Trade Alert - (SPY) November 18, 2022 - BUY

When John identifies a strategic exit point, he will send you an alert with specific trade information as to what security to sell, when to sell it, and at what price. Most often, it will be to TAKE PROFITS, but, on rare occasions, it will be to exercise a STOP LOSS at a predetermined price to adhere to strict risk management discipline.

Trade Alert - (SPY) - BUY

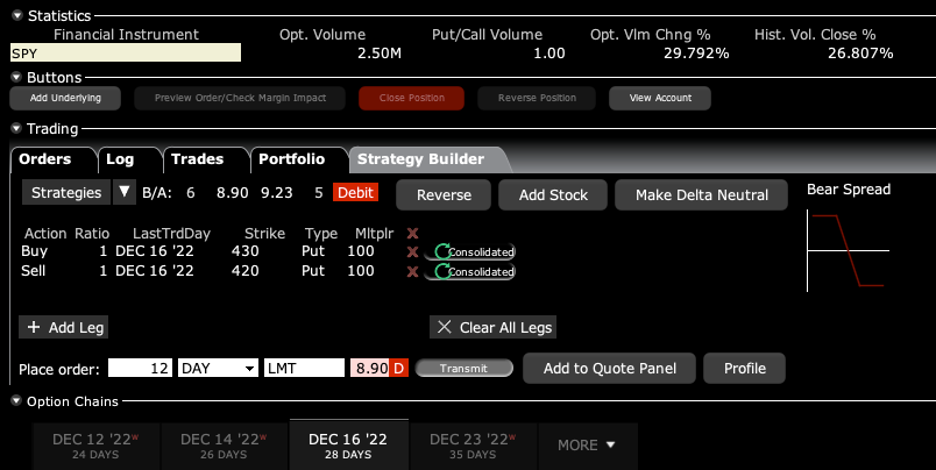

Buy the S&P 500 (SPY) December 2022 $420-$430 in-the-money vertical bear put spread at $8.90 or best

Opening Trade

11-18-2022

expiration date: December 16, 2022

Portfolio weighting: 10%

Number of Contracts = 12 contracts

Stock markets have just enjoyed a run for the ages, up a heart-palpitating 14% in five weeks. As we approach the 200-day moving average at $403.47 there is a risk that we may stall and get hit with a round of profit-taking.

The market is really easy to call here.

If the December 13 Consumer Price Index report is weak and we drop another 1%, markets will blast off to new highs. If it is hot, markets will give up their recent gains and retest the lows. So, we may flatline all the way until December 13. I plan to be out of this position before then.

We still have a recession overhanging the market, even if it is just a mild one. That sets up a round of profit-taking in January. Notice also that with the Volatility Index all the way down to $23 we won’t earn as much from this spread as we did when it was in the mid $30s.

In addition, I know you all of substantial longs out there that we have been Hoovering up since the October low. This position would make a nice hedge against those longs, at least for a month.

Therefore, I am buying the S&P 500 (SPY) December 2022 $420-$430 in-the-money vertical bear put spread at $8.90 or best.

DO NOT USE MARKET ORDERS UNDER ANY CIRCUMSTANCES.

Simply enter your limit order, wait five minutes, and if you don’t get done cancel your order and increase your bid by 5 cents with a second order.

Don’t pay more than $9.30 or you will be chasing.

If you don’t do options, stand aside. This is a short-term options play only.

This is a bet that the S&P 500 (SPY) will not trade above $420.00 by the December 16 option sexpiration day in 20 trading days.

Here are the specific trades you need to execute this position:

Buy 12 December 2022 (SPY) $430 puts at………....…$36.00

Sell short 12 December 2022 (SPY) $420 puts at…….$27.10

Net Cost:………………………....................….……….………$8.90

Potential Profit: $10.00 - $8.90 = $1.10

(12 X 100 X $1.10) = $1,320, or 12.36% in 20 trading days.

If you are uncertain about how to execute an options spread, please watch my training video by clicking here.

The best execution can be had by placing your bid for the entire spread in the middle market and waiting for the market to come to you. The difference between the bid and the offer on these deep in-the-money spread trades can be enormous.

Don’t execute the legs individually or you will end up losing much of your profit. Spread pricing can be very volatile on expiration months farther out.

Keep in mind that these are ballpark prices at best. After the alerts go out, prices can be all over the map.