Trade Alert - (QQQ) March 18, 2021 - SELL-TAKE PROFITS

When John identifies a strategic exit point, he will send you an alert with specific trade information as to what security to sell, when to sell it, and at what price. Most often, it will be to TAKE PROFITS, but, on rare occasions, it will be to exercise a STOP LOSS at a predetermined price to adhere to strict risk management discipline.

Trade Alert - (QQQ) – TAKE PROFITS

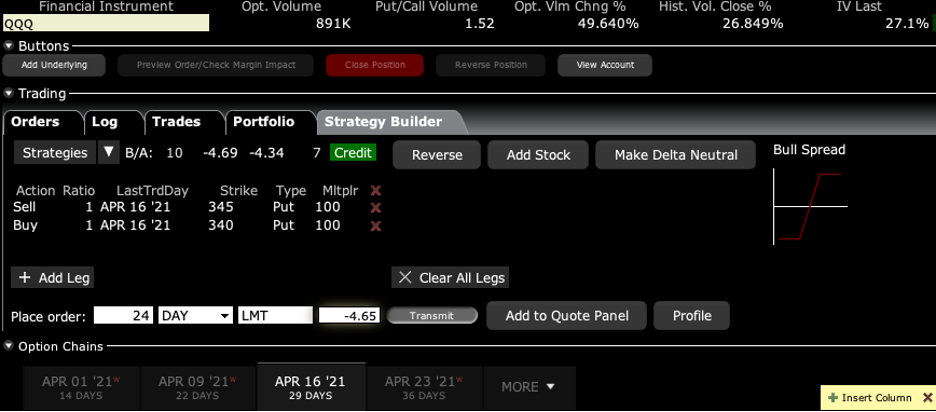

SELL the Invesco QQQ Trust NASDAQ ETF (QQQ) April 2021 $340-$345 in-the-money vertical BEAR PUT spread at $4.65 or best

Closing Trade

3-18-2021

expiration date: April 16, 2021

Portfolio weighting: 10%

Number of Contracts = 24 contracts

We have a major crash underway in the (QQQ)s this morning which I absolutely have to take advantage of.

Normally I don’t take a 50% profit in an option spread. However, we have just earned a respectable 50% of the profit in only three days off the back of a $10 plunge in the (QQQ). I prefer to run positions into expiration to avoid transactional costs and price slippage. But the risk/reward of continuing with this position for the next 21 trading days is no longer favorable.

We may be only days away from a bout of profit-taking in massive bond shorts with the ten-year US Treasury yield at a loft 1.73%, and a “rip your face off” rally in tech.

I am therefore selling the Invesco QQQ Trust NASDAQ ETF (QQQ) April 2021 $340-$345 in-the-money vertical BEAR PUT spread at $4.65 or best.

By coming out here, you get to take home $840, or 8.14% in only 3 trading days. Well done and on to the next trade.

It is clear that tech stocks and the bond market are joined at the hip. And with another 37-basis point to go before the ten-year US Treasury bond hits my 2.0% target, that means more downside in tech may be in store. Massive government borrowing is assuring we will get there sooner or later.

This was a bet that the Invesco QQQ Trust NASDAQ ETF S&P 500 (QQQ) would not trade above $340.00 by the April 16 option expiration day in 24 trading days.

heaven.

Here are the specific trades you need to exit this position:

Sell 24 April 2021 (QQQ) $345 puts at………….…......……$29.00

Buy to cover short 24 April 2021 (QQQ) $340 puts a…….$24.35

Net Proceeds:………………………….………..…......……….….....$4.65

Profit: $4.65 - $4.30 = $0.35

(24 X 100 X $0.35) = $840 or 8.14% in 3 trading days.

If you are uncertain on how to execute an options spread, please watch my training video by clicking here.

The best execution can be had by placing your bid for the entire spread in the middle market and waiting for the market to come to you. The difference between the bid and the offer on these deep in-the-money spread trades can be enormous.

Don’t execute the legs individually or you will end up losing much of your profit. Spread pricing can be very volatile on expiration months farther out.

Keep in mind that these are ballpark prices at best. After the alerts go out, prices can be all over the map.