Trade Alert - (GM) March 13, 2025 - BUY

When John identifies a strategic exit point, he will send you an alert with specific trade information as to what security to sell, when to sell it, and at what price. Most often, it will be to TAKE PROFITS, but on rare occasions, it will be to exercise a STOP LOSS at a predetermined price to adhere to strict risk management discipline.

Trade Alert - (GM) - BUY

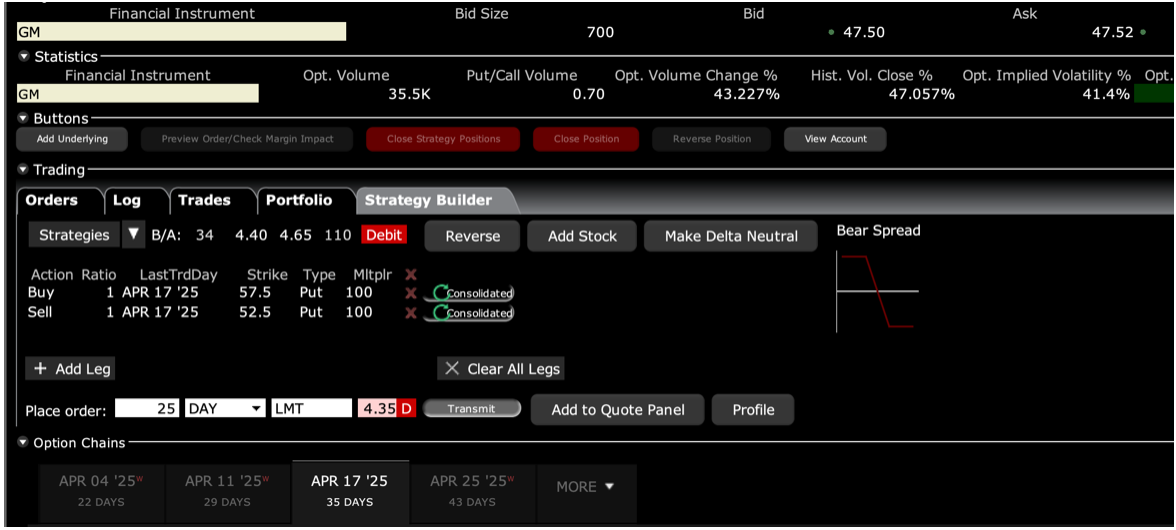

Buy the General Motors (GM) April 2025 $52.50-$57.50 in-the-money vertical bear put debit spread at $4.35 or best

Opening Trade

3-13-2025

expiration date: April 17, 2025

Portfolio weighting: 10% weighting

Number of Contracts = 25 contracts

I believe that the trade wars will continue for months, if not years, and the biggest victim is General Motors (GM). The administration has shown zero interest in supporting the stock market. “Transition” and “disruption” are code words for a recession and stock market crash.

(GM) options are now trading at an incredible 41% implied volatility. Only weeks ago, they were trading in the low 20%’s

The trade wars are throwing the US economy into complete turmoil, and there is no end in sight. So, I have been on the hunt for short positions that benefit from falling stock prices. I expect the selloff to amount to 20% for the S&P 500 by summer. If I’m wrong, it’s going down 50%.

It's hard to name a more damaged company than General Motors (GM). The company completely restructured itself to fit the United States-Mexico-Canada Agreement (USMCA), signed by President Trump in 2019, replacing the existing North American Free Trade Agreement (NAFTA).

Now, Trump is tearing up that treaty and throwing it in the trash. That leaves (GM) horribly out of position with its manufacturing base. It has tens of billions of dollars’ worth of factories in the wrong places that aren’t easily moved.

Over 25% of (GM)’s cars are built in Canada and Mexico, with some parts crossing borders several times. These will be subject to the new 25% import duty, forcing the company to raise prices by a highly inflationary $10,000 per vehicle. The required restructuring is so enormous and so traumatic that (GM) may not survive. At the very least, mass unemployment in Detroit will ensue.

We also learned today that delinquencies on auto loans hit a new all-time high at 3.17%.

Therefore, I am buying the General Motors (GM) April 2025 $52.50-$57.50 in-the-money vertical bear put debit spread at $4.35 or best.

DO NOT USE MARKET ORDERS UNDER ANY CIRCUMSTANCES.

Don’t pay more than $4.60, or you will be chasing.

Simply enter your limit order, wait five minutes, and if you don’t get done, cancel your order and increase your bid by 5 cents with a second order.

If you live in a foreign time zone when the US stock market is closed, such as Australia, or don’t want to sit in front of a screen all day, simply enter a spread of Good-Until-Cancelled orders overnight, like $4.35, $4.40, $4.45, and $4.50. You should get done on some or all of these.

With this trade, I am willing to bet that (GM) shares will not rise above $52.50 by the April 17 option expiration in 25 trading days.

Here are the specific trades you need to execute this position:

Buy 25 April 2025 (GM) $57.50 puts at……….…..$10.00

Sell short 25 April 2025 (GM) $52.50 puts at…….$5.65

Net cost:………………………….……….……………........$4.35

Potential Profit: $5.00 - $4.35 = $0.65

(25 X 100 X $0.65) = $1,625 or 14.94% in 25 trading days

If you are uncertain about how to execute an options spread, please watch my training video by clicking here.

The best execution can be had by placing your bid for the entire spread in the middle market and waiting for the market to come to you. The difference between the bid and the offer on these deep-in-the-money spread trades can be enormous.

Don’t execute the legs individually, or you will end up losing much of your profit. Spread pricing can be very volatile on expiration months farther out.

Keep in mind that these are ballpark prices at best. After the alerts go out, prices can be all over the map.