Trade Alert - (TLT) October 4, 2024 - STOP LOSS

When John identifies a strategic exit point, he will send you an alert with specific trade information as to what security to sell, when to sell it, and at what price. Most often, it will be to TAKE PROFITS, but on rare occasions, it will be to exercise a STOP LOSS at a predetermined price to adhere to strict risk management discipline.

Trade Alert - (TLT) – STOP LOSS

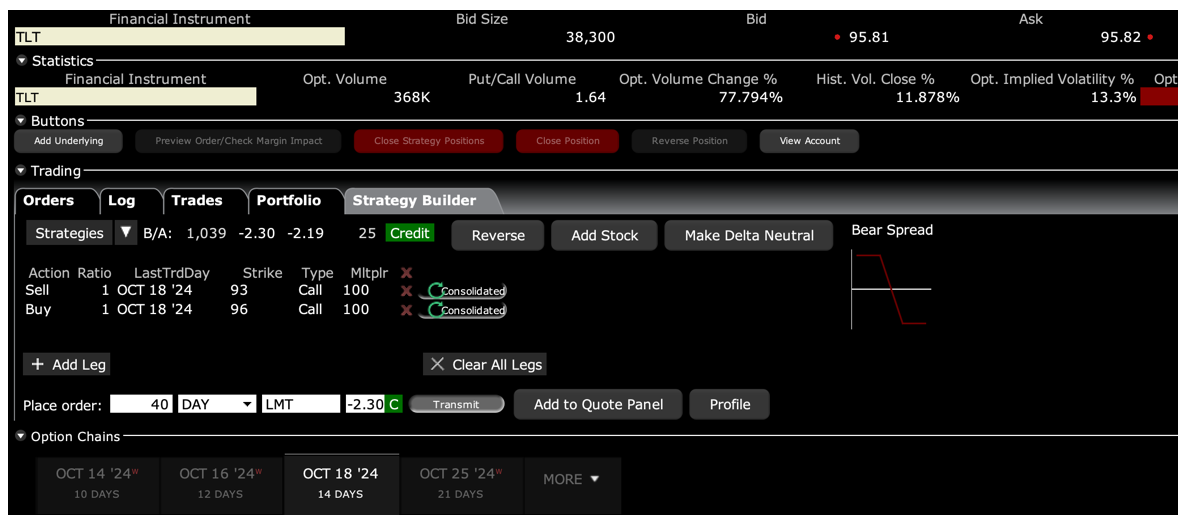

SELL the iShares Barclays 20+ Year Treasury Bond Fund (TLT) October 2024 $93-$96 in-the-money vertical Bull Call debit spread at $2.30 or best

Closing Trade

10-4-2024

expiration date: October 18, 2024

Portfolio weighting: 10%

Number of Contracts = 40 contracts

The September Nonfarm Payroll Report Came in Hot, as US employers added 254,000 jobs in September, topping economists’ most optimistic estimates. The payroll gain, the biggest advance since March, was led by leisure and health care. The headline Unemployment Rate fell to a three-month low of 4.1%. As a result, bond interest rates surged 12 basis points to 3.97%.

This has forced the (TLT) into a bigger pullback than I expected. We crossed my upper $96 strike price at the opening, triggering an automatic stop loss. If I had to bet money, this position will probably expire at its maximum profit in two weeks at the October 18 option expiration. But rigid risk control is essential for successful trading. It’s easier to dig yourself out of a small hole than a large one.

I am therefore selling the iShares Barclays 20+ Year Treasury Bond Fund (TLT) October 2024 $93-$96 in-the-money vertical Bull Call debit spread at $2.30 or best.

We are now entering a long-term declining period for the interest rate cycle. By midyear, economic weakness will be so obvious to the Fed that a dramatic rate-cutting policy will ensue to avoid a recession.

And this won’t be just any old easy money policy. I expect 0.25% rate CUTS for the indefinite future and for the Fed to continue cutting at a 0.25% rate at every meeting until the economy stabilizes.

In addition, the Fed is ending its quantitative tightening program this year, which is currently sucking $90 billion a month out of the economy. That’s a lot of bond selling that suddenly ends.

Bonds will soar.

I’m looking for $110 in the (TLT) sometime in 2025 and maybe even $120. Use every dip to load up on shares in the ETF, calls, call spreads, and one-year LEAPS. This trade is going to work fast. It is the low-hanging fruit of 2024.

Kaching!

The only way to lose money on this position is if the US economy absolute catches on fire and sends interest rates soaring in the next months. As we are on the verge of a possible soft landing, I highly doubt this is going to happen.

This was a bet that the (TLT) would not fall below $96.00 by the October 18 option expiration in 12 trading days.

Here are the specific trades you need to close out this position:

Sell 40 October 2024 (TLT) $93 calls at………….…....……$3.25

Buy to cover short 40 October 2024 (TLT) $96 calls at…$0.95

Net Proceeds:…………………….………..………….…..............$2.30

Loss: $2.30 - $2.60 = -$0.30

(40 X 100 X- $0.30) = -$1,200

It’s now the Opening Act for the Bond Market

If you are uncertain about how to execute an options spread, please watch my training video by clicking here.

The best execution can be had by placing your bid for the entire spread in the middle market and waiting for the market to come to you. The difference between the bid and the offer on these deep-in-the-money spread trades can be enormous.

Don’t execute the legs individually or you will end up losing much of your profit. Spread pricing can be very volatile on expiration months farther out.

Keep in mind that these are ballpark prices at best. After the alerts go out, prices can be all over the map.