Trade Alert - (JPM) November 26, 2021 - BUY

When John identifies a strategic exit point, he will send you an alert with specific trade information as to what security to sell, when to sell it, and at what price. Most often, it will be to TAKE PROFITS, but, on rare occasions, it will be to exercise a STOP LOSS at a predetermined price to adhere to strict risk management discipline.

Trade Alert - (JPM) – BUY

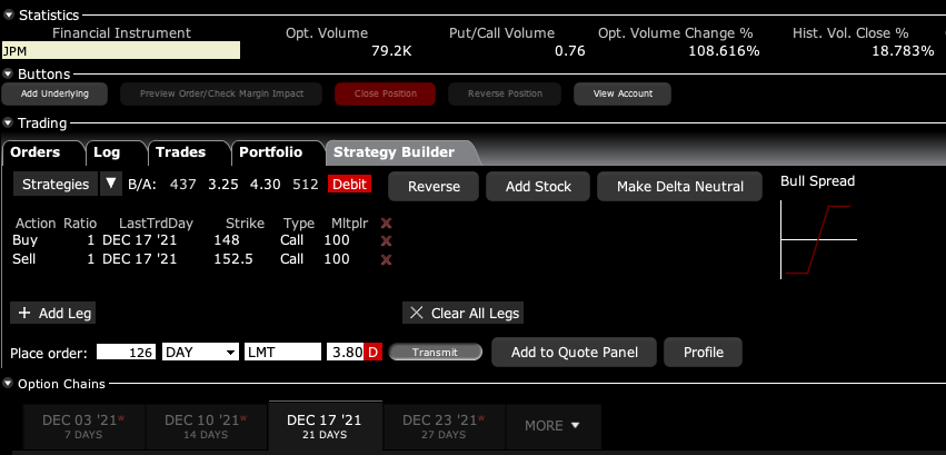

BUY the JP Morgan (JPM) December 2021 $148-$152.50 in-the-money vertical Bull Call spread at $3.80 or best

Trade Date: 11-26-2021

Expiration Date: December 17, 2021

Portfolio weighting: 10%

Number of Contracts = 26 contracts

New mandatory lockdowns in Austria and Holland have triggered rioting. It’s just another less than 5% correction. The farther we go down now, the more we can go up in December and in January.

America’s 90% immunity will hold at bay any variants. There is no evidence this new one can’t be stopped by vaccines. Africa is another story. I went into this 80% cash. Wait for the selling to burn out in a day or two then use the high volatility to add front month call spreads and LEAPS in your favorites.

If you don’t do options, buy the stock. My target for (JPM) next year is $200, up 32%.

I told you I’d be back in this name.

Bank shares have been joined at the hip with interest rates for the past eight months, and I believe that both rates and bank shares have much higher to go. With $3.5 trillion in new government spending about to be approved, but not funded, it can’t go any other way.

The Volatility Index (VIX) hitting $29 this morning has given us a gift.

I am therefore buying the JP Morgan (JPM) December 2021 $148-$152.50 in-the-money vertical Bull Call spread at $3.80 or best

Don’t pay more than $4.20 or you’ll be chasing.

(JPM) is the class act in the global banking sector, and CEO Jamie Diamond is the best CEO in the country.

I believe that massive government borrowing and spending will drive US interest rates up through the roof and the value of the US dollar (UUP) down. Banks love high-interest rates because they vastly improve profit margins.

This is a bet that JP Morgan (JPM) will not fall below $152.50 by the December 17 option expiration day in 15 trading days.

Here are the specific trades you need to execute this position:

Buy 26 December 2021 (JPM) $148 calls at………….….....……$15.00

Sell short 26 December 2021 (JPM) $152.50 calls at………....$11.20

Net Cost:……………………..................…….………..………….….....$3.80

Potential Profit: $4.50 - $3.80 = $0.70

(26 X 100 X $0.70) = $1,820 or 18.42% in 15 trading days.

If you are uncertain about how to execute an options spread, please watch my training video by clicking here.

The best execution can be had by placing your bid for the entire spread in the middle market and waiting for the market to come to you. The difference between the bid and the offer on these deep in-the-money spread trades can be enormous.

Don’t execute the legs individually or you will end up losing much of your profit. Spread pricing can be very volatile on expiration months farther out.

Keep in mind that these are ballpark prices at best. After the alerts go out, prices can be all over the map.