Trade Alert - (GS) February 12, 2025 - BUY

When John identifies a strategic exit point, he will send you an alert with specific trade information as to what security to sell, when to sell it, and at what price. Most often, it will be to TAKE PROFITS, but on rare occasions, it will be to exercise a STOP LOSS at a predetermined price to adhere to strict risk management discipline.

Trade Alert - (GS) - BUY

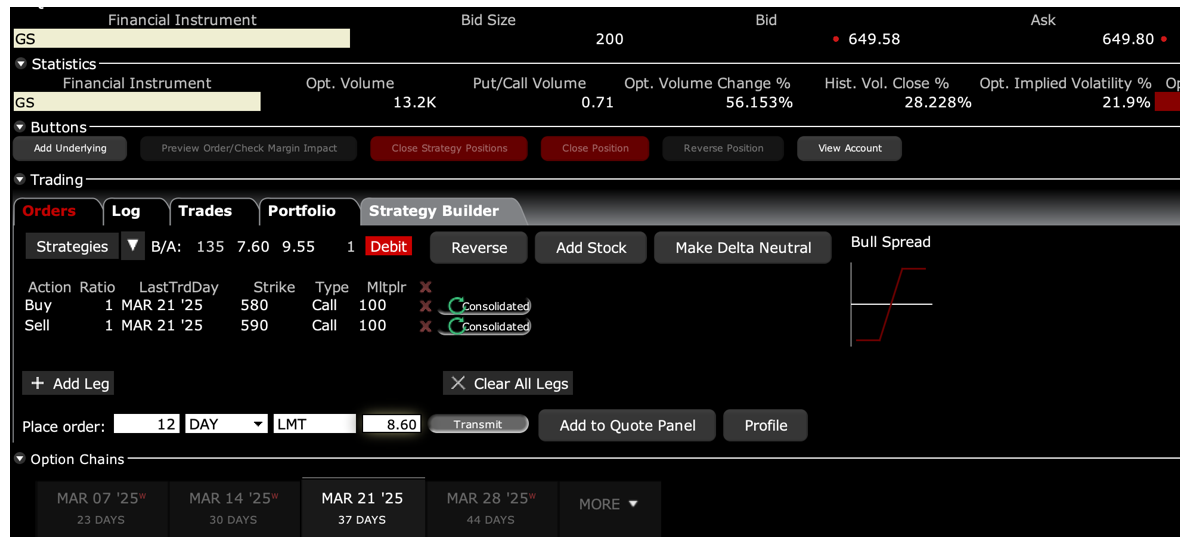

Buy the Goldman Sachs (GS) March 2025 $580-$590 in-the-money vertical bull call debit spread at $8.60 or best

Opening Trade

2-12-2025

expiration date: March 21, 2025

Portfolio weighting: 10% weighting

Number of Contracts = 12 contracts

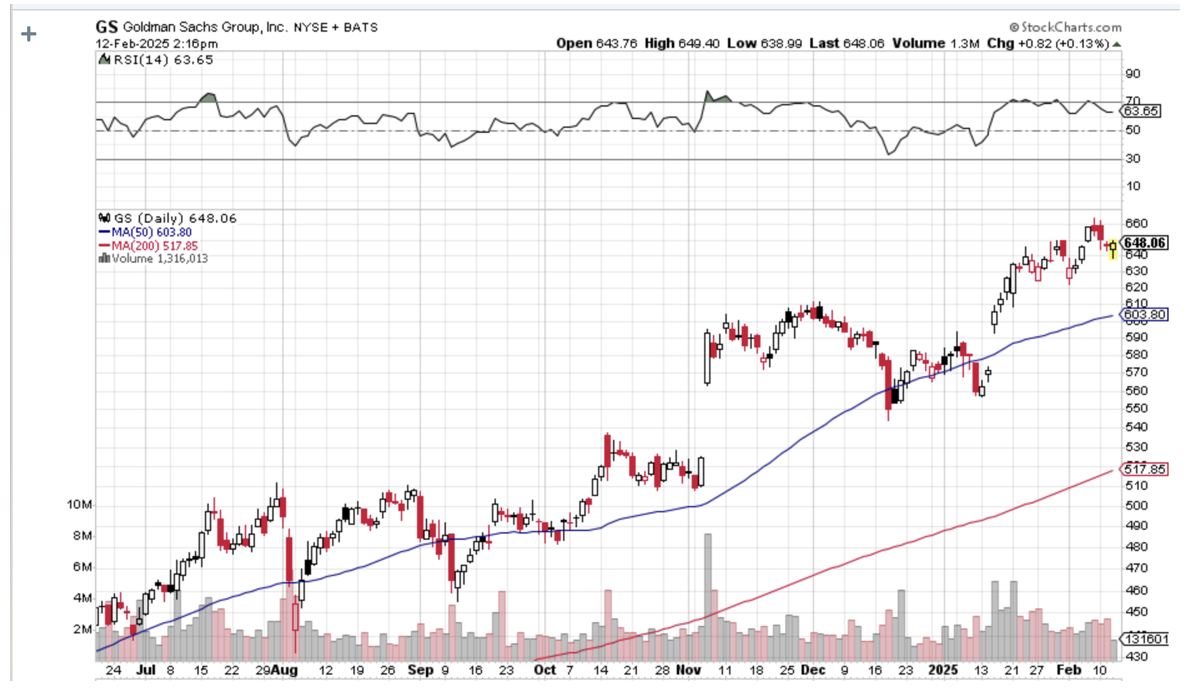

I have been trying to get into Goldman Sachs all year, and it’s worth it to pay up. Although we have only seen a $24, or 3.6% pullback from the recent peak, I am going to dive in. Worst case, we flat line, which will still deliver a maximum profit for this position.

The play here is deregulation, the only sure thing in 2025. Government regulation costs (GS) tens of millions of dollars a year. Lose the file behind the radiator, and this money drops to the bottom line.

This is also a bet on the return of mergers & acquisitions, which will take place once the current mass confusion dials down. This is the single most profitable business line at Goldman Sachs when it takes place.

Therefore, I am buying the Goldman Sachs (GS) March 2025 $580-$590 in-the-money vertical bull call debit spread at $8.60 or best.

Don't pay more than $9.30 or you'll be chasing.

DO NOT USE MARKET ORDERS UNDER ANY CIRCUMSTANCES.

Simply enter your limit order, wait five minutes, and if you don’t get done, cancel your order and increase your bid by 10 cents with a second order.

If you live in a foreign time zone when the US stock market is closed, such as Australia, or don’t want to sit in front of a screen all day, simply enter a spread of Good-Until-Cancelled orders overnight, like $8.60, $8.70, $8.80, and $8.90. You should get done on some or all of these.

This is a bet that (GS) will not drop below $590 by the March 21 option expiration in 21 trading days.

Here are the specific trades you need to execute this position:

Buy 12 March 2025 (GS) $580 calls at…………………....…$72.00

Sell short 12 March 2025 (GS) $590 calls at……………….$63.40

Net cost:………………………….……….……………..............……$8.60

Potential Profit: $10.00 - $8.60 = $1.40

(12 X 100 X $1.40) = $1,680 or 16.27% in 21 trading days

If you are uncertain about how to execute an options spread, please watch my training video by clicking here.

The best execution can be had by placing your bid for the entire spread in the middle market and waiting for the market to come to you. The difference between the bid and the offer on these deep-in-the-money spread trades can be enormous.

Don’t execute the legs individually, or you will end up losing much of your profit. Spread pricing can be very volatile on expiration months farther out.

Keep in mind that these are ballpark prices at best. After the alerts go out, prices can be all over the map.