Trade Alert - (TLT) December 20, 2022 - BUY

When John identifies a strategic exit point, he will send you an alert with specific trade information as to what security to sell, when to sell it, and at what price. Most often, it will be to TAKE PROFITS, but, on rare occasions, it will be to exercise a STOP LOSS at a predetermined price to adhere to strict risk management discipline.

Trade Alert - (TLT) – BUY

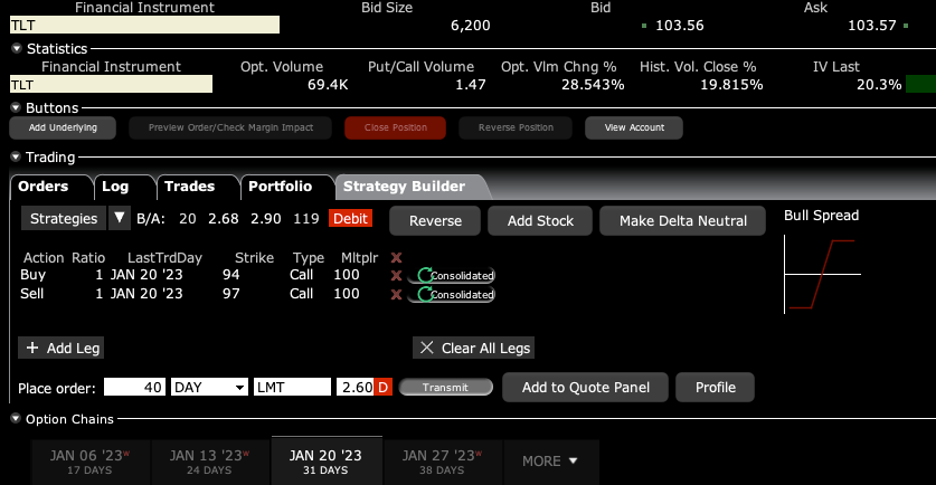

BUY the iShares Barclays 20+ Year Treasury Bond Fund (TLT) January 2023 $94-$97 in-the-money vertical Bull Call spread at $2.60 or best

Opening Trade

12-20-2022

expiration date: January 20, 2023

Portfolio weighting: 20% - double weighting

Number of Contracts = 80 contracts

We just had another $2.00 dip in the (TLT) this morning and $7.00 from the recent high. So, as promised, I am going back on the long side.

I am therefore buying the iShares Barclays 20+ Year Treasury Bond Fund (TLT) December 2022 $94-$97 in-the-money vertical Bull Call spread at $2.60 or best.

Don’t pay more than $2.75 or you’ll be chasing on a risk/reward basis.

After selling short bonds (TLT) from $180 all the way down to $91, I flipped to the long side on October 14. The next day, bonds saw their biggest rally in years, making instant millionaires out of several of my followers.

In a heartbeat, we went from super bear to hyper bull.

I am looking for the Fed to raise interest rates by 0.50% rise at the February 1 meeting, 0.25% at the March 22 meeting. After that, rates will flight line for three months. By June, economic weakness will be so obvious that a dramatic rate-cutting policy will ensue.

And this won’t be just any old easy money policy. I expect a 0.75% rate CUT at the July 26 meeting and for the Fed to continue cutting at a 0.75% rate at every meeting until the economy stabilizes. In addition, the Fed will end its quantitative tightening program by June, which is currently sucking $90 billion a month out of the economy. That’s a lot of bond selling that suddenly ends.

There is another huge bond positive in the works. In 2022, the US budget deficit dropped at its fastest rate in history, from $3 trillion to $1.5 trillion. Reduce the supply and prices can only go up. It’s basic supply in demand.

Bonds will soar.

I’m looking for $120 in the (TLT) sometime in 2023, with a possible stretch to $130. Use every five-point dip to load up on shares in the ETF, calls, call spreads, and one-year LEAPS. This trade is going to work fast. It is the low-hanging fruit of 2023.

Kaching!

The only way to lose money on this position is if the US economy absolutely catches on fire and sends interest rates soaring in the next month. As we are on the verge of a possible mild recession, I highly doubt this is going to happen.

This is a bet that the (TLT) will not fall below $97.00 by the January 20 option expiration in 18 trading days.

Here are the specific trades you need to execute this position:

Buy 80 January 2023 (TLT) $94 calls at………….………$10.00

Sell short 80 January 2023 (TLT) $97 calls at……...……$7.40

Net Cost:………………………….………..………….…..............$2.60

Potential Profit: $3.00 - $2.60 = $0.40

(80 X 100 X $0.40) = $3,200, or 16.00% in 18 trading days.

It’s now the Opening Act for the Bond Market

If you are uncertain about how to execute an options spread, please watch my training video by clicking here.

The best execution can be had by placing your bid for the entire spread in the middle market and waiting for the market to come to you. The difference between the bid and the offer on these deep in-the-money spread trades can be enormous.

Don’t execute the legs individually or you will end up losing much of your profit. Spread pricing can be very volatile on expiration months farther out.

Keep in mind that these are ballpark prices at best. After the alerts go out, prices can be all over the map.