Trade Alert - (ILMN) June 19, 2020 - BUY

When John identifies a strategic exit point, he will send you an alert with specific trade information as to what security to sell, when to sell it, and at what price. Most often, it will be to TAKE PROFITS, but, on rare occasions, it will be to exercise a STOP LOSS at a predetermined price to adhere to strict risk management discipline.

Trade Alert - (ILMN) – BUY

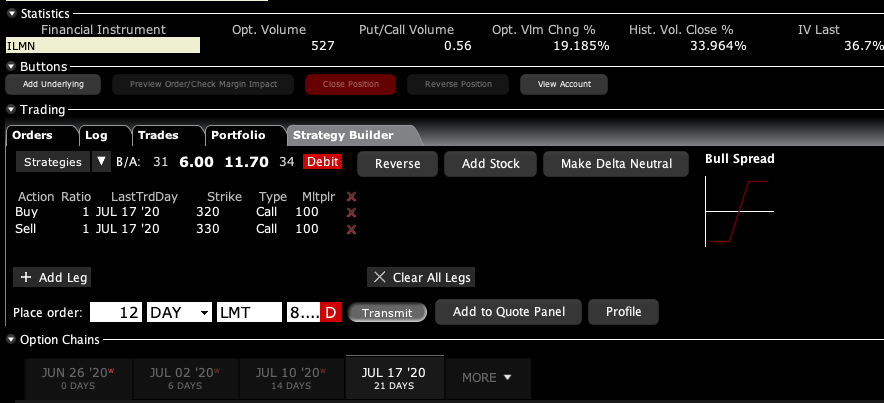

Buy the Illumina (ILMN) July 2020 $320-$330 in-the-money vertical Bull Call spread at $8.50 or best

Opening Trade

6-26-2020

expiration date: July 17, 2020

Portfolio weighting: 10%

Number of Contracts = 12 contracts

It is safe to say that the Biotech Sector (IBB) is breaking out to the upside. Take a look at the ten largest components of the iShares NASDAQ Biotechnology ETF and you’ll see they all have virtually the same chart.

With a massive Corona tailwind, it is no surprise. Trillions of dollars are raining down upon the sector. As a result, we will see ten years of research are being compressed into one. Not only will a way to address for Covid-19 be discovered, so will cures for everything else, especially cancer.

I just spent a week researching the entire listed biotech sector. My conclusion is that you want to get into Illumina, which is in melt-up mode. For the full report on Illumina, please see the research report below.

I am therefore buying the Illumina (ILMN) July 2020 $320-$330 in-the-money vertical Bull Call spread at $8.50 or best. These options are somewhat illiquid so you may have to finesse the execution.

Don’t pay more than $9.00 or you will be chasing.

DO NOT USE MARKET ORDERS UNDER ANY CIRCUMSTANCES.

Simply enter your limit order, wait five minutes, and if you don’t get done, cancel your order and increase your bid by 20 cents with a second order.

This is a bet that Illumina (ILMN) will not trade below $330 by the July 17 option expiration day in 14 trading days.

Here are the specific trades you need to execute this position:

Buy 12 July 2020 (ILMN) $320 calls at….……….………$44.00

Sell short 12 July 2020 (ILMN) $330 puts at…………...$35.50

Net Cost:…………………….........…….………..………….….....$8.50

Potential Profit: $10.00 - $8.50 = $1.50

(12 X 100 X $1.50) = $1,800 or 17.64% in 14 trading days.

To see how to enter this trade in your online platform, please look at the order ticket above, which I pulled off of Interactive Brokers.

If you are uncertain on how to execute an options spread, please watch my training video by clicking here.

The best execution can be had by placing your bid for the entire spread in the middle market and waiting for the market to come to you. The difference between the bid and the offer on these deep in-the-money spread trades can be enormous.

Don’t execute the legs individually or you will end up losing much of your profit. Spread pricing can be very volatile on expiration months farther out.

Keep in mind that these are ballpark prices at best. After the alerts go out, prices can be all over the map.

The Future of Precision Medicine

Hyper-personalized treatments, otherwise known as precision medicine, have been hailed as one the hallmarks of the healthcare revolution in the past decade.

Although a lot of people don’t see the need for such personalized treatments, a 2017 study by Boston medicine professor Jason Vassy indicated otherwise.

In his paper, titled “Annals of Internal Medicine,” Vassy discussed how his team performed whole-genome sequencing to 100 perfectly healthy adults.

