Trade Alert - (TLT) October 10, 2018 TAKING PROFITS

When John identifies a strategic exit point, he will send you an alert with specific trade information as to what security to sell, when to sell it, and at what price. Most often, it will be to TAKE PROFITS, but, on rare occasions, it will be to exercise a STOP LOSS at a predetermined price to adhere to strict risk management discipline.

Trade Alert - (TLT) – TAKE PROFITS

SELL the iShares Barclays 20+ Year Treasury Bond Fund (TLT)October 2018 $118-$121 in-the-money vertical BEAR PUT spread at $2.99 or best

Closing Trade

10-10-2018

expiration date: October 19, 2018

Portfolio weighting: 10%

Number of Contracts = 37 contracts

This morning the Producer Price Index came in at 0.2%, with some subsectors incredibly hot. That has gut punched the bond market once again.

I wish they were all this easy.

Of course it helps a lot that the Chinese government followed your opening short position with a $100 billion worth of selling. Finally, nurturing a 45-year relationship with senior officials in the Beijing government is hitting pay dirt.

After we established this short position, bonds completely collapsed.

I am therefore taking profits on my position in the iShares Barclays 20+ Year Treasury Bond Fund (TLT) October 2018 $118-$121 in-the-money vertical BEAR PUT spread at $2.99 or best. Although the screen is showing $3.00 bid, I’ll give you a penny to get it done at $2.99.

The risk reward of continuing the final seven days until the October 19 option expiration is no longer favorable. We have pretty much squeezed this lemon for all its worth.

In this heightened risk environment discretion is the better part of valor.

By coming out here you earn a very respectable 10.74%, or $1,073 profitin only eight trading days. Well done, and on to the next trade.

This was a bet that the (TLT) would not trade above $118 by the October 19 option expiration day in 14 trading days. We are currently trading at$113.24. Notice that I went very short dated and deep in-the-money to minimize my risk.

If you don’t do options, close your (TLT) short position. Take the home run.

You made a lot more money than the options guys. If you own the (TBT) take profits. We are most likely entering a new range, and the cost of carry for the ETF is extremely high.

Here are the specific trades you need to exit this position:

Sell 37 October, 2018 (TLT) $121 puts at………….………$7.85

Buy to cover short 37 October, 2018 (TLT) $118 puts at….$4.86

Net Proceeds:………………………….………..………….

Profit: $2.99 - $2.70 = $0.29

(37 X 100 X $0.29) = $1,073 or 10.74% in 7 trading days.

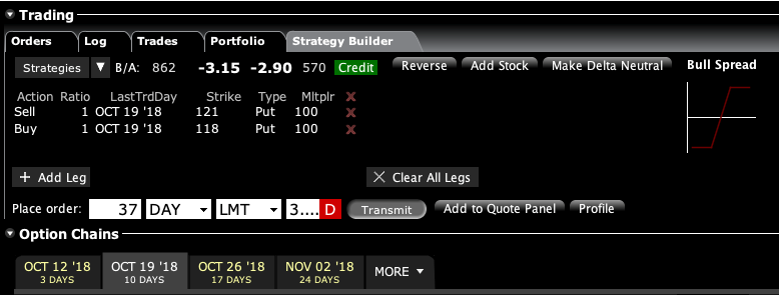

To see how to enter this trade in your online platform, please look at the order ticket above, which I pulled off of Interactive Brokers.

If you are uncertain on how to execute an options spread, please watch my training video on How to Execute Vertical Call and Put Debit Spreads by clicking here.

You must be logged into your account to view the video.

Please keep in mind that these are ballpark prices only. There is no telling how much the market can move by the time you get this.

Be sure you've signed up for our FREE text alert service. When seconds count, this feature offers a trading advantage. In today's market, investors need every advantage they can get.

The best execution can be had by placing your bid for the entire spread in the middle market and waiting for the market to come to you.

The difference between the bid and the offer on these deep in-the-money spread trades can be enormous.

Don't execute the legs individually or you will end up losing much of your profit. Spread pricing can be very volatile close to expiration.

If you don't get done, don't worry. There are another 250 Trade Alerts coming at you over the coming 12 months.