Trade Alert - (NVDA) June 28, 2023 - BUY

When John identifies a strategic exit point, he will send you an alert with specific trade information as to what security to sell, when to sell it, and at what price. Most often, it will be to TAKE PROFITS, but, on rare occasions, it will be to exercise a STOP LOSS at a predetermined price to adhere to strict risk management discipline.

Trade Alert - (NVDA) – BUY

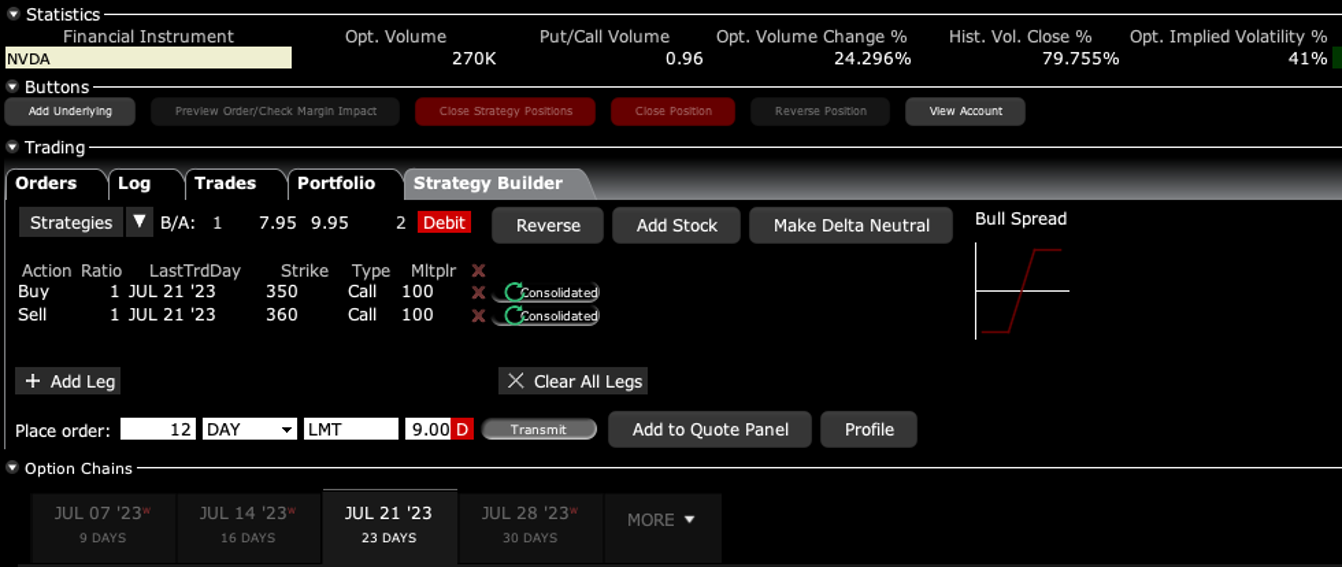

BUY the NVIDIA (NVDA) July 2023 $350-$360 in-the-money vertical Bull Call debit spread at $9.00 or best

Opening Trade

6-28-2023

expiration date: July 21, 2023

Number of Contracts = 12 contracts

NVIDIA dove this morning on possible new export restrictions from the US government. The goal is to prevent US companies from selling China the rope with which they will hand us. (AMD) would also be affected by limitations on the sale of its highest-end AI chips.

This gives us a rare entry point for (NVDA) shares, now off $30, or 6.8% from its recent high.

During periods of no market direction like this one with an ultra-low Volatility Index ($VIX), traders flock to the few corners of the options market where the payout is still big.

That would include NVIDIA (NVDA), whose options have the second-highest implied volatility at 40% of any major company after Tesla.

After decent earnings, which triggered a blowout 20% move up in the shares, the good news is out, at least for the next 16 trading days, which includes the ultra-slow Fourth of July week, a US national holiday. It is now up an impressive 319% from the October low.

It helps also that the market is still expensive and overbought, with an S&P 500 earnings multiple of 20X and a Mad Hedge Market Timing Index of 77.

I am therefore buying the NVIDIA (NVDA) July 2023 $350-$360 in-the-money vertical Bull Call debit spread at $9.00 or best.

Don’t pay more than $9.40 or you’ll be chasing on a risk/reward basis.

Only use a limit order. DO NOT USE MARKET ORDERS UNDER ANY CIRCUMSTANCES. Just enter a limit order and work it.

Analysts always make projections based on extrapolating current demand. What they don’t take into account is the fact that NVIDIA’s products are being designed into new products at an incredible rate.

As a result, every portfolio manager has to own (NVDA) or risk getting fired, unless they run a value fund. I fully expect to see $1,000 a share in the next 3-5 years.

It’s also hard to imagine NVIDIA’s stock not going ballistic when Tesla’s EV production is rocketing from 1 million to 20 million in ten years.

That’s me. I’m always looking at the ten-year view. I have been doing so since 1970. It pays big time.

Santa Clara-based NVIDIA designs and manufactures high-end, top-performing graphics cards or GPUs. There is probably one in your PC. They are essential in the artificial intelligence, automobile, PC, supercomputing, cybersecurity, and gaming industries.

They are also crucial for national defense. The Biden administration recently banned NVIDIA from exporting high-end chips and their manufacturing equipment to China, which they were using them to build sophisticated weapons to use against us. This revenue loss is what has taken the shares down to their current low levels, down 65% in six months.

NVIDIA has long been one of the fastest growing US companies. Since 2005, its annual net income has soared from $89 million to $9.7 billion. Its NVIDIA Titan V graphics processing unit used for supercomputing architecture sells for an eye-popping $2,999. It is the one stock every portfolio wants to buy on the dip.

If the highest growth sectors in the economy are Robotics, AI, and energy storage, (NVDA) is in the sweet spot of every one of these.

And before you ask, NVIDIA is an abbreviation for the Latin word for “envy.”

To learn more about the company please visit their website at https://www.nvidia.com/en-us/

This is a bet that NVIDIA will not go below $360 by the July 21 options expiration in 16 days.

Here are the specific trades you need to execute this position:

Buy 12 July 2023 (NVDA) $350 Calls at………….………$64.00

Sell short 12 July 2023 (NVDA) $360 Calls at….………$55.00

Net Cost:………………………….………..........………….….....$9.00

Potential Profit: $10.00 - $9.00 = $1.00

(12 X 100 X $1.00) = $1,200 or 11.11% in 16 days.

If you are uncertain about how to execute an options spread, please watch my training video by clicking here.

The best execution can be had by placing your bid for the entire spread in the middle market and waiting for the market to come to you. The difference between the bid and the offer on these deep-in-the-money spread trades can be enormous.

Don’t execute the legs individually or you will end up losing much of your profit. Spread pricing can be very volatile on expiration months farther out.

Keep in mind that these are ballpark prices at best. After the alerts go out, prices can be all over the map.