Trade Alert - (FCX) May 5, 2021 - SELL-TAKE PROFITS

When John identifies a strategic exit point, he will send you an alert with specific trade information as to what security to sell, when to sell it, and at what price. Most often, it will be to TAKE PROFITS, but, on rare occasions, it will be to exercise a STOP LOSS at a predetermined price to adhere to strict risk management discipline.

Trade Alert - (FCX) – TAKE PROFITS

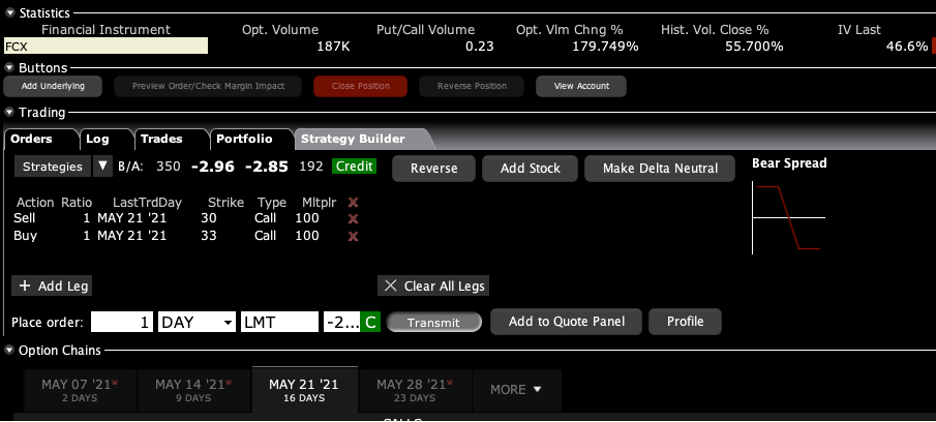

SELL the Freeport McMoRan (FCX) May 2021 $30-$33 vertical bull call spread at $2.95 or best

Closing Trade

5-5-2021

expiration date: May 21, 2021

Portfolio weighting: 10%

Number of Contracts = 40 contracts

Freeport McMoRan shares have gone ballistic today off the back of a spectacular earnings report. My long-term target for the shares is still $100.

However, we now have 90% of the maximum potential profits of this position in hand. The risk/reward of continuing is no longer favorable. By coming out here, you get to take home $1,800 or 18.00% in 13 trading days.

Well done and on to the next trade!

You can’t have a synchronized global economic recovery without a bull market in commodities, and the mother of all recoveries is now in play according to the latest economic data. Phoenix, AZ Freeport-based McMoRan (FCX) is one of the world’s largest producers of copper and a long-time Mad Hedge customer.

I am therefore selling the Freeport McMoRan (FCX) May $30-$33 vertical bull call spread at $2.95 or best.

You remember the two oil shocks, don’t you? The endless lines at gas stations, soaring prices, and paying close attention to OPEC’s every murmur?

Now we are about to get the 2020’s environmentally friendly, decarbonizing economy version: the copper shock.

For, copper is about to become the new oil.

The causes of the coming supply crunch for the red metal are manyfold.

If you take all of the commitments to green energy made by the Paris Climate Accord, which the US just reentered, they amount to demand for copper that is about ten times current world production. Oops, nobody thought of that.

Copper is needed in enormous quantitates to build millions of electric cars, solar panels, batteries, windmills, and long-distance transmission lines for a power grid that is going to have to triple in size.

In addition, existing copper miners seem utterly clueless about the coming shortage of their commodities. Capital spending has been deferred for decades and maintenance deferred. New greenfield mines are scant and far between. Copper inventories are at a ten-year low. Mines were closed for months in 2020 thanks to a shortage of workers caused by the pandemic.

Copper is the last of the old-school commodities that are still actively traded. It takes 5-10 years at a minimum to bring new mines online. By the time potential sites are surveyed, permits obtained, heavy equipment moved on-site, rail lines laid, water supplies obtained, and bribes paid, it can be a very expensive proposition. That’s why near-term prospects are only to be found in Chile, Peru, and South Africa.

Copper is the single best value for conductor of electricity for which there are very few replacements. Aluminum melts and corrodes. And then there is silver (SLV), right below copper in the periodic chart, which gangster Al Capone used to wire his bullet-proof 1928 Cadillac. Below silver is gold (GLD), a fine conductor of electricity but is somewhat cost-prohibitive.

As a result, base metal prices could more than double from here to $15,000 a metric tonne or more. The last time the price was that high was in 1968 when the Vietnam War was in full swing as the military needs a lot of copper to fight wars. The economy was booming.

The stock has been on a tear for a year on the back of record Chinese buying of copper ahead of their economic recovery, which started well before ours. I believe this move will continue for years. The old high for the stock in the last cycle was $50.

DO NOT USE MARKET ORDERS UNDER ANY CIRCUMSTANCES.

This was a bet that Freeport McMoRan would not trade below $33 by the May 21 option expiration day in 20 trading days.

Here are the specific trades you need to exit this position:

Sell 40 May 2021 (FCX) $30 calls at…….............…….………$11.30

Buy to cover short 40 May 2021 (FCX) $33 calls at………....$8.35

Net Proceeds:………..…....................….………..………….….....$2.95

Profit: $2.95 - $2.50 = $0.45

(40 X 100 X $0.45) = $1,800 or 18.00% in 13 trading days.

If you are uncertain about how to execute an options spread, please watch my training video by clicking here.

The best execution can be had by placing your bid for the entire spread in the middle market and waiting for the market to come to you. The difference between the bid and the offer on these deep in-the-money spread trades can be enormous.

Don’t execute the legs individually or you will end up losing much of your profit. Spread pricing can be very volatile on expiration months farther out.

Keep in mind that these are ballpark prices at best. After the alerts go out, prices can be all over the map.