Trade Alert - (NVDA) March 10, 2025 - TAKE PROFITS - SELL

When John identifies a strategic exit point, he will send you an alert with specific trade information as to what security to sell, when to sell it, and at what price. Most often, it will be to TAKE PROFITS, but, on rare occasions, it will be to exercise a STOP LOSS at a predetermined price to adhere to strict risk management discipline.

Trade Alert - (NVDA) – TAKE PROFITS

SELL the NVIDIA (NVDA) March 2025 $150-$155 in-the-money vertical Bear Put debit spread at $4.98 or best

Closing Trade

3-10-2025

expiration date: March 21, 2025

Number of Contracts = 25 contracts

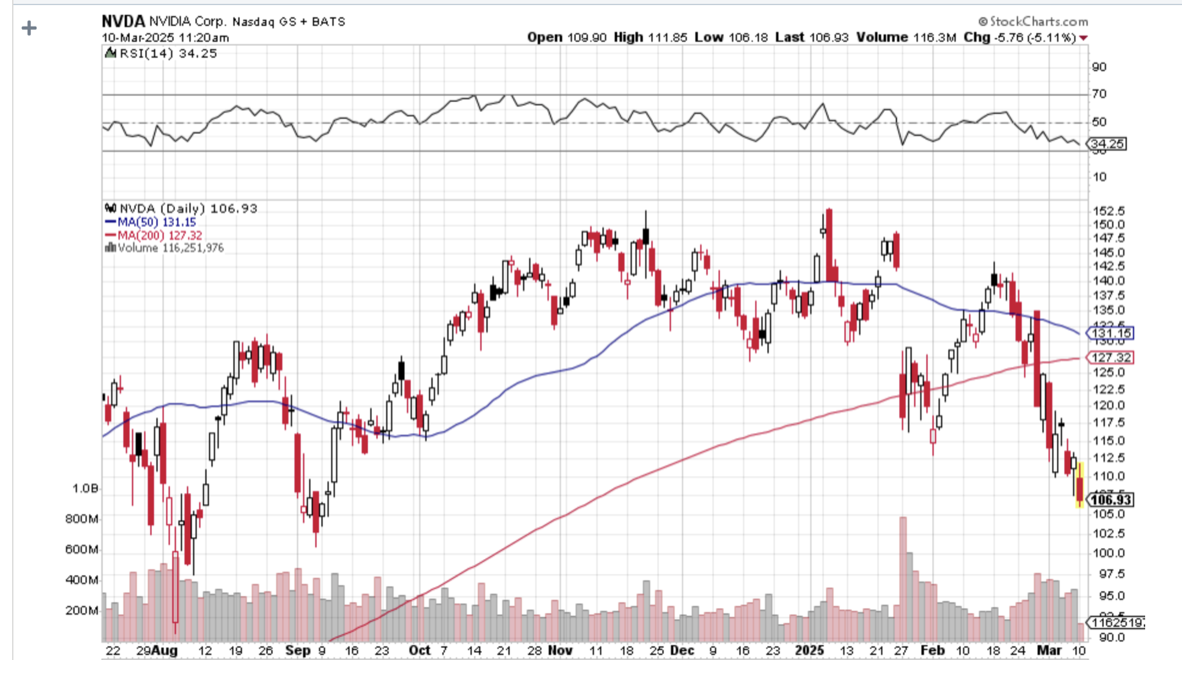

In retrospect, this position was insanely conservative. Everyone said I was crazy selling short a company that is growing 70% a year. That’s why they call me Mad. Nvidia shares have cratered by an incredible 30% in two months.

With 97% of the maximum potential profit in hand, the risk reward of continuing is no longer favorable. Better to raise cash for a bigger selloff. Besides, with the Mad Hedge AI Market Timing Index at a lowly 15, we are extremely oversold and can bounce at any time.

I am therefore selling the NVIDIA (NVDA) March 2025 $150-$155 in-the-money vertical Bear Put debit spread at $4.98 or best.

Only use a limit order. DO NOT USE MARKET ORDERS UNDER ANY CIRCUMSTANCES. Just enter a limit order and work it.

Simply enter your limit order, wait five minutes, and if you don’t get done, cancel your order and lower your offer by 2 cents with a second order.

If you live in a foreign time zone when the US stock market is closed, such as Australia, or don’t want to sit in front of a screen all day, simply enter a spread of Good-Until-Cancelled orders overnight, like $4.98, $4.96, $4.94, $4.92, and $4.90. You should get done on some or all of these.

The good news was in the price.

Markets brimming with confidence see earnings multiples expand. Markets wrought with fear and uncertainty trade at discounts. Whether that is a 10%, 20%, or 50% discount is anyone’s guess. But it is certainly not 5%, which is where we were when we added this trade.

Nvidia just announced blockbuster earnings better than the most optimistic expectations. Even the most optimistic expectations. The company forecasted higher first-quarter revenue, signaling continued strong demand for artificial intelligence chips, and said orders for its new Blackwell semiconductors were "amazing."