To give you a better picture of how big this project was, whole-genome sequencing involves the analysis of the entire body’s DNA -- yes, all 3 billion pairs of letters found in every individual’s body.

So, you can imagine how tedious and complicated Vassy’s process was and why a lot of people found that to be incredibly pointless, especially since the adults in the study are all “healthy.” More importantly, the naysayers believed that this process would only bring unnecessary panic and anxiety to the subjects.

However, the results shocked them as 20% of the people tested positive for rare, life-threatening conditions that required immediate medical attention.

This prompted more experts to delve deeper into gathering genetic data sets in an effort to bolster the preventive power of genomics. This movement was supported by the National Institutes of Health in 2018 via their “All of Us” project, investing $27 million.

Meanwhile, a Harvard geneticist named George Church founded a similar organization called Nebula Genomics.

Basically, the idea behind precision medicine is very simple: Understanding how your genome works means knowing exactly how to “optimize” your body.

That means health professionals will be able to determine the perfect diet, perfect exercise routine, and of course, the perfect drugs for every patient. You’ll even learn the diseases your body is most susceptible to and how to prevent those.

At the moment, the biotechnology world only has a handful of companies focusing on precision medicine.

One of the leading biotechnology companies in this field is Illumina (ILMN), which focuses on DNA sequencing.

Utilizing its advanced machines, Illumina has been designing treatments to target specific cells in the human body -- and its efforts have been rewarded in recent years.

So far, Illumina stock has been up by 5,791% since its initial public offering back in 2000.

At the moment, Illumina practically controls approximately 80% of the next-generation sequencing space geared towards human genome analysis.

The key to its success is the company’s move to zero in on short-read data sequencing, which has been known as the cheapest, quickest, and most accurate service available in the market.

Since Illumina is one of the top movers in this field, it has easily become the top dog with a long waiting list of clients willing to pay tons of cash for the biotechnology firm’s machines.

While the machines definitely cost a lot upon purchase, Illumina actually earns more from the follow-up revenues generated from all the instances that a biotechnology or research laboratory uses the company’s technology to sequence a genome.

In 2019, Illumina earned $390 million in instrument revenue and $1.73 billion in consumables profit in the first three quarters alone.

Unfortunately, one of Illumina’s efforts to broaden its hold of the market failed.

The company opened 2020 to bad news as regulatory pressures pushed Illumina to shut down its plan to acquire its rival, Pacific Biosciences (PACB), for $1.2 billion.

While no particular reason was officially given by the reviewing bodies, reports indicate that the merger had been delayed due to fears of creating a monopoly.

Nonetheless, many consider this an odd excuse considering that Illumina’s supposed “monopoly” would actually compete directly with Roche (RHHBY).

For comparison, Roche’s market capitalization is $275 billion while Illumina is at $49 billion. In terms of revenue, Illumina earns $3.5 billion annually while Roche rakes in $56.8 billion.

Nevertheless, Illumina has decided to shrug off the rejection and move on to another potentially lucrative deal -- a 15-year partnership with another up and coming next-generation sequencing company: Qiagen (QGEN).

Initially thought to be a surefire acquisition candidate by Thermo Fisher Scientific (TMO) to the tune of $8 billion, Qiagen opted to reject the offer.

Instead, the smaller biotechnology firm has decided to focus on expanding its product portfolio. In the next five years, Qiagen estimates an earnings growth rate of roughly 9.1%.

Between Qiagen and Illumina, the former focuses more on individually customized treatments or “N-of-1 medicine.”

This has become even more pronounced following Qiagen’s acquisition of N-of-One, which raised $12.4 million in funding at the time, in January 2019.

N-of-One provides precision cancer care services. It offers clinical solutions like molecular interpretation to doctors and other healthcare professionals.

Apart from its partnership with Illumina, Qiagen also collaborates closely with NeoGenomics for cancer genetic testing services and DiaSorin for automated TB testing.

We’re in an era of remarkably personalized medical care.

With more and more genetic data made available for analysis, the rare diseases that boggled the minds of the healthcare industry are gradually becoming a thing of the past.

Now, we have access to tools that help with preventive measures to save us from the rare conditions that plagued our predecessors. If you really stop to think about it, targeted medicine just might be the key to immortality -- or at least to a significantly less disease-laden life.

If you’re looking to invest in Illumina or Qiagen stock (or both), the best thing to do is to take advantage of the next price drop.