Trade Alert - (TRIP) January 23, 2020 - BUY

When John identifies a strategic exit point, he will send you an alert with specific trade information as to what security to sell, when to sell it, and at what price. Most often, it will be to TAKE PROFITS, but, on rare occasions, it will be to exercise a STOP LOSS at a predetermined price to adhere to strict risk management discipline.

Tech Alert - TripAdvisor, Inc. (TRIP) – BUY

BUY TripAdvisor, Inc. (TRIP) February 2020 $34-$37 in-the-money vertical BEAR put spread at $2.60

Opening Trade

1-23-2020

expiration date: February 21, 2020

Portfolio weighting: 10%

Number of Contracts = 38 contracts

This is a short-term trade that TripAdvisor won’t rise 11% in 30 days – this is a short term that shares will trade sideways to down and is a bet that I am willing to make.

I didn’t like this company before the coronavirus and now that Chinese are homesitters for the Chinese New Year, this could put a dent into TripAdvisor’s new China initiative.

Trip.com Group took the lead in the day-to-day running of TripAdvisor China. It owns the majority share, with TripAdvisor having a 40 percent stake.

Chinese were supposed to increasingly travel the world while its customer base is also becoming more global, particularly with Trip.com and Skyscanner.

But that is all on hold as the following cities have been quarantined and things might just get worse.

- Wuhan (11 million people)

- Huanggang (7 million people)

- Xianning (2.5 million people, starting at 10 a.m.)

- Chibi (half a million people)

Yes, there could be a dead cat bounce if the virus is tamed, but the 2-week travel season is something you can’t get back once it’s over for TravelAdvisor.

I believe this will come out in the numbers along with details about Google raining on their parade.

Then take into account that the company just announced a 200-employee layoff amid increased competition from Google which is the initial reason why I hate this company.

The company is reliant on Google’s search algorithm while Google is going head to head with them.

Google has upgraded its travel search tools recently to compete with trip booking websites like TripAdvisor, Booking.com, and Priceline.

In its last earnings release, TripAdvisor noted that Google has placed ads at the top of its search results, forcing companies like it to buy more ads.

The company had a rough last quarter, reporting adjusted earnings of 58 cents a share, down from 72 cents a year earlier and short of analysts’ estimates of 69 cents.

The company said that the disappointing quarter was partially due to the fact that “Google (is) pushing its own hotel products in search results and siphoning off quality traffic that would otherwise find TripAdvisor via free links and generate high margin revenue in our hotel click-based auction.”

“Google has got more aggressive. We’re not predicting that it’s going to turn around,” TripAdvisor CEO Stephen Kaufer said at the time.

If you don’t do options, stand aside.

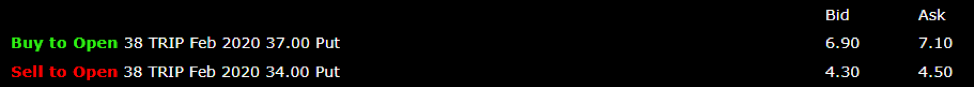

Here are the specific trades you need to execute this position:

Buy 38 February 2020 (TRIP) $37 puts at…………..………$7.00

Sell short 38 February 2020 (TRIP) $34 puts at………….$4.40

Net Cost:…….................………………..…….………..…….......$2.60

Potential Profit: $3.00 - $2.60 = $.40

(38 X 100 X $.40) = $1,520 or 15.20 % in 30 days

To see how to enter this trade in your online platform, please look at the order ticket below, which I pulled off of Interactive Brokers.

If you are uncertain on how to execute an options spread, please watch my training video on “How to Execute a Vertical Bull Call Spread” by clicking here.

The best execution can be had by placing your bid for the entire spread in the middle market and waiting for the market to come to you. The difference between the bid and the offer on these deep in-the-money spread trades can be enormous.

Don’t execute the legs individually or you will end up losing much of your profit. Spread pricing can be very volatile on expiration months farther out.

Keep in mind that these are ballpark prices at best. After the alerts go out, prices can be all over the map.