Trade Alert - (SPY) December 24, 2018 - STOP LOSS

When John identifies a strategic exit point, he will send you an alert with specific trade information as to what security to sell, when to sell it, and at what price. Most often, it will be to TAKE PROFITS, but, on rare occasions, it will be to exercise a STOP LOSS at a predetermined price to adhere to strict risk management discipline.

SELL the S&P 500 (SPY) January 2019 $230-$240 in-the-money vertical BULL CALL spread at $6.90 or best

Closing Trade

12-24-2018

expiration date: January 18, 2019

Portfolio weighting: 10%

Number of Contracts = 11 contracts

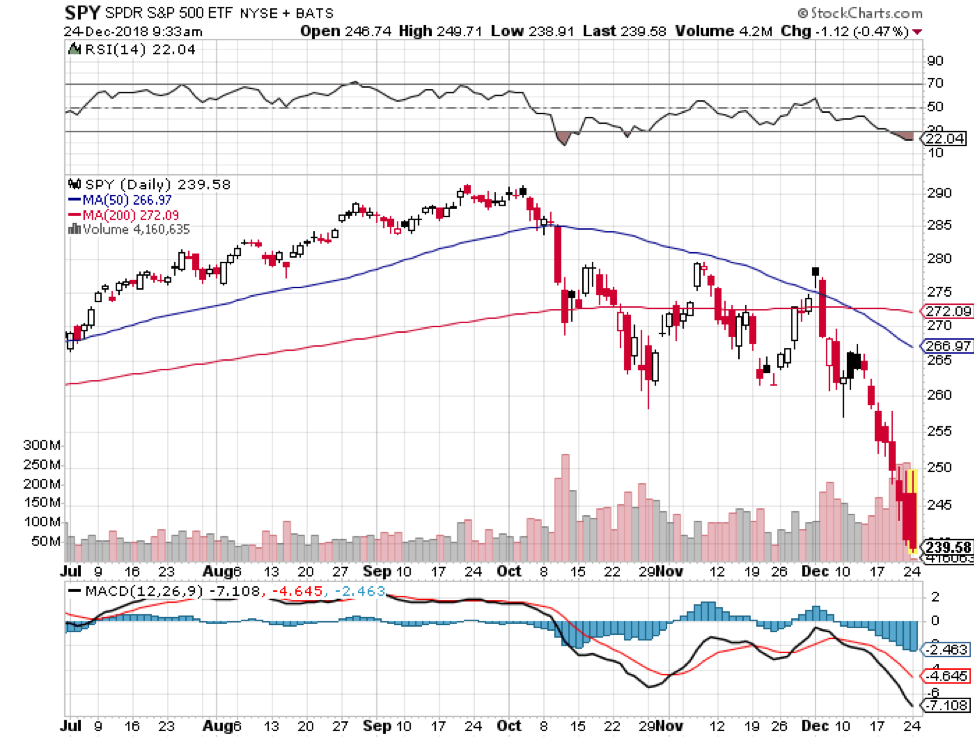

Santa Claus is dead on arrival.

The administration’s ham-handed efforts to halt the stock market crash has only made matters worse. With Treasury Secretary Mnuchin calling the six major banks to enquire about liquidity while on vacation in Mexico, investors are asking exactly what it is they have to worry about. Futures trading in Asia immediately flipped from a 150-point gain to a 200-point loss.

With the Mad Hedge Market Timing Index at 3, a 30-year low, the last thing I want to do is stop out of this position. However, trading discipline is discipline.

I am therefore selling the S&P 500 (SPY) January 2019 $230-$240 in-the-money vertical BULL CALL spread at $6.90 or best.

This was a bet that the S&P 500 (SPY) would not trade below $240 by the January 18 option expiration day in 20 trading days. That was a level 25 points down from the then current price. We covered that ground in an incredible two trading days, and that was after dropping an unbelievable 25 points in the previous two months.

This is clearly a market event, not an economic one. The stock market is now discounting a severe recession in 2019 which isn’t going to happen. The economy is booming now. Christmas sales have been great with online sale up 18% year on year. It may slow from a 3.2% to a 2.0% growth next year but there is no crash anywhere on the horizon.

Events in Washington which couldn’t be predicted are clearly weighing heavily on the market. The government is shut down indefinitely and two of three key cabinet members have been fired or resigned in the past month.

To see Apple (AAPL), 4% of the (SPY) Index, off $75 in the wake of record earnings is amazing. The market has clearly lost confidence in this government. The latest tweet from the president is that he is NOT going to fire Fed governor Jerome Powell.

This is happening against the backdrop of a huge drop in interest rates in the US Treasury ten-year yield from 3.25% to 2.75%, and a $43 collapse in the price of oil. Both are hugely market positive.

This was a very conservative trade. It was very deep-in-the-money, short-dated (one month to expiration), and had a $10 spread between the strikes. There were also three public holidays during the life of this position, and generally slow, low volume trading conditions. That should greatly reduce the day-to-day volatility of your portfolio.

When you lose money in this kind of position, it’s time to get out of the market, no matter what.

If you don’t do options and bought the (SPY) outright for a quick end of year oversold trading bounce, keep it. We will likely rally sharply in the new year.

Here are the specific trades you need to exit this position:

Sell 11 January 2019 (SPY) $230 calls at………….………$13.50

Buy to cover short 11 January 2019 (SPY) $240 calls at…..$6.60

Net Proceeds:………………………….………..………….….....$6.90

Loss: $9.00 - $6.90 = $2.10

(11 X 100 X $2.10) = $2,310%

To see how to enter this trade in your online platform, please look at the order ticket above, which I pulled off of Interactive Brokers.

If you are uncertain on how to execute an options spread, please watch my training video on How to Execute Vertical Call and Put Debit Spreads by clicking here.

You must be logged in to your account to view the video.

Please keep in mind that these are ballpark prices only. There is no telling how much the market can move by the time you get this.

Be sure you've signed up for our FREE text alert service. When seconds count, this feature offers a trading advantage. In today's market, investors need every advantage they can get.

The best execution can be had by placing your bid for the entire spread in the middle market and waiting for the market to come to you.

The difference between the bid and the offer on these deep in-the-money spread trades can be enormous.

Don't execute the legs individually or you will end up losing much of your profit. Spread pricing can be very volatile close to expiration.

If you don't get done, don't worry. There are another 250 Trade Alerts coming at you over the coming 12 months.