Trade Alert - (REGN) July 2, 2020 - BUY

When John identifies a strategic exit point, he will send you an alert with specific trade information as to what security to sell, when to sell it, and at what price. Most often, it will be to TAKE PROFITS, but, on rare occasions, it will be to exercise a STOP LOSS at a predetermined price to adhere to strict risk management discipline.

Trade Alert - (REGN) – BUY

BUY the Regeneron (REGN) July 2020 $570-$580 in-the-money vertical Bull Call spread at $8.60 or best

Opening Trade

7-2-2020

expiration date: July 17, 2020

Portfolio weighting: 10%

Number of Contracts = 12 contracts

As the evidence mounts daily that the biotech sector is entering a long term upside breakout, I am adding to my already overweight holdings.

Regeneron is one of a handful of companies likely to deliver a Covid-19 treatment in the near future.

For my in-depth report on Regeneron and four other leading biotech stocks, see below.

I am therefore buying the Regeneron (REGN) July 2020 $570-$580 in-the-money vertical Bull Call spread at $8.60 or best.

Don't pay more than $9.20 or you'll be chasing.

DO NOT USE MARKET ORDERS UNDER ANY CIRCUMSTANCES.

Simply enter your limit order, wait five minutes, and if you don’t get done, cancel your order and increase your offer by 10 cents with a second order.

These options are somewhat illiquid so you may have to finesse your order a bit, such as by raising the strike prices or expending the maturity.

If you don’t do options, simply buy the stock outright. There is a potential double in these shares.

This is a bet that Regeneron (REGN) will not trade below $580 by the July 17 option expiration day in 10 trading days.

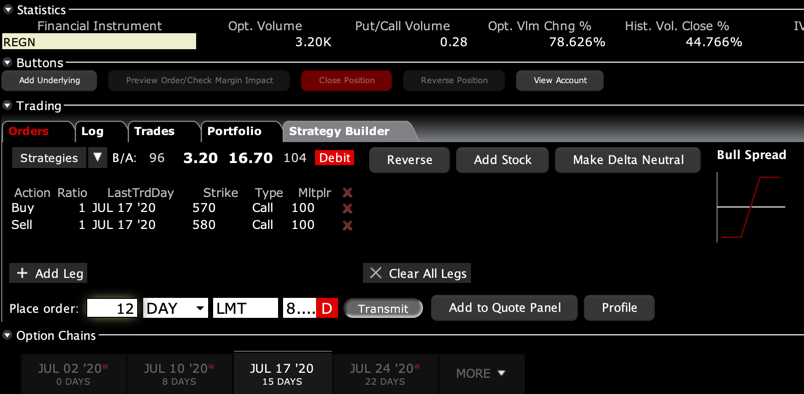

Here are the specific trades you need to execute this position:

Buy 12 July 2020 (REGN) $570 calls at………….….……$65.00

Sell short 12 July 2020 (REGN) $580 calls at……..…...$56.40

Net Cost:……………......………..…….………..………….….....$8.60

PotentialProfit: $10.00 - $8.60 = $1.40

(12 X 100 X $1.40) = $1,680 or 16.27% in 10 trading days.

To see how to enter this trade in your online platform, please look at the order ticket above, which I pulled off of Interactive Brokers.

If you are uncertain on how to execute an options spread, please watch my training video by clicking here.

The best execution can be had by placing your bid for the entire spread in the middle market and waiting for the market to come to you. The difference between the bid and the offer on these deep in-the-money spread trades can be enormous.

Don’t execute the legs individually or you will end up losing much of your profit. Spread pricing can be very volatile on expiration months farther out.

Keep in mind that these are ballpark prices at best. After the alerts go out, prices can be all over the map.

See below my most recent research report on Regeneron

Five Biotech Stocks to Buy at the Market Top

As the world grapples with the COVID-19 pandemic, Regeneron (REGN) has been hailed as one of the “miracle stocks” in the biotechnology sector.