The forecast helps allay doubts around a slowdown in spending on its hardware that emerged last month, following DeepSeek's claims that it had developed AI models rivaling Western counterparts at a fraction of their cost.

Nvidia's outlook for gross margin in the current quarter was slightly lower than expected, though, as the company's Blackwell chip ramp-up weighs on Nvidia's profit. Nvidia forecasted that first-quarter gross margins will sink to 71%, below the 72.2% forecast by Wall Street, according to data compiled by LSEG.

However, the shares rallied only 3%, far less than the 10% anticipated by the options market. This is not good. This was a bet that (NVDA) was not going to a new all-time high in the next 11 trading days. And with implied volatility at a sky-high 64%, I am paid amply to have done so.

(NVDA) is the most over-owned stock in the market. It is the largest position held by virtually all of my followers, largely through capital appreciation. If investors are going to de-risk in the face of today’s unprecedented uncertainty, this is the first name they will hit. This is why the share price has remained virtually unchanged for nine months.

Santa Clara-based NVIDIA designs and manufactures high-end, top-performing graphics cards or GPUs. There is probably one on your PC. They are essential in the artificial intelligence, automobile, PC, supercomputing, cybersecurity, and gaming industries.

And before you ask, NVIDIA is an abbreviation for the Latin word for “envy.”

To learn more about the company, please visit their website at https://www.nvidia.com/en-us/

This was a bet that NVIDIA would not rise above $150 by the March 21 option expiration in 11 trading days.

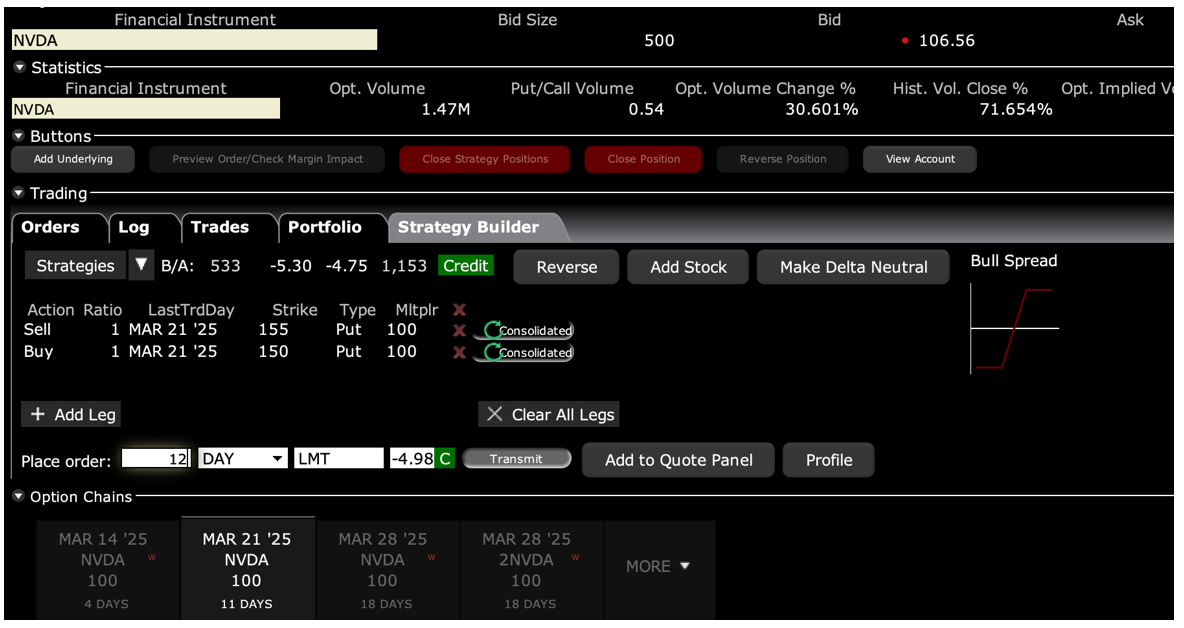

Here are the specific trades you need to close out this position:

Sell 25 March 2025 (NVDA) $155 Puts at………….……….............$48.00

Buy to cover short 25 March 2025 (NVDA) $150 puts at…………$43.02

Net Proceeds:………………………….………..………….…......................$4.98

Profit: $4.98 - $4.35 = $0.63

(25 X 100 X $0.63) = $1,575 or 13.55% in 11 days.

To see how to enter this trade in your online platform, please look at the order ticket below, which I pulled off of Interactive Brokers.

If you are uncertain about how to execute an options spread, please watch my training video by clicking here.

The best execution can be had by placing your bid for the entire spread in the middle market and waiting for the market to come to you. The difference between the bid and the offer on these deep-in-the-money spread trades can be enormous.

Don’t execute the legs individually, or you will end up losing much of your profit. Spread pricing can be very volatile on expiration months farther out.

Keep in mind that these are ballpark prices at best. After the alerts go out, prices can be all over the map.