

Elliot’s reasons for altering eBay’s business model were essentially blamed on two issues - shoddy management and the commingling of growth assets with its inferior e-commerce platform within the eBay umbrella hindering value appreciation.

The sacking of the CEO is important in the process of reconfiguring the business.

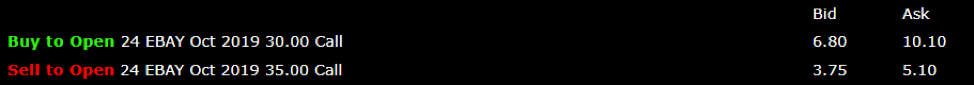

Here are the specific trades you need to execute this position:

Buy 24 October 2019 (EBAY) $30 call at………….….……$8.45

Sell short24 October 2019 (EBAY) $35 call at……….….$4.42

Net Cost:……………………..…….………..…...............…......$4.03

Potential Profit: $5.00 - $4.03 = $0.97

(24 X 100 X $0.97) = $2,328 or 23.28%

To see how to enter this trade in your online platform, please look at the order ticket below, which I pulled off of Interactive Brokers.

If you are uncertain on how to execute an options spread, please watch my training video on “How to Execute a Vertical Bull Call Spread” by clicking here.

The best execution can be had by placing your bid for the entire spread in the middle market and waiting for the market to come to you. The difference between the bid and the offer on these deep in-the-money spread trades can be enormous.

Don’t execute the legs individually or you will end up losing much of your profit. Spread pricing can be very volatile on expiration months farther out.

Keep in mind that these are ballpark prices at best. After the alerts go out, prices can be all over the map.