Trade Alert - (FXY) March 17, 2016

As a potentially profitable opportunity presents itself, John will send you an alert with specific trade information as to what should be bought, when to buy it, and at what price.

?

Trade Alert - (FXY) ? STOP LOSS

SELL the Currency Shares Japanese Yen Trust (FXY) April, 2016 $87-$90 in-the-money vertical bear put spread at $2.27 or best

Closing Trade

3-17-2016

expiration date: April 15, 2016

Portfolio weighting: 10%

Number of Contracts = 39 contracts

Federal Reserve chairman Janet Yellen blew this trade to pieces yesterday by indicating that there would only be two more quarter point rate hikes this year.

That has cut the knees out from under the dollar and sent the Japanese yen flying to a one year high.

I am therefore going to maintain discipline and stop out of the Currency Shares Japanese Yen Trust (FXY) April, 2016 $87-$90 in-the-money vertical bear put spread at a small loss.

Minimizing losses and hanging on to profits is the key to keeping your head above water in this incredible year.

You don?t want to go out-of-the-money on these deep-in-the-money vertical bear put debit spreads on pain of death.

If you have the ProShares Ultra Short Yen ETF (YCS) outright keep it. Markets should come back into line eventually.

I think we are at the tag ends of the recent unbelievable bout of yen strength.

The best execution for the options can be had by placing your bid for the entire spread in the middle market and waiting for the market to come to you.

The difference between the bid and the offer on these deep in-the-money spread trades can be enormous.

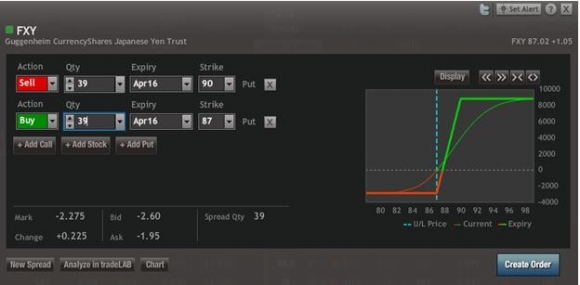

To see how to enter this trade in your online platform, please look at the order ticket below, which I pulled off of optionshouse.

If you are uncertain on how to execute an options trade, please watch my training video on ?How to Execute a Vertical Bear Put Debit Spread? by clicking here at http://www.madhedgefundtrader.com/ltt-executetradealerts/. You must be logged into your account to view the video.

Don?t execute the legs individually or you will end up losing much of your profit.

Keep in mind that these are ballpark prices only.

More depth on the Japanese yen to follow.

Here are the specific trades you need to execute this position:

Sell 39 April, 2016 (FXY) $90 puts at?????$3.20

Buy to cover short 39 April, 2016 (FXY) $87 puts at..??.$0.93

Net Proceeds:??????????????????.....$2.27

Loss: $2.57 - $$2.27 = $0.30

(39 X 100 X $0.30 ) = $1,170 or 13.21% loss.

?