Trade Alert - (SFIX) April 20, 2020 - BUY

When John identifies a strategic exit point, he will send you an alert with specific trade information as to what security to sell, when to sell it, and at what price. Most often, it will be to TAKE PROFITS, but, on rare occasions, it will be to exercise a STOP LOSS at a predetermined price to adhere to strict risk management discipline.

Tech Alert - Stitch Fix, Inc. (SFIX) – BUY

BUY Stitch Fix, Inc. (SFIX) May 2020 $18-$21 in-the-money vertical BEAR put spread at $2.47

Opening Trade

4-20-2020

expiration date: May 15, 2020

Portfolio weighting: 10%

Number of Contracts = 42 contracts

This is a short-term trade that online clothing company Stich Fix won’t rise above $18 by May 15.

SFIX has retraced itself and to offset my long positions, I will execute a put spread on a company that I am bearish on.

Online personal styling service Stitch Fix (SFIX) announced that it withdrew its business outlook for the third quarter and fiscal year 2020, due to the increasing uncertainty resulting from the COVID-19 pandemic.

Stitch Fix also revealed that it has experienced considerable disruption in its logistics function as warehouses have closed for various periods and operated at lower capacity resulting in delays. For instance, SFIX has had to close three of its five facilities at various points due to local directives, though all five facilities are currently open.

CEO Katrina Lake said, “While we anticipated our business would be impacted, we did not have visibility into the extent to which it would disrupt our distribution centers.”

From a demand standpoint, the most loyal clients have been resilient, and the company has seen a relative low number of auto-ship cancellations. However, conversion in new and infrequent clients has been more challenging over the last couple of weeks.

This is not a service that people need when over 20 million get laid off.

Only use a limit order. DO NOT USE MARKET ORDERS UNDER ANY CIRCUMSTANCES AND DO NOT BUY THE STOCK.

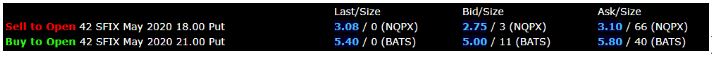

Here are the specific trades you need to execute this position:

Buy 42 May 2020 (SFIX) $21 put at………….………$5.40

Sell short 42 May 2020 (SFIX) $18 put at………….$2.93

Net Cost:……………………..…........….………..…….....$2.47

Potential Profit: $3.00 - $2.47 = $.53

(42 X 100 X $.53) = $2,226 or 22.26%

To see how to enter this trade in your online platform, please look at the order ticket below, which I pulled off of Interactive Brokers.

If you are uncertain on how to execute an options spread, please watch my training video on “How to Execute a Vertical Bull Call Spread” by clicking here at

http://www.madhedgefundtrader.com/ltt-vbpds/

The best execution can be had by placing your bid for the entire spread in the middle market and waiting for the market to come to you. The difference between the bid and the offer on these deep in-the-money spread trades can be enormous.

Don’t execute the legs individually or you will end up losing much of your profit. Spread pricing can be very volatile on expiration months farther out.

Keep in mind that these are ballpark prices at best. After the alerts go out, prices can be all over the map.

To see how to enter this trade in your online platform, please look at the order ticket below, which I pulled off of Interactive Brokers.

If you are uncertain on how to execute an options spread, please watch my training video on “How to Execute a Vertical Bull Call Spread” by clicking here.

The best execution can be had by placing your bid for the entire spread in the middle market and waiting for the market to come to you. The difference between the bid and the offer on these deep in-the-money spread trades can be enormous.

Don’t execute the legs individually or you will end up losing much of your profit. Spread pricing can be very volatile on expiration months farther out.

Keep in mind that these are ballpark prices at best. After the alerts go out, prices can be all over the map.