Trade Alert - (NVDA) May 5, 2025 - BUY

When John identifies a strategic exit point, he will send you an alert with specific trade information as to what security to sell, when to sell it, and at what price. Most often, it will be to TAKE PROFITS, but, on rare occasions, it will be to exercise a STOP LOSS at a predetermined price to adhere to strict risk management discipline.

Trade Alert - (NVDA) – BUY

BUY the NVIDIA (NVDA) June 2025 $140-$145 in-the-money vertical Bear Put debit spread at $4.40 or best

Opening Trade

5-5-2025

expiration date: June 20, 2025

Number of Contracts = 25 contracts

We have just seen a nice $30, or 35% rise in Nvidia shares, so I think it's time to sell short the shares once again. I am drawn by the sky-high 57% implied volatility.

Every client I know is now selling into every rally or laying on hedges. People want OUT!

The good news is in the price.

Markets brimming with confidence see earnings multiples expand. Markets wrought with fear and uncertainty trade at discounts. Whether that is a 10%, 20%, or 50% discount is anyone’s guess. But it is certainly not 10%, which is where we are now.

I am therefore buying the NVIDIA (NVDA) June 2025 $140-$145 in-the-money vertical Bear Put debit spread at $4.40 or best

Don’t pay more than $4.60 or you’ll be chasing on a risk/reward basis.

Only use a limit order. DO NOT USE MARKET ORDERS UNDER ANY CIRCUMSTANCES. Just enter a limit order and work it.

Simply enter your limit order, wait five minutes, and if you don’t get done, cancel your order and increase your bid by 5 cents with a second order.

If you live in a foreign time zone when the US stock market is closed, such as Australia, or don’t want to sit in front of a screen all day, simply enter a spread of Good-Until-Cancelled orders overnight, like $4.40, $4.50, $4.60, $4.70, and $4.80. You should get done on some or all of these.

(NVDA) is the most overowned stock in the market. It is the largest position held by virtually all of my followers, largely through capital appreciation. If investors are going to de-risk in the face of today’s unprecedented uncertainty, this is the first name they will hit. This is why the share price has remained virtually unchanged for nine months.

Santa Clara-based NVIDIA designs and manufactures high-end, top-performing graphics cards or GPU’s. There is probably one in your PC. They are essential in the artificial intelligence, automobile, PC, supercomputing, cybersecurity, and gaming industries.

And before you ask, NVIDIA is an abbreviation for the Latin word for “envy.”

To learn more about the company please visit their website at https://www.nvidia.com/en-us/

This is a bet that NVIDIA will not rise above $140 by the June 20 option expiration in 34 trading days.

Here are the specific trades you need to execute this position:

Buy 25 June 2025 (NVDA) $145 puts at………….……..…$29.00

Sell short 25 June 2025 (NVDA) $140 puts at……………$24.70

Net Cost:………………………….……….….…..........................$4.40

Potential Profit: $5.00 - $4.40 = $0.60

(25 X 100 X $0.60) = $1,500 or 13.64% in 34 days.

To see how to enter this trade in your online platform, please look at the order ticket below, which I pulled off of Interactive Brokers.

If you are uncertain about how to execute an options spread, please watch my training video by clicking here.

The best execution can be had by placing your bid for the entire spread in the middle market and waiting for the market to come to you. The difference between the bid and the offer on these deep-in-the-money spread trades can be enormous.

Don’t execute the legs individually, or you will end up losing much of your profit. Spread pricing can be very volatile on expiration months farther out.

Keep in mind that these are ballpark prices at best. After the alerts go out, prices can be all over the map.

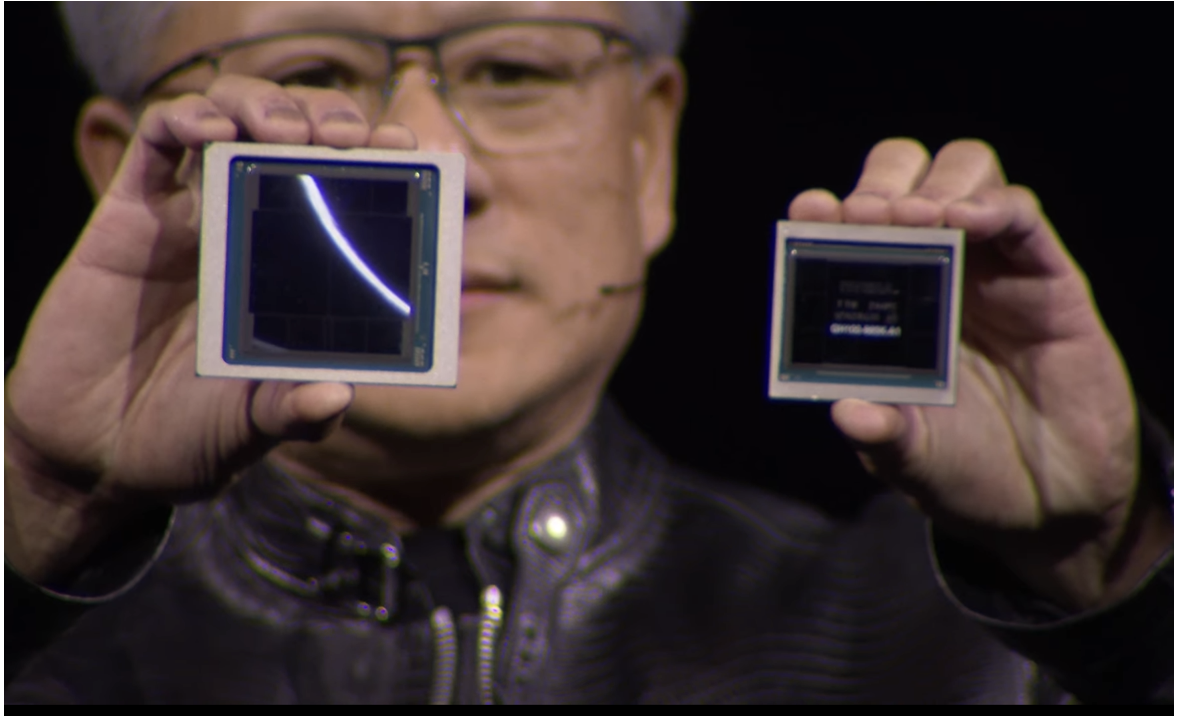

The Blackwell Chip