Trade Alert - (TLT) March 23, 2023 - TAKE PROFITS - SELL

When John identifies a strategic exit point, he will send you an alert with specific trade information as to what security to sell, when to sell it, and at what price. Most often, it will be to TAKE PROFITS, but, on rare occasions, it will be to exercise a STOP LOSS at a predetermined price to adhere to strict risk management discipline.

Trade Alert - (TLT) – TAKE PROFITS

SELL the iShares Barclays 20+ Year Treasury Bond Fund (TLT) April 2023 $114-$117 in-the-money vertical Bear Put debit spread at $2.90 or best

Closing Trade – not for new subscribers

3-23-2023

expiration date: April 21, 2023

Portfolio weighting: 10%

Number of Contracts = 40 contracts

I have a client emailing me this morning that they are getting $2.90 for this spread. So, I might as well join the crowd. It may be handy if the market melts down again at the Friday close, which has been the case for the last several weeks.

So I am going to use the $1.00 dump in the (TLT) to take profits.

I don’t believe that bonds can maintain a sustainable rally until the debt ceiling dispute is resolved in Washington. As long as the bomb throwers are in charge in the House, this isn’t going to happen.

A war over the budget has just been unleashed, with each party presenting totally different visions of an American future. This has further made bond-buyers skittish.

As a result, ten-year US Treasury yields have crashed from 4.40% to 3.40%, bringing the prospects of an economic recovery to a juddering halt.

Buying bonds now is like lending money to someone even after they told you they won’t repay.

I am therefore selling the iShares Barclays 20+ Year Treasury Bond Fund (TLT) April 2023 $114-$117 in-the-money vertical Bull Call debit spread at $2.90 or best.

As a result, you get to take home $1,600, or 16.00% in 6 trading days. Well done, and on to the next trade.

As I expected, the Fed raised interest rates by 0.25% at the March 22 meeting. After that, rates will flatline for three months. By June, economic weakness will be so obvious that a dramatic rate-cutting policy will ensue.

And this won’t be just any old easy money policy. I expect a 0.75% rate CUT at the July 26 meeting and for the Fed to continue cutting at a 0.75% rate at every meeting until the economy stabilizes.

In addition, the Fed will end its quantitative tightening program by June, which is currently sucking $90 billion a month out of the economy. That’s a lot of bond selling that suddenly ends. The bank bailout has already sucked $300 billion worth of liquidity into the financial system, a de facto quantitative easing. Bonds will soar.

I’m looking for $120 in the (TLT) sometime in 2023, with a possible stretch to $130. Use every five-point dip to load up on shares in the ETF, calls, call spreads, and one-year LEAPS. This trade is going to work fast. It is the low-hanging fruit of 2023.

Kaching!

The only way to lose money on this position is if the US economy goes into a deep recession very quickly. As we are on the verge of a possible mild recession at worst, I highly doubt this is going to happen. And this has to happen in only 22 trading days.

This was a bet that the (TLT) will not rise above $114.00 by the April 21 optionS expiration in 22 trading days.

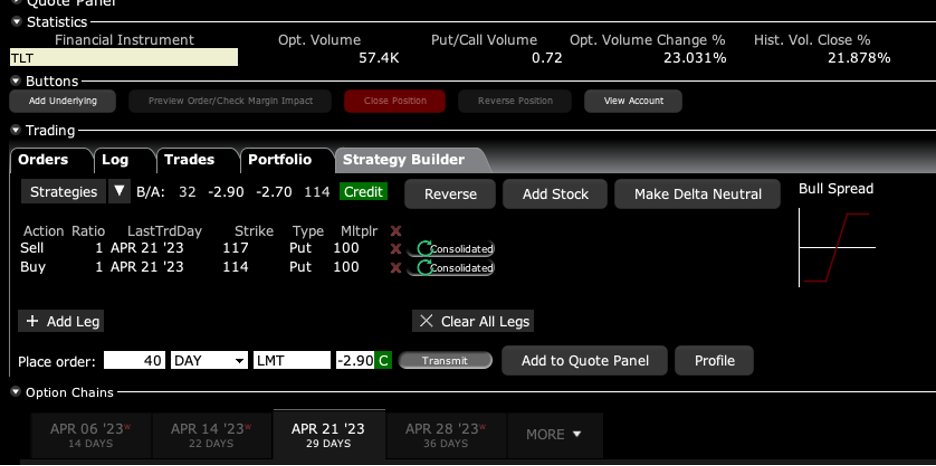

Here are the specific trades you need to close out this position:

Sell 40 April 2023 (TLT) $117 puts at………….………$12.00

Sell short 40 April 2023 (TLT) $114 puts at………..…$9.10

Net Proceeds:……………….………..….......……….….....$2.90

Profit: $2.90 - $2.50 = $0.40

(40 X 100 X $0.40) = $1,600, or 16.00% in 6 trading days.

It’s now the Opening Act for the Bond Market

If you are uncertain about how to execute an options spread, please watch my training video by clicking here.

The best execution can be had by placing your bid for the entire spread in the middle market and waiting for the market to come to you. The difference between the bid and the offer on these deep in-the-money spread trades can be enormous.

Don’t execute the legs individually or you will end up losing much of your profit. Spread pricing can be very volatile on expiration months farther out.

Keep in mind that these are ballpark prices at best. After the alerts go out, prices can be all over the map.