Trade Alert - (NVDA) April 4, 2025 - BUY

When John identifies a strategic exit point, he will send you an alert with specific trade information as to what security to sell, when to sell it, and at what price. Most often, it will be to TAKE PROFITS, but, on rare occasions, it will be to exercise a STOP LOSS at a predetermined price to adhere to strict risk management discipline.

Trade Alert - (NVDA) – BUY

BUY the NVIDIA (NVDA) April 2025 $70-$75 in-the-money vertical Bull Call debit spread at $4.50 or best

Opening Trade

4-4-2025

expiration date: April 17, 2025

Number of Contracts = 25 contracts

The Dow Average is down $2,000 today and $3,700 in two days. I am willing to bet that Nvidia won’t drop another 16% on top of its existing 39% drop over the next 9 days. We are at the August 2024 capitulation lows.

I firmly believe that Nvidia is still one of the crown jewels of the stock market and that it is the first company that institutions will pile back into once the “all clear” signal is given.

Some $1 trillion in capital spending for AI over the next three years, as elicited by CEO Jensen Huang this week, is hard to argue with. (NVDA) will get a big chunk of this. I am also lured by a high 44% implied volatility for the options.

I am therefore buying the NVIDIA (NVDA) April 2025 $70-$75 in-the-money vertical Bull Call debit spread at $4.50 or best.

Don’t pay more than $4.70 or you’ll be chasing on a risk/reward basis.

DO NOT USE MARKET ORDERS UNDER ANY CIRCUMSTANCES.

Simply enter your limit order, wait five minutes, and if you don’t get done, cancel your order and increase your bid by 10 cents with a second order. If that gets you nothing, try raising your strike prices by $1.00.

If you don’t want to sit in front of a screen all day, simply enter a spread of Good-Until-Cancelled orders overnight, like $4.50, $4.55, $4.60, $4.65, and $4.70, You should get done on some or all of these.

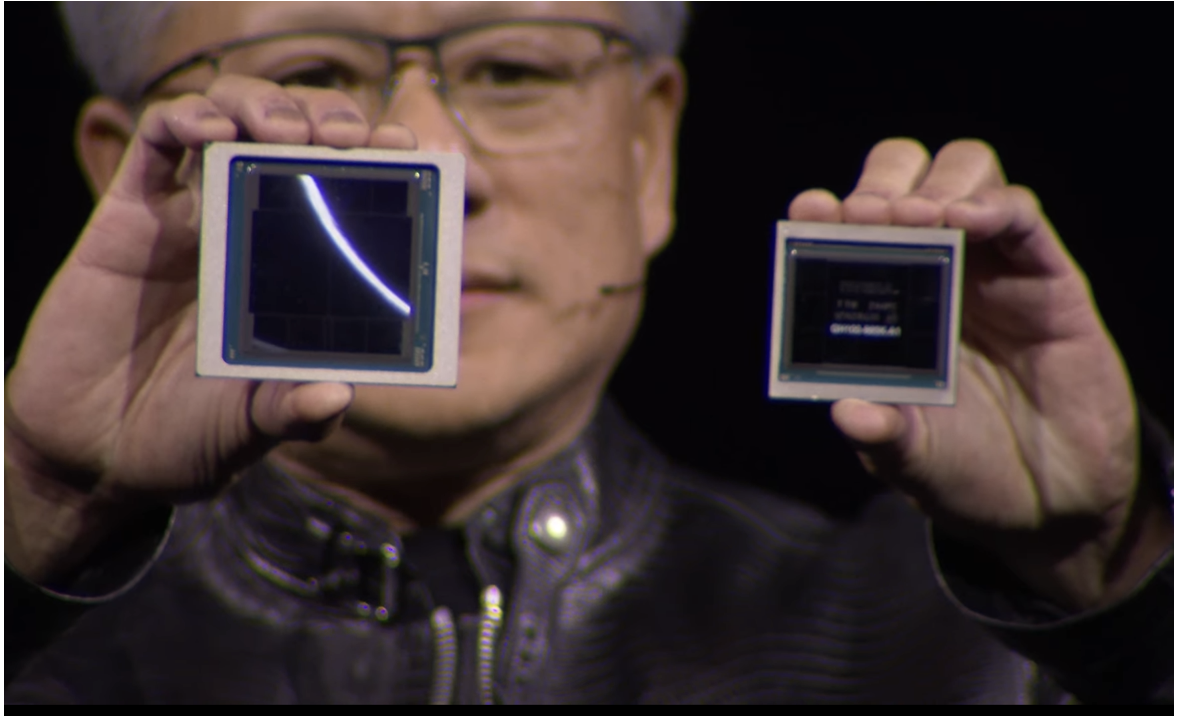

NVIDIA is so far ahead of the competition that no one will catch up for years. Its top-end Blackwell card sells for $70,000.

What the (NVDA) bears don’t get is that the company has a moat so wide it is impossible to cross. Their enormous lead in software is the result of crucial platform decisions made 20 years ago. The key staff are all looking for ultra-cheap equity options with strike prices around $1-$2.

Santa Clara-based NVIDIA designs and manufactures high-end, top-performing graphics cards or GPUs. There is probably one in your PC. They are essential in the artificial intelligence, automobile, PC, supercomputing, cybersecurity, and gaming industries.

They are also crucial for national defense. The Biden administration recently banned NVIDIA from exporting high-end chips and their manufacturing equipment to China, which they were using to build sophisticated weapons to use against us. This revenue loss is what has taken the shares down to their current low levels, down 65% in six months.

NVIDIA has long been one of the fastest-growing US companies. Since 2005, its annual net income has soared from $89 million to $9.7 billion.

If the highest growth sectors in the economy are Robotics, AI, and energy storage, (NVDA) is in the sweet spot of every one of these.

And before you ask, NVIDIA is an abbreviation for the Latin word for “envy.”

To learn more about the company, please visit their website at https://www.nvidia.com/en-us/

This is a bet that NVIDIA will not fall below $75 by the April 17 option expiration in 9 trading days.

Here are the specific trades you need to execute this position:

Buy 25 April 2025 (NVDA) $70 calls at………….…….…$25.00

Sell short 25 April 2025 (NVDA) $75 calls at……………$20.50

Net Cost:………………………….………..…………...................$4.50

Potential Profit: $5.00 - $4.50 = $0.50

(25 X 100 X $0.50) = $1,250 or 11.11% in 9 trading days.

To see how to enter this trade in your online platform, please look at the order ticket below, which I pulled off of Interactive Brokers.

If you are uncertain about how to execute an options spread, please watch my training video by clicking here.

The best execution can be had by placing your bid for the entire spread in the middle market and waiting for the market to come to you. The difference between the bid and the offer on these deep-in-the-money spread trades can be enormous.

Don’t execute the legs individually, or you will end up losing much of your profit. Spread pricing can be very volatile on expiration months farther out.

Keep in mind that these are ballpark prices at best. After the alerts go out, prices can be all over the map.

The Blackwell Chip