Trade Alert - (SH) March 21, 2025 - EXPIRATION AT MAX PROFIT

When John identifies a strategic exit point, he will send you an alert with specific trade information as to what security to sell, when to sell it, and at what price. Most often, it will be to TAKE PROFITS, but on rare occasions, it will be to exercise a STOP LOSS at a predetermined price to adhere to strict risk management discipline.

Trade Alert - (SH) – EXPIRATION AT MAX PROFIT

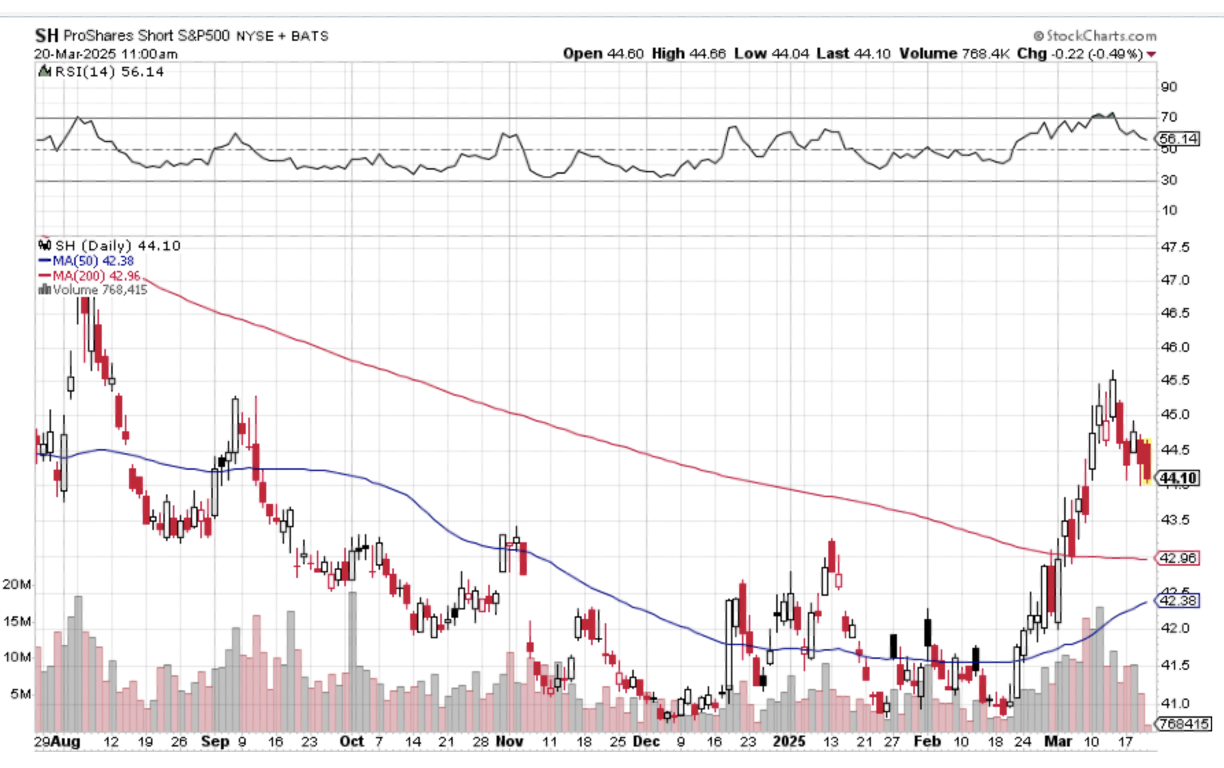

EXPIRATION of the Proshares S&P 500 ETF (SH) March 2025 $38-$41- in-the-money vertical Bull Call debit spread at $3.00

Closing Trade

3-21-2025

expiration date: March 21, 2025

Number of Contracts = 40 contracts

Because we have so many options positions expiring at max profit on the Friday, March 21 option expiration day, I am going to start feeding these out now.

Like all successful trades, this one looks stupidly cautious with 20:20 hindsight and (SH) at $117.46. All the safe stocks have been slaughtered. Bitcoin is down 30%, twice the (SPY) decline.

As a result, you get to take home $1,600 or 15.38% in 12 trading days.

Well done and on to the next trade.

You don’t have to do anything with this expiration.

Your broker will automatically use your long position to cover your short position, canceling out the total holdings.

The entire profit will be credited to your account on Monday morning March 24 and the margin freed up.

Some firms charge you a modest $10 or $15 fee for performing this service.

The flight of money right now is from small, undercapitalized, and questionable to large, overcapitalized, and rock-solid balance sheets.

The Proshares S&P 500 (SH) is an inverse ETF that rises in value when the index falls on a one-to-one basis. Its current NAV is $863 million. It makes an excellent hedge for tech-heavy stock portfolios, with a hefty 32.6% exposure to the sector and 7% in Apple (AAPL) alone. If the (SPY) drops by 15% from here by the August 16 option expiration, this fund should rise by 10% to over $46.

There is a catch.

Inverse ETFs have their own special problems and are ideally designed to be traded intraday. They are not cheap. There can be tracking errors, although the (SH) has tracked pretty well over time. There is a contango because the fund managers have to borrow money at around a 6% annual interest rate to buy the futures contracts that the fund invests in.

You also have to cover the cost of paying dividends for the S&P 500, now at a 1.2% annualized rate. There is derivative risk in that the futures contracts that the fund buys in theory could default.

You also have a compounding risk because the fund is reset at the end of every day. That means that if the (SPY) goes up and down frequently over a short period of time, the value of the (SH) will fall.

All in all, the S&P 500 has to drop about 5% by August 16 just to cover all of the costs associated with this short position.

I did take a close look at another ETF, the Proshares Ultrashort S&P 500 ETF (SDS), a leveraged -2X short ETF. The problem here is that with twice the short position you are paying twice the expenses. The borrowing cost goes from 6% to 12% annualized and the short dividends go from 1.2% to 2.4%. The (SPY) would have to drop a lot just to cover these expenses unless the drop happens immediately.

It’s great for catching short, sharp selloffs. If you bought the (SDS) on February 18 bottom, you would have made a quick 12% profit on a 6% decline in the (SPY). But for a five-month hold, you are giving up the first 12% move to expenses.

To learn more about the (SH) ETF, please visit their website at https://www.proshares.com/our-etfs/leveraged-and-inverse/sh

Here are the specific trades you need to exit this position. You must place an order for this single vertical bull call debit spread.

Expiration of 40 March 2025 (SH) $38.00 calls at………$79.46

Expiration of 40 March 2025 (SH) $41.00 calls at………$76.46

Net proceeds:………………………..………….……...................$3.00

Profit: $3.00 - $2.60 = $0.40

(40 X 100 X $0.40) = $1,600 or 15.38% in 12 trading days.