Trade Alert - (TSLA) April 21, 2023 - BUY

When John identifies a strategic exit point, he will send you an alert with specific trade information as to what security to sell, when to sell it, and at what price. Most often, it will be to TAKE PROFITS, but, on rare occasions, it will be to exercise a STOP LOSS at a predetermined price to adhere to strict risk management discipline.

TRADE ALERT - (TSLA) - BUY

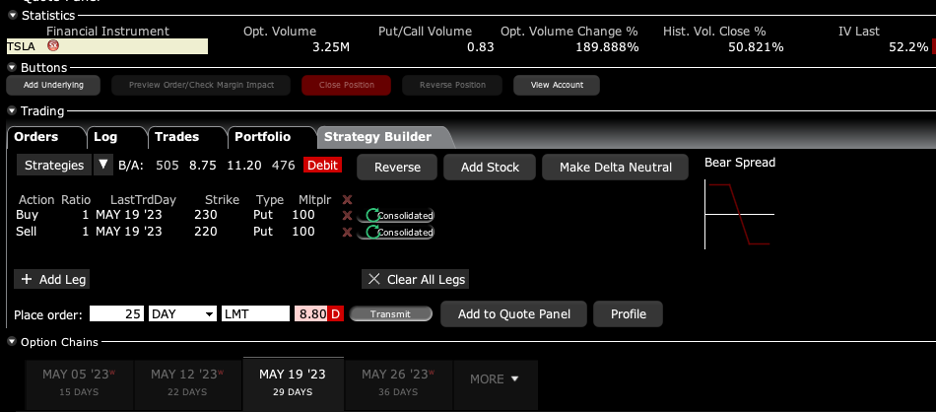

Buy the Tesla (TSLA) May 2023 $220-$230 in-the-money vertical bear put debit spread at $8.80 or best

Opening Trade

4-21-2023

expiration date: May 19, 2023

Portfolio weighting: 10% weighting

Number of Contracts = 12 contracts

As much as I love Tesla for the long term, the stock is wildly overbought for the short term. With their sixth price cut this year, another $3,000 for the Model 3, the company aims to buy market share at the expense of current profits. There is no doubt that the short-term hit to profits will be momentous.

Tesla is now the most widely owned stock in the world and accounts for a staggering 6% of the options market. With an eye-popping 51% implied volatility compared to only 19% for the Volatility Index ($VIX), those figures should rise.

Therefore, I am buying the Tesla (TSLA) May 2023 $220-$230 in-the-money vertical bear put debit spread at $8.80 or best.

Don’t pay more than $9.30 or you’ll be chasing.

DO NOT USE MARKET ORDERS UNDER ANY CIRCUMSTANCES.

Simply enter your limit order, wait five minutes, and if you don’t get done, cancel your order and increase your bid by 10 cents with a second order.

Elon Musk really checkmated the rest of the EV industry with his price cuts, which are 40% after adding in newly qualifying government subsidies.

Ford Motors (F) threw in the towel and cut the price of their EV Mustang by 10%. The problem for Ford is this only increases their losses in the EV sector by more than $2 billion. The problem is that other EV makers lack the parts for an aggressive market share strategy and lose money on what EVs they do make.

Tesla Earnings Disappoint, taking the profit margin down to a two-year low. It’s all about market share now, spending profits to maintain global dominance in EVs. The company still made $2.5 billion in Q1. The shares dropped $18 on the news. Tesla still makes money selling EVs while the competitors are losing billions.

Put spreads this far in the money trade all over the map but give this your best shot.

With this trade, I am willing to bet that Tesla shares will not rise above $220 by the May 21 option expiration in 20 trading days.

I am also betting that a company that is growing sales at 50% per year and earnings expanding at an incredible 40% a year. Tesla will remain the top EV maker for the next decade easily.

Here are the specific trades you need to execute this position:

Buy 12 May 2023 (TSLA) $230 puts at………....…$68.00

Sell short 12 May 2023 (TSLA) $220 puts at…….$59.20

Net cost:………………………….…........…….……………$8.80

Potential Profit: $10.00 - $8.80 = $1.20

(12 X 100 X $1.20) = $1,440, or 13.64% in 20 trading days.

If you are uncertain about how to execute an options spread, please watch my training video by clicking here.

The best execution can be had by placing your bid for the entire spread in the middle market and waiting for the market to come to you. The difference between the bid and the offer on these deep-in-the-money spread trades can be enormous.

Don’t execute the legs individually or you will end up losing much of your profit. Spread pricing can be very volatile on expiration months farther out.

Keep in mind that these are ballpark prices at best. After the alerts go out, prices can be all over the map.