Trade Alert - (FXY) November 3, 2015

As a potentially profitable opportunity presents itself, John will send you an alert with specific trade information as to what should be bought, when to buy it, and at what price.

Trade Alert - (FXY)

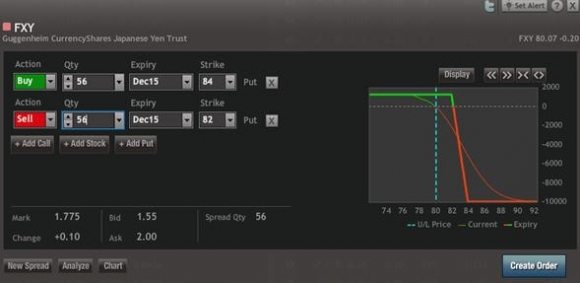

Buy the Currency Shares Japanese Yen Trust (FXY) December, 2015 $82-$84 in-the-money vertical bear put spread at $1.77 or best

Opening Trade

11-3-2015

expiration date: December 18, 2015

Portfolio weighting: 10%

Number of Contracts = 56 contracts

It looks like a new ?RISK ON? leg is underway. Stocks are strong, oil is up, junk bonds are rallying, and gold is trash.

More importantly, the Treasury bond market is in free fall, breaking though to the new lower range that I anticipated, started its run it a 2.30% yield.

When interest rate are rising in a ?RISK ON? environment, there is one trade you should be reaching for like a Pavlovian dog.

You should be selling short the Japanese yen.

A short in the yen is a safe, low risk trade right here in a world gone crazy.

You can buy this vertical bear put spread anywhere within a $1.70-$1.80 range and have a reasonable expectation of making money on this trade.

These options aren?t that liquid, nor is the potential profit off the charts. But if you can get the spread at the right price, there is some easy money here.

With the Euro (FXE) in free fall, the yen can?t be far behind.

If you can?t do the options, then buy the ProShares Ultra Short Yen ETF (YCS) outright.

The best execution can be had by placing your bid for the entire spread in the middle market and waiting for the market to come to you. The difference between the bid and the offer on these deep in-the-money spread trades can be enormous.

If you are uncertain on how to execute an options spread, please watch my training video on ?How to Execute a Bull Call Spread? by clicking here at http://www.madhedgefundtrader.com/ltt-executetradealerts/

Don?t execute the legs individually or you will end up losing much of your profit. Spread pricing can be very volatile on expiration months farther out.

If the price of this spread has moved more than 5% by the time you receive this Trade Alert, don?t chase it. Wait for the next one. There are plenty of fish in the sea.

Here are the specific trades you need to execute this position:

Buy 56 December, 2015 (FXY) $84 puts at?????$3.85

Sell short 56 December, 2015 (FXY) $82 puts at..?.$2.08

Net Cost:??????????????????.....$1.77

Profit at expiration: $2.00 - $1.77 = $0.23

(56 X 100 X $0.23 ) = $1,288 or 1.29% profit for the notional $100,000 portfolio.