Trade Alert - (PANW) February 22, 2024 - BUY LEAPS

When John identifies a strategic exit point, he will send you an alert with specific trade information as to what security to sell, when to sell it, and at what price. Most often, it will be to TAKE PROFITS, but, on rare occasions, it will be to exercise a STOP LOSS at a predetermined price to adhere to strict risk management discipline.

Mad Hedge AI

Trade Alert - (PANW) – BUY

BUY the Palo Alto Networks (PANW) January 17, 2025 $290-$300 out-of-the-money vertical Bull Call spread LEAPS at $4.00 or best

Opening Trade

2-22-2024

expiration date: January 17, 2025

Number of Contracts = 1 contract

A 32% selloff in the (PANW) on disappointing guidance is the best entry point we are going to get for this LEAPS this year. Is hacking going out of style? I think not. If anything, it is going to get much worse, thanks to AI.

While the chance of winning a real lottery is something like a million to one, this one is more like 10:1 in your favor. And the payoff is 150% in a year. That is the probability that (PANW) shares will rise by only 9.90% over the next 11 months.

The logic behind this LEAPS is fairly simple.

After keeping interest rates too low for too long, and then raising them too far too fast, what does the Fed do next? It then lowers interest rates too far too fast. In other words, a mistake-prone Jay Powell will keep on making mistakes. That’s what you get with a Fed chair who only has a degree in political science.

I am using the very conservative $290-$300 strike price. (PANW) shares only need to return to where they were two days ago to hit the maximum profit point in this position, and they have 11 months to do it.

If that is not enough profit for you, perhaps you should consider another line of business.

I am therefore buying the Palo Alto Networks (PANW) January 17, 2025 $290-$300 out-of-the-money vertical Bull Call spread LEAPS at $4.00 or best.

Don’t pay more than $5.00 or you’ll be chasing on a risk/reward basis.

I am going out only to a January 17, 2025 expiration because I think this trade will work fairly quickly. Please note that these options are illiquid, and it may take some work to get in or out. Executing these trades is more an art than a science.

Let’s say the Palo Alto Networks (PANW) January 17, 2025 $290-$300 out-of-the-money vertical Bull Call spread LEAPS are showing a bid/offer spread of $3.80-$4.20, which is typical. Enter an order for one contract at $3.80, another for $3.90, another for $4.00 and so on. Eventually, you will enter a price that gets filled immediately. That is the real price. Then enter an order for your full position at that real price.

A lot of people ask me about the appropriate size. Remember, if the (PANW) does NOT rise by 9.90% in 11 months, the value of your investment goes to zero. The way to play is to use a venture capital approach and buy LEAPS in ten different companies. If one out of ten increases ten times, you break even. If two of ten work you double your money, and if only three of ten work you triple your money.

You never should have a position that is so big that you can’t sleep at night, or worse, need to call John Thomas asking if you should sell at a market bottom. Please also note that I don’t follow LEAPS prices on a daily basis. I tend to buy them and forget about them. So if the stock suddenly doubles, which is possible, I WILL NOT send out a trade alert to take profits. That is up to you.

There is another way to cash in. Let’s say we get half of your double in the next three months, which from these low levels is entirely possible. Then you could earn half of the maximum potential profit in months. You can decide whether to keep the threefold return or go for the full 1 ½ bagger. It’s a nice problem to have.

Notice that the day-to-day volatility of LEAPS prices is minuscule since the time value is so great, usually sporting implies of less than 10%. This means that the day-to-day moves in your P&L will be small. It also means you can buy your position over the course of a month just entering new orders every day. I know this can be tedious but getting screwed by overpaying for a position is even more tedious.

Look at the math below and you will see that a 9.90% rise in (PANW) shares will generate a 150% profit with this position, such is the wonder of LEAPS. That gives you an implied leverage of 15.5:1 across the $290-$300 space.

Only use a limit order. DO NOT USE MARKET ORDERS UNDER ANY CIRCUMSTANCES. Just enter a limit order and work it.

This is a bet that (PANW) will not fall below $300 by the January 17, 2025 option expiration in 11 months.

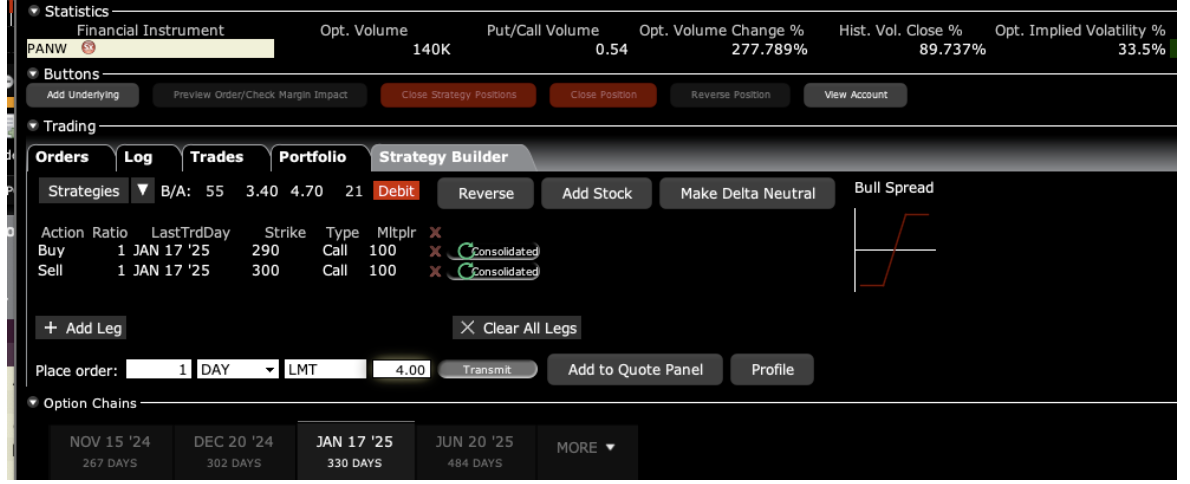

Here are the specific trades you need to execute this position:

Buy 1 January 2025 (PANW) $290 calls at………….………$40.00

Sell short 1 January 2025 (PANW) $300 calls at……..………$36.00

Net Cost:………………………….………..………….…..................$4.00

Potential Profit: $10.00 - $4.00 = $6.00

(1 X 100 X $6.00) = $600 or 150% in 11 months.

To see how to enter this trade in your online platform, please look at the order ticket below, which I pulled off of Interactive Brokers.

If you are uncertain on how to execute an options spread, please watch my training video on “How to Execute a Vertical Bull Call Debit Spread” by clicking here.

The best execution can be had by placing your bid for the entire spread in the middle market and waiting for the market to come to you. The difference between the bid and the offer on these deep in-the-money spread trades can be enormous.

Don’t execute the legs individually or you will end up losing much of your profit. Spread pricing can be very volatile on expiration months farther out.