Trade Alert - (JPM) July 19, 2021 - BUY

When John identifies a strategic exit point, he will send you an alert with specific trade information as to what security to sell, when to sell it, and at what price. Most often, it will be to TAKE PROFITS, but, on rare occasions, it will be to exercise a STOP LOSS at a predetermined price to adhere to strict risk management discipline.

Trade Alert - (JPM) – BUY

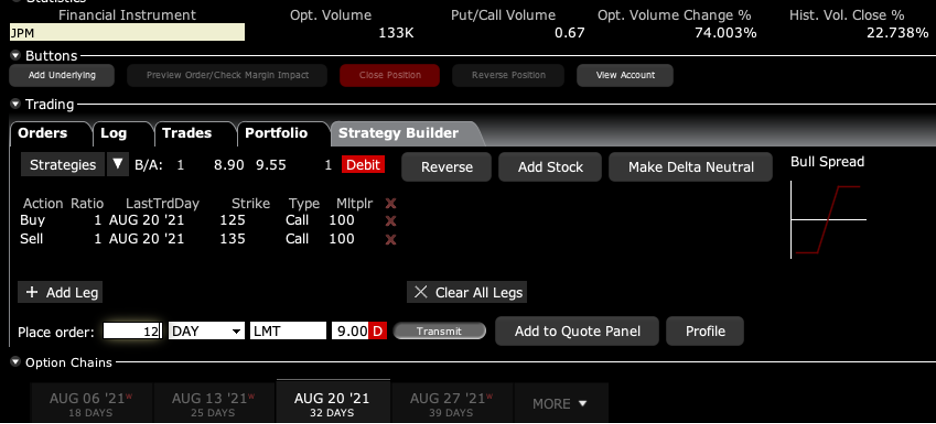

BUY the JP Morgan (JPM) August 2021 $125-$135 in-the-money vertical Bull Call spread at $9.00 or best

Trade Date: 7-19-2021

Expiration Date: August 20, 2021

Portfolio weighting: 10%

Number of Contracts = 12 contracts

If you don’t do options, buy the stock. My target for (JPM) this year is $200, up 32%.

With the Volatility Index back above $125, we are in the happy hunting grounds again.

I told you I’d be back in this name.

Bank shares have been joined at the hip with interest rates for the past eight months, and I believe that both rates and bank shares have much higher to go. With $10 trillion in new government spending about to be approved, but not funded, it can’t go any other way.

Beaten like a red-headed stepchild in this correction, financials will similarly soar after rates bottom and bond prices peak.

This trade benefits from huge support at the 200-day moving average at $135.89.

I am therefore buying the JP Morgan (JPM) August 2021 $125-$135 in-the-money vertical Bull Call spread at $9.00 or best.

Don’t pay more than $9.50 or you’ll be chasing.

That has given us a gift. (JPM) is the class act in the global banking sector, and CEO Jamie Diamond is the best CEO in the country.

I believe that massive government borrowing and spending will drive US interest rates up through the roof and the value of the US dollar (UUP) down. Banks love high-interest rates because they vastly improve profit margins.

In addition, my own Mad Hedge Market Timing Index is strongly in “BUY” territory at 16. This is the lowest level since before the presidential election eight months ago.

This is a bet that JP Morgan (JPM) will not fall below $135 by the August 20 option expiration day in 20 trading days.

Here are the specific trades you need to execute this position:

Buy 12 August 2021 (JPM) $125 calls at………….………$22.00

Sell short 12 August 2021 (JPM) $135 calls at………....$13.00

Net Cost:……………………..…….………..………….......….....$9.00

Potential Profit: $10.00 - $9.00 = $1.00

(12 X 100 X $1.00) = $1,200 or 11.11% in 20 trading days.

If you are uncertain about how to execute an options spread, please watch my training video by clicking here.

The best execution can be had by placing your bid for the entire spread in the middle market and waiting for the market to come to you. The difference between the bid and the offer on these deep in-the-money spread trades can be enormous.

Don’t execute the legs individually or you will end up losing much of your profit. Spread pricing can be very volatile on expiration months farther out.

Keep in mind that these are ballpark prices at best. After the alerts go out, prices can be all over the map.