Trade Alert - (NVDA) March 21, 2025 - EXPIRATION AT MAX PROFIT

When John identifies a strategic exit point, he will send you an alert with specific trade information as to what security to sell, when to sell it, and at what price. Most often, it will be to TAKE PROFITS, but on rare occasions, it will be to exercise a STOP LOSS at a predetermined price to adhere to strict risk management discipline.

Trade Alert - (NVDA) EXPIRATION AT MAX PROFIT

Expiration of the NVIDIA (NVDA) March 2025 $88-$90 in-the-money vertical Bull Call debit spread at $2.00

Closing Trade

3-21-2025

expiration date: March 21, 2025

Number of Contracts = 50 contracts

Because we have so many options positions expiring at max profit on the Friday, March 21 expiration day, I am going to start feeding these out now.

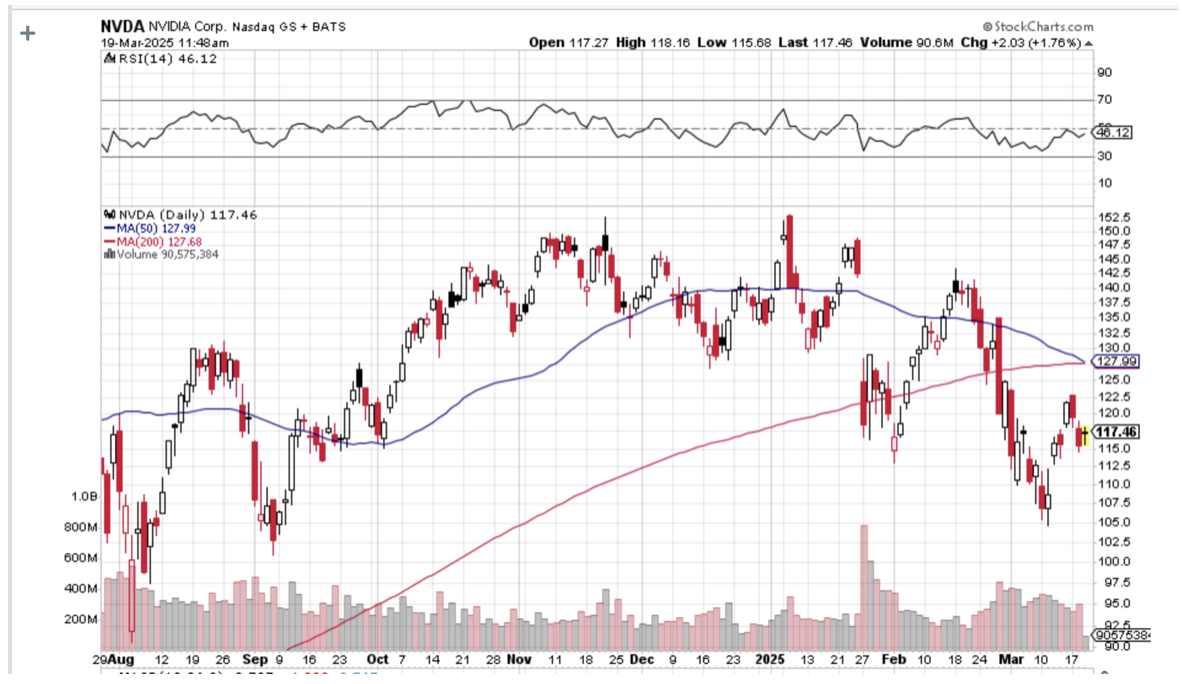

Like all successful trades, this one looks stupidly cautious with 20:20 hindsight and (NVDA) at $117.46. All the safe stocks have been slaughtered. Bitcoin is down 30%, twice the (SPY) decline.

As a result, you get to take home $1,250 or 14.29% in 10 trading days.

Well done and on to the next trade.

You don’t have to do anything with this expiration.

Your broker will automatically use your long position to cover your short position, canceling out the total holdings.

The entire profit will be credited to your account on Monday morning March 24 and the margin freed up.

Some firms charge you a modest $10 or $15 fee for performing this service.

The flight of money right now is from small, undercapitalized, and questionable to large, overcapitalized, and rock-solid balance sheets.

NVIDIA is so far ahead of the competition that no one will catch up for years. What the (NVDA) bears don’t get is that the company has a moat so wide it is impossible to cross. Their enormous lead in software is the result of crucial platform decisions made 20 years ago. The key staff are all looked up with ultra-cheap equity options with strike prices around $1-$2.

Virtually everyone has now raised their upside targets for the stock over $1,000/share. That’s because with a price-earnings multiple of 30X, it is still the biggest Big Tech stock in the market. By comparison, its biggest customer, (META) is at 34X, AI Leader (MSFT) is at 38X, and (AMZN) is at 63X. Efforts by Alphabet to break into the AI chip business are feeble at best.

Every 15% correction in (NVDA) over the last two years has been a strong “BUY”. It owns the AI manufacturing business. It’s looking at $250-$500 BILLION in sales growth per year over the next several years.

Santa Clara-based NVIDIA designs and manufactures high-end, top-performing graphics cards or GPUs. There is probably one in your PC. They are essential in the artificial intelligence, automobile, PC, supercomputing, cybersecurity, and gaming industries.

They are also crucial for national defense. The Biden administration recently banned NVIDIA from exporting high-end chips and their manufacturing equipment to China, which they were using them to build sophisticated weapons to use against us. This revenue loss is what has taken the shares down to their current low levels, down 65% in six months.

NVIDIA has long been one of the fastest-growing US companies. Since 2005, its annual net income has soared from $89 million to $9.7 billion.

If the highest growth sectors in the economy are Robotics, AI, and energy storage, (NVDA) is in the sweet spot of every one of these.

And before you ask, NVIDIA is an abbreviation for the Latin word for “envy.”

To learn more about the company please visit their website at https://www.nvidia.com/en-us/

This was a bet that NVIDIA would not fall below $92 by the March 21 option expiration in 10 trading days.

Here are the specific accounting you need to close out this position:

Expiration of 50 March 2025 (NVDA) $88 calls at………….………...$29.46

Expiration of Sell short 50 March 2025 (NVDA) $90 calls at………$27.46

Net Proceeds:………………………….………..…………..............................$2.00

Profit: $2.00 - $1.75 = $0.25

(50 X 100 X $0.25) = $1,250 or 14.29% in 10 trading days.