Trade Alert - (TSLA) August 26, 2024 - BUY

When John identifies a strategic exit point, he will send you an alert with specific trade information as to what security to sell, when to sell it, and at what price. Most often, it will be to TAKE PROFITS, but, on rare occasions, it will be to exercise a STOP LOSS at a predetermined price to adhere to strict risk management discipline.

(TSLA) – BUY PUTS

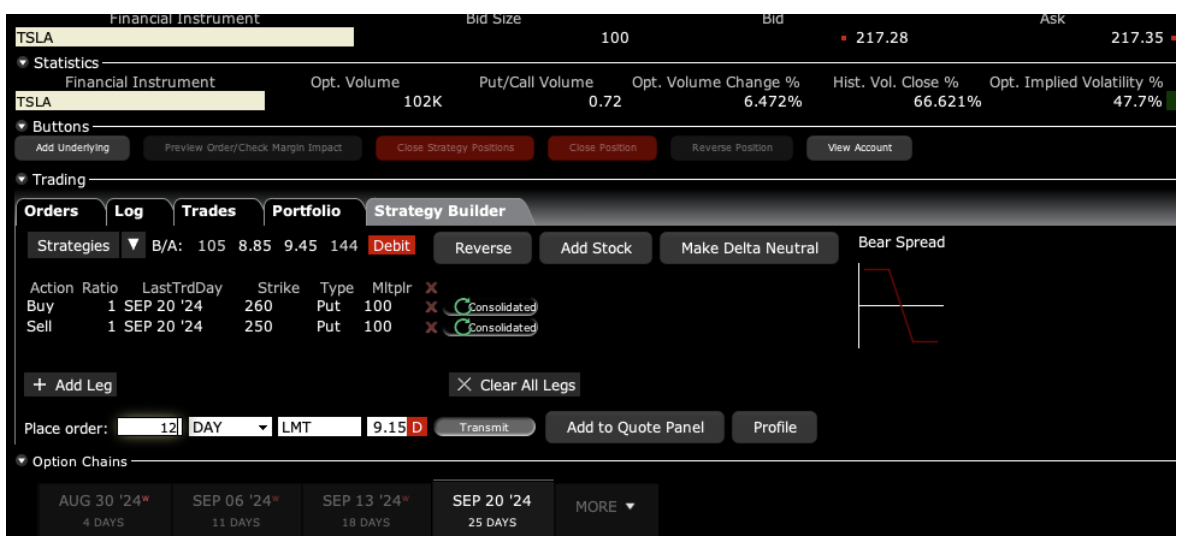

Buy the Tesla (TSLA) September 2024 $250-$260 in-the-money vertical bear put debit spread at $8.90 or best

Opening Trade

8-26-2024

expiration date: September 20, 2024

Portfolio weighting: 10% weighting

Number of Contracts = 12 contracts

Since the last Tesla short position worked out so well, I am happy to dive back in one more time.

As much as I love Tesla for the long term, I don’t mind going short into September, which is usually the worst trading month of the year. We have also just seen a monster 11% rally in the S&P 500 where some giveback is owed.

The earnings are out, the EV nuclear winter continues, and China’s economy remains stuck in the mud. The next upside influence won’t occur until October when Elon Musk has promised to deliver a new Robotaxi.

Tesla is now one of the most widely owned stock in the world. With an eye-popping 47.7% implied volatility compared to only 16% for the Volatility Index ($VIX), Tesla put options are among the most expensive in the market.

Therefore, I am buying the Tesla (TSLA) September 2024 $250-$2160 in-the-money vertical bear put debit spread at $8.90 or best.

Don’t pay more than $9.40 or you’ll be chasing.

DO NOT USE MARKET ORDERS UNDER ANY CIRCUMSTANCES.

Simply enter your limit order, wait five minutes, and if you don’t get done, cancel your order and increase your bid by 10 cents with a second order.

Elon Musk really checkmated the rest of the EV industry with his massive price cuts and buyer incentives, which is 35% after adding in newly qualifying government subsidies.

Tesla Q2 sales came in better than expected but are still down YOY, delivering 444,000. The Chinese government recently approved Tesla cars for purchase. Tesla has recently been rediscovered as one of the cheapest AI plays out there.

Don’t get me wrong. I still love Tesla for the long term and expect it to reach $1,000 someday. This is just a summer short-term options trade.

Put spreads this far in the money trade all over the map but give this your best shot.

Tesla shares plunged last year because Elon Musk sold an additional $3.6 billion worth of shares in December, bringing his total for the year to a mind-numbing $40 billion, according to SEC filings.

With this trade, I am willing to bet that Tesla shares will not rise above $245 by the September 20 option expiration in 19 trading days.

Tesla will remain the top EV maker for the next decade easily.

Here are the specific trades you need to execute this position:

Buy 12 September 2024 (TSLA) $260 puts at………....…$43.00

Sell short 12 September 2024 (TSLA) $250 puts at…….$34.10

Net cost:………………………….……….…………….................$8.90

Potential Profit: $10.00 - $8.90 = $1.10

(12 X 100 X $1.10) = $1,320 or 12.36% in 19 trading days.

If you are uncertain about how to execute an options spread, please watch my training video by clicking here.

The best execution can be had by placing your bid for the entire spread in the middle market and waiting for the market to come to you. The difference between the bid and the offer on these deep-in-the-money spread trades can be enormous.

Don’t execute the legs individually or you will end up losing much of your profit. Spread pricing can be very volatile on expiration months farther out.

Keep in mind that these are ballpark prices at best. After the alerts go out, prices can be all over the map.