Trade Alert - (OXY) November 21, 2022 - BUY

When John identifies a strategic exit point, he will send you an alert with specific trade information as to what security to sell, when to sell it, and at what price. Most often, it will be to TAKE PROFITS, but, on rare occasions, it will be to exercise a STOP LOSS at a predetermined price to adhere to strict risk management discipline.

Trade Alert - (OXY) - BUY

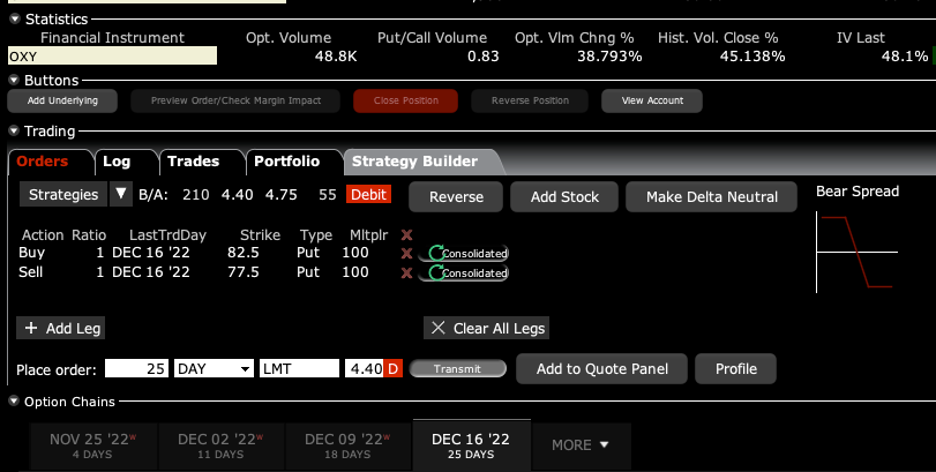

Buy the Occidental Petroleum (OXY) December 2022 $77.50-$82.50 in-the-money vertical bear put spread at $4.40 or best

Opening Trade

11-21-2022

expiration date: December 16, 2022

Portfolio weighting: 10%

Number of Contracts = 25 contracts

Oil is breaking down here, losing the $80 handle on Friday. This is despite the fact that we are entering peak oil demand.

This could be happening because Russia’s continuing retreat from Ukraine could lead to an eventual tsunami of Russian oil hitting the market in 2023. We also could finally be seeing EV make a dent in oil demand.

EV production will top 1.5 million this year, and 20 million in 2032. Some 50% of US oil production now goes to automobiles and that market will eventually disappear. From 2035, it will be illegal to sell a gasoline-powered engine in much of the US.

The proof of this is that oil companies themselves have ceased making long-term investments in their own industry, instead paying out cash flow in very high dividends and share buybacks. Traditionally, the oil industry made capital investments with a 30-year life.

And while oil prices have been flat-lining for months, the shares of Occidental have been on an absolute tear, up some 33% since the September low. Particularly ominous for (OXY) is the clear double top on the charts indicating a failing rally.

Another nail in the coffin for the oil industry was the disastrous outcome of the midterm elections. No red wave means no congressional air cover, which is desperately needed by oil producers during a period of accelerating climate change.

In addition, I know you all have substantial longs out there that we have been Hoovering up since the October low. This position would make a nice hedge against those longs, at least for a month. To learn more about Occidental Petroleum please visit their website at https://www.oxy.com. Please also read the extended research report below.

Therefore, I am buying the Occidental Petroleum (OXY) December 2022 $77.50-$82.50 in-the-money vertical bear put spread at $4.40 or best.

DO NOT USE MARKET ORDERS UNDER ANY CIRCUMSTANCES.

Simply enter your limit order, wait five minutes, and if you don’t get done cancel your order and increase your bid by 10 cents with a second order.

Don’t pay more than $4.60 or you will be chasing.

If you don’t do options, stand aside. This is a short-term options play only.

This is a bet that the Occidental Petroleum (OXY) will not trade above $77.50 by the December 16 option expiration day in 19 trading days.

Here are the specific trades you need to execute this position:

Buy 25 December 2022 (OXY) $82.50 puts at……...….…$15.00

Sell short 25 December 2022 (OXY) $77.50 puts at…….$10.60

Net Cost:……………………........................…….……….………$4.40

Potential Profit: $5.00 - $4.40 = $0.60

(25 X 100 X $0.60) = $1,500, or 13.64% in 19 trading days.

If you are uncertain about how to execute an options spread, please watch my training video by clicking here.

The best execution can be had by placing your bid for the entire spread in the middle market and waiting for the market to come to you. The difference between the bid and the offer on these deep in-the-money spread trades can be enormous.

Don’t execute the legs individually or you will end up losing much of your profit. Spread pricing can be very volatile on expiration months farther out.

Keep in mind that these are ballpark prices at best. After the alerts go out, prices can be all over the map.

Take a Look at Occidental Petroleum (OXY)

There are a lot of bells at the ball, but you can’t dance with all of them.

While a student at UCLA in the early seventies, I took a World Politics course, which required me to pick a country, analyze its economy, and make recommendations for its economic development.

I chose Algeria, a country where I had spent the summer of 1968 caravanning among the Bedouins, eventually crawling out of the desert-starving, lice-ridden, and half-dead.

I concluded that the North African country should immediately nationalize the oil industry and raise prices from $3/barrel to $10. I knew that Los Angeles-based Occidental Petroleum (OXY) was interested in exploring for oil there, so I sent my paper to the company for review.

They called the next day and invited me to their imposing downtown headquarters, then the tallest building in Los Angeles.

I was ushered into the office of Dr. Armand Hammer, one of the great independent oil moguls of the day, a larger-than-life figure who owned a spectacular impressionist art collection, and who confidently displayed a priceless Fabergé egg on his desk. He said he was impressed with my paper, and then spent two hours grilling me.

Why should oil prices go up? Who did I know there? What did I see? What was the state of their infrastructure? Roads? Bridges? Rail lines? Did I see any oil derricks? Did I see any Russians? I told him everything I knew, including the two weeks in an Algiers jail for taking pictures in the wrong places.

His parting advice was to never take my eye off the oil industry, as it is the driver of everything else. I have followed that advice ever since.

When I went back to UCLA, I told a CIA friend of mine that I had just spent the afternoon with the eminent doctor (Marsha, call me!). She told me that he had been a close advisor of Vladimir Lenin after the Russian Revolution, had been a double agent for the Soviets ever since, that the FBI had known this all along, and was currently funneling illegal campaign donations to President Richard Nixon.

Shocked, I kicked myself for going into an interview so ill-prepared and had missed a golden opportunity to ask some great questions. I never made that mistake again.

Some 40 years later, in 2010 while trolling the markets for great buying opportunities set up by the BP oil spill, I stumbled across (OXY) once more. (OXY) had a minimal offshore presence, nothing in deep water, and huge operations in the Middle East and South America.

(OXY)’s substantial California production was expected to leap to 45% to 200,000 barrels a day over the next four years. Its horizontal multistage fracturing technology would enable it to dominate California shale. The company has raised its dividend for the eleventh year in a row, to 2.90%, and had a sub-market earnings multiple of only 13.7 times.

Need I say more?

The clear message that came out of the BP oil spill is that onshore energy resources are now more valuable than offshore ones. I decided to add it to my model portfolio. Energy was one of a tiny handful of industries I was willing to put my money in back then (technology, industrials, and health care were the others).

Oh, and I got an A+ on the paper, and the following year Algeria raised the price of oil to $12 and nationalized the industry.

Lenin and Friend

A Faberge Egg