Although late to the party, Regeneron quickly became a frontrunner in the race to find a COVID-19 treatment in June when the company entered clinical trials with its COVID-19 treatment candidate. The New York biotechnology company has also already started manufacturing, with the company expecting trial results to be released later this summer.

Regeneron followed the lead of other biotechnology companies repurposing seasoned medicines to treat this deadly disease, such as Gilead Sciences (GILD) and Pfizer (PFE).

Prior to developing it to target SARS-CoV-2, Regeneron’s antibody cocktail had been used to treat Ebola.

In response to Regeneron’s promising progress on the COVID-19 treatment, the market showed its appreciation by pushing the company’s shares up over 60% year to date.

Needless to say, Regeneron has been heavily outperforming the broad biotechnology indexes and even the broader market.

However, Regeneron’s success these days isn’t only attributed to its COVID-19 efforts. In fact, Regeneron’s annual revenue has been consistently increasing for more than a decade now.

Prior to starting its coronavirus program, the company has already lined up several candidates that can serve as catalysts for growth.

One of the catalysts for Regeneron’s growth is skin cancer injection Libtayo.

At present, Libtayo dominates the advanced cutaneous squamous cell carcinoma market as seen in the 179% jump in its sales to hit $75 million in the first quarter of 2020.

Riding on the momentum of Libtayo’s current sales, Regeneron is also looking to expand its coverage to include non-small cell lung cancer and basal cell carcinoma.

This means that Libtayo still has a long way to go before it reaches its peak.

To give this drug’s potential some context, keep in mind that roughly 9,500 individuals in the United States alone get a skin cancer diagnosis every day. Meanwhile, over 3 million Americans are diagnosed with either basal cell carcinoma or squamous cell carcinoma each year.

As for non-small cell lung cancer, this disease accounts for 84% of over 228,000 cases of lung cancer in the US annually.

Combined, the market size of Libtayo could reach roughly 3.2 million patients.

Libtayo is priced at $9,100 to cover a three-week treatment course. Patients are advised to regularly take the infusion every three weeks. This puts the annual cost of Libtayo treatment somewhere around $158,000.

With this annual treatment cost and the projected total market size in mind, it’s safe to say that Libtayo can yield profits of well over 12 figures. This is the best-case scenario, though.

If we go for the least likely scenario, where Regeneron only reaches 10,000 patients for all the diseases mentioned, then the company can still generate an annual revenue exceeding $1.5 billion.

As for the other products in Regeneron’s pipeline, the company’s recent earnings report showed that sales in the first quarter were only marginally impacted by the pandemic.

For instance, Eylea’s annual growth rate was only at 6%. Nonetheless, this wet macular degeneration and metastatic colorectal cancer medication’s first quarter sales still reached a decent $1.9 billion.

Moreover, there’s a growing market that can substantially boost Eylea’s performance in the coming years.

Studies show that the global market for wet age-related macular degeneration is projected to rise at an annual rate of 7.1%. By 2024, this market could reach $10.4 billion.

Aside from Eylea, Regeneron’s eczema biologic Dupixent sales have been soaring as well. This drug went up by an impressive 124% year-over year, generating $855 million in revenue.

Dubbed as Regeneron’s “pipeline in a product,” the company is looking to transform Dupixent into a mega-blockbuster drug like AbbVie’s (ABBV) Humira.

So far, Dupixent is being studied to determine if it can also be marketed to asthma patients and recently gained approval to be cover atopic dermatitis as well.

Overall, Regeneron merits a closer look, especially among biotechnology investors searching for a dependable stock with a lot more room to grow.

Not only does the company have over $7.2 billion in cash and have minimal debt, it also has a remarkable profit growth.

In the first quarter of 2020 alone, Regeneron’s bottom line jumped by a whopping 48% year over year to reach $771 million or $6.60 per share.

Looking at its annualized rate, Regeneron stock is actually trading for roughly 22 times earnings -- a reasonable price to pay for a well-rounded blue chip company that offers such impressive growth and a strong track record